Advertisement

Anonymous

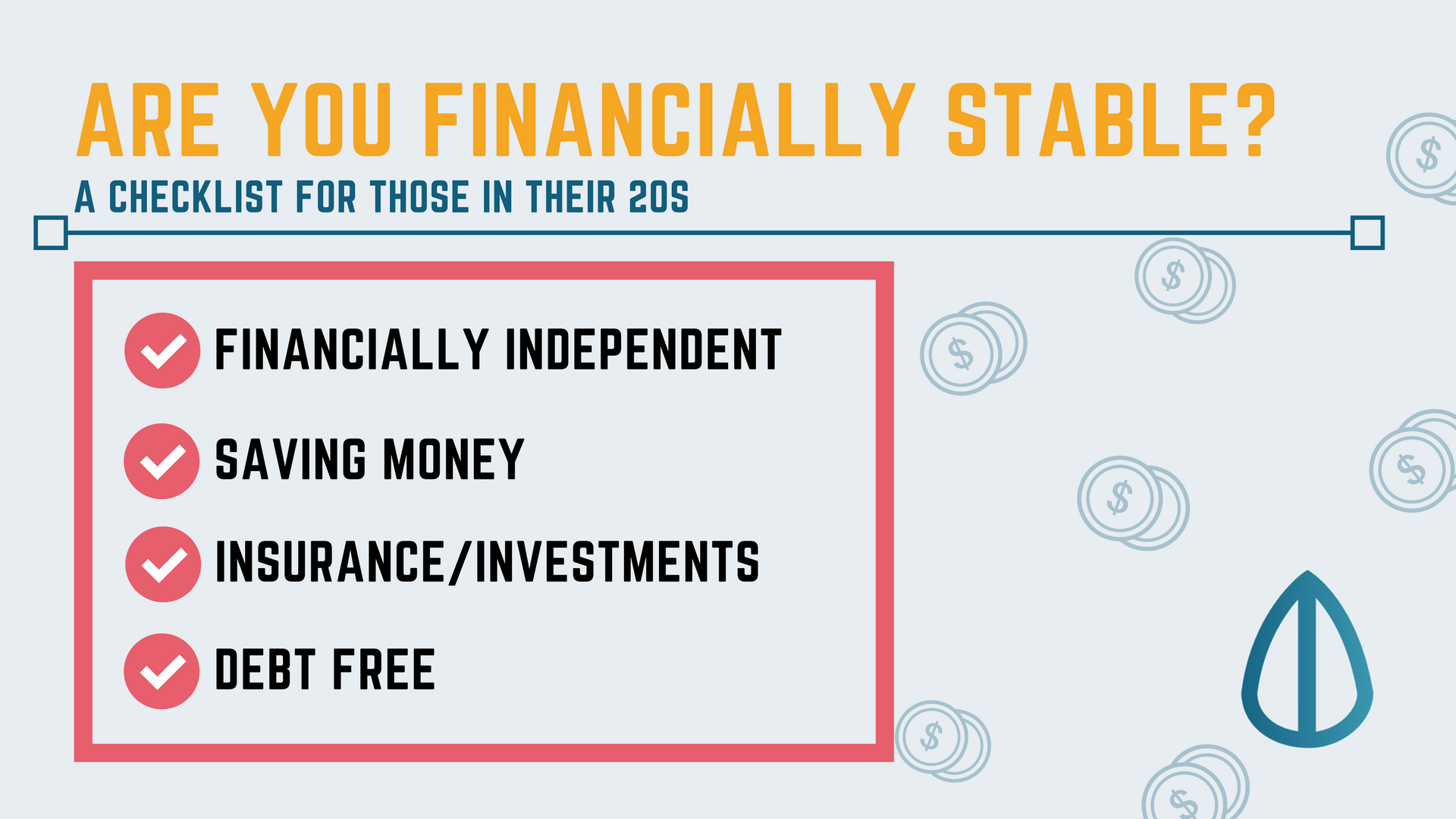

Which career path should I go for so as to quickly clear my debts and achieve my financial goals?

25 this year. My current situation - I have about 3k debts, monthly financial commitments of around $300 with zero cash savings. My passion has always been in the Financial industry. However, in 3 years time, I will be getting my BTO.

Given my current situation, should I just take the plunge and start doing insurance full-time?

Need some advice. Thank you!

5

Discussion (5)

Learn how to style your text

Fergus Tan

07 Sep 2019

Senior Partner at Vision Advisory Management

Reply

Save

Loh Tat Tian

14 Aug 2019

Founder at PolicyWoke (We Buy Insurance Policies)

Be prepared to learn a lot, and have less time for yourself if you are going sales / entreprenuership.

I would ask you to understand yourself first. What is your current skillset? Which are the money making 1? Who will pay for your skillset? This is the most important to understand. If not, you can't even negotiate in a job interview.

Then from there, go towards your financial goal. IF you can't type out and convince anyone, who will be confident that you can achieve it? IF you are inexperienced, go and take experiences now. Be it in intern etc etc.

3k debts is easily settled ($500 a month X 7 months to include horrendous interest rates).

But always have a goal in mind.

Reply

Save

Finance industry is volatile. It is not that glamorous and rosy as what people thought it would be. ...

Read 2 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

3k debts is not a big amount.

Is your passion in financial sales, or just looking at numbers?

To be honest, it's hard to advise because there really isn't much details on your current work, or skillset, or whatnot.

Besides insurance sales, you can consider looking at other types of sales if you want to clear your debts quickly.

Insurance or financial advisory is hard. Most people will reject you even before trying to understand you who are. In other industry, you might still be able to get the first meeting before your presentation skills are put to the test.

My suggestion is to go check out the people who are hiring in the insurance and financial advisory space. Talk to them, ask them how they will help you, and try to find people who have gotten success recently, and if you feel you can model after them.

It will be hard work. Good luck!!