Advertisement

Anonymous

Where to start in savings, budgeting and investment?

Hi there, i've recently graduated with a diploma cert and started a full time job, however i may be taking up uni next year as well.

As i have no savings at all now, i'm trying to start with a finance plan along with start investing. Are there any suggestion on how i may improve on my financial planning and investment planning?

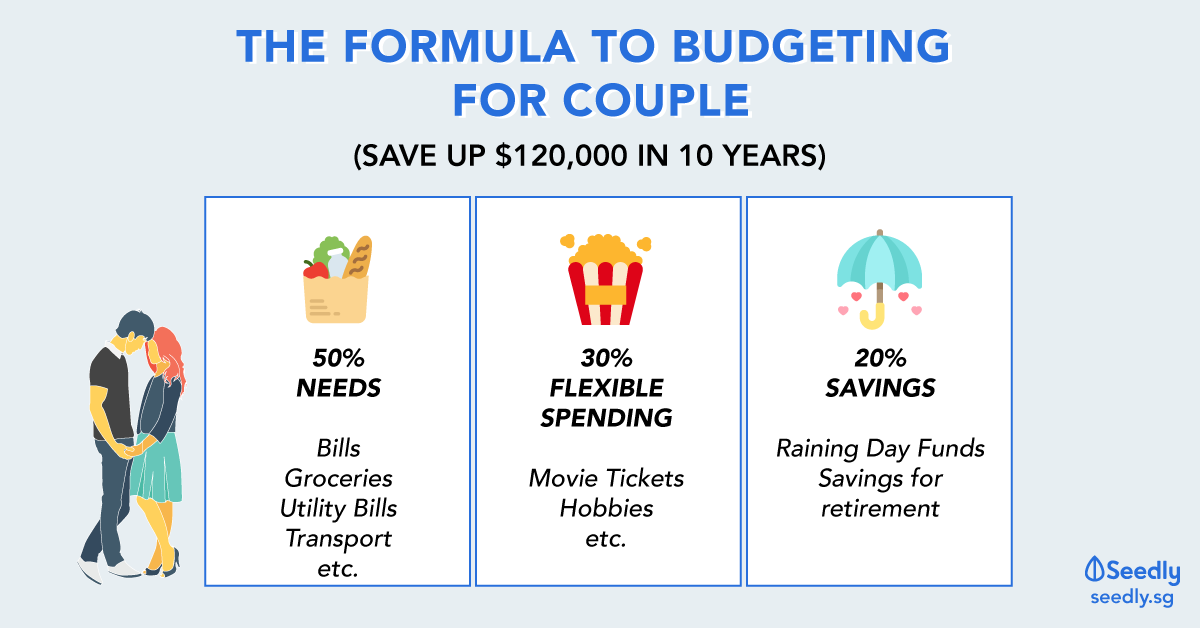

Currently my financial plan is to set aside $200 of my pay to savings (long term saving, emergency and uni maybe?) $100 of my pay for more fluid savings (travel and wants) then $100 for investment (thinking of posb invest savers but i need to have unit trust with dbs to be eligible?) the rest would be expenses (including bills and etc.)

7

Discussion (7)

Learn how to style your text

Reply

Save

Jay Liu

11 Aug 2018

Accounting and Finance at ACCA

All these are imo.

Savings account:

CIMB fast saver. 1% p.a. but need maintain min $1000; though no fall below fee. Dump all your cash in here.

Expense account:

Any account. But since you just finish your studies, I'm assuming you're still 20-23.

Have either OCBC FRANK account(no fall below fee till you're 26) or DBS multi currency autosave account(no fall below fee till you're 29).

Only transfer your cash to your expense account when you need to spend it. To me, this form let's you know how much you are spending based on transferring basis.

Investment:

Robo advisors: Smartly has pretty low investment amount needed so you can consider.

RSP: Nikko am STI ETF with DBS. No need to create a brokerage account as long as you have a existing account with DBS, Internet banking can just do it.

P2P loans: If you're a more hungry investor and willing to take risk you can try this out. For me I will go for invoice financing loans since to me it's less risky as backed by an invoice. Shorter tenure loans, able to see interest repayment as short as a month.

Hope it helps! :)

Reply

Save

Jonathan Chia Guangrong

11 Aug 2018

SOC at Local FI

Hi there.

You don't really need to be invested in unit trusts with DBS to start on POSB Invest Savers. Believe the latter can be started via an atm instruction at any POSB atm.

Firstly, you may wish to look into getting your insurance protection and health plans in place first before looking at investing. Good to have an hospital plan in place so that it can relieve potentially heavy hospital bills. Look into low cost term protection plans as well.

As some of the others have already mentioned, for the amout you are looking of investing into, you may consider robo advisory platforms for a global investment perspective (perhaps StashAway if you don't have a large capital base to start off with), or STI ETF via POSB if you prefer a local flavour. Please do your own due diligence before embarking on any investment. And perhaps the best investment you can make is on educating yourself via books. Or feel free to ask anyone in the community here if you have any questions.

For medium to long term investing, if you are keen, look into the investment programmes widely available and choose one that fits your personality. Not to mention you need to find the right mentor that is approachable, even after graduating from the programme. You'll need to pay quite a bit, but I see it as a shortcut to retiring earlier.

All the best in your journey. Cheers :)

Reply

Save

Bryan

11 Aug 2018

Co-Founder at Algorithmic Trader

Just save everything, don’t even bother to invest or travel. Set aside some money once you have sufficient savings/captial to do other things. But for now just save

Reply

Save

Png Cheng Xi Damien

10 Aug 2018

Happy Life Seeker at Home

Is your uni local or private? For local unis, easier to obtain partial or full scholarship/bond. Som...

Read 3 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Products

Standard Chartered JumpStart Account

4.8

785 Reviews

Maximum Interest: 2.50% p.a. for balances up to S$50,000

INTEREST RATES

$0

MIN. INITIAL DEPOSIT

$0

MIN. AVG DAILY BALANCE

DBS/POSB Multiplier Account

4.3

329 Reviews

OCBC FRANK Account

4.7

213 Reviews

Related Posts

Advertisement

As per what financial books said, it's better to have 6 months of your expenses as rainy day savings. As such I believe the investment plan should be put on hold until you achieve this saving amount.