Advertisement

Where would savings for big items fall under for the 50-30-20 rule? Such as savings for a travel trip?

6

Discussion (6)

Learn how to style your text

Reply

Save

Upticked the question coz there's so many different ways to look at it. From what I have read, plus the different variations:

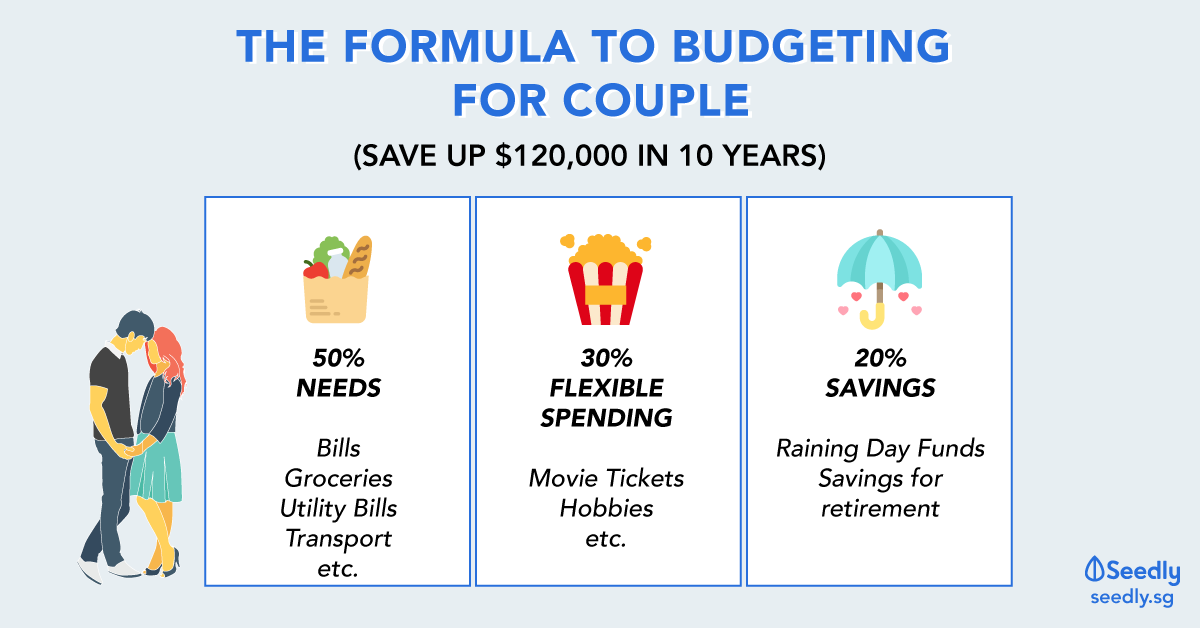

Seedly - 50% expenses / 30% wealth retirement / 20% savings or emergency

Elizabeth Warren who's running for elections:

50% needs / 30% wants / 20% savings

Gail Vaz Oxlade (Canada): 35% housing / 15% transportation / 25% life / 15% debt / 10% savings.

Big items actually come in several categories (eg downpayments, medical emergencies, retirement, wedding)... Personally I feel three category is too tight (you end up with very broad buckets), but if I had to recommend, I would use a six bucket framework like this:

A) Allowance for self, and family (some call 家用): 15% +/- 5%

B) Housing / Rent: 30% +/- 5%

If you have yet to pay your own mortgage, consider splitting between saving for downpayment and household utilities.

C) Recurring expenses and/ or annual ones like insurance, transportation, tax, wifi / cable, s&cc, dental... : 15% +/- 5%

D) Entertainment and Wants: 10% +/- 5%

Travel would be here, as well as clubbing/movies, shopping...

E) Emergencies: 5% (keep in bank and/or SSBs)

Theoretically, we all advocate 3 - 6 mths, which is a topic in itself. It's a nice place to be but even for myself, I want 12 mths for certain types of expenses. But if u carry consumer debts, then hoarding a lot of emergency funds in low yield safe places is not a very smart thing to do.

F) Lumping up retirement / savings / non-housing debts / other future goals here. Would suggest 15-25% here, but it goes in an order

- pay off debts if you have any

- no debt, look at future goals (wedding/children)

- split out some for retirement, helps to start early, but up to your comfort level in things like annuities, SRS and RSTU.

- put the remaining in investments that you have some sort of flexibility in case you really really need to sell them to meet some needs.

They would need to be balanced to 100% total. And it's not dead... For budgets, you will slowly get the hang of it and adjust as necessary based on your priorities.

Personally, over my entire career, my total savings per year (for category E and F) tend to average about 3 to 4 mth salary, so about 1/3 goes to retirement, I adjust my emergency funds between cash and SSBs, and the rest in dividend-paying assets to have passive income in case shit happens.

Reply

Save

Elijah Lee

02 Oct 2019

Senior Financial Services Manager at Phillip Securities (Jurong East)

Hi Cassandra,

If I was following Seedly's 50-30-20 rule, I would probably classify it under the '5...

Read 1 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

Savings for big items purchase will be in the 30%.