Advertisement

Anonymous

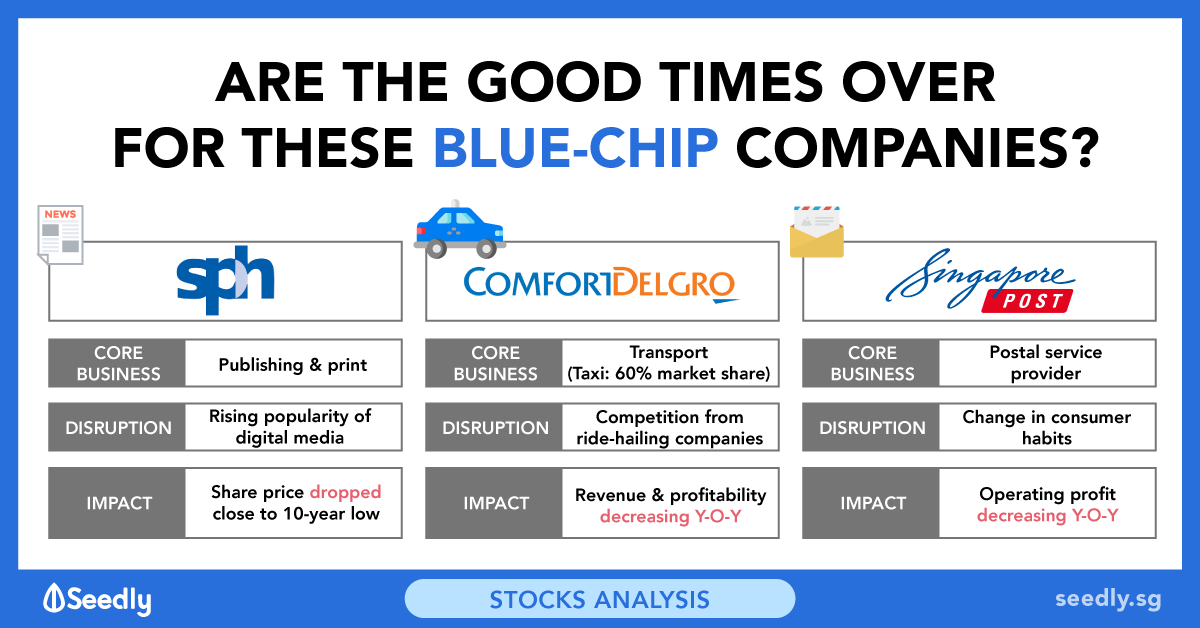

What were the unexcellent companies in Dr Wealth's presentation involved in (sector wise)? Is it accurate to dismiss good management entirely, rather than acknowledging it accounts for an important minority in asset allocation?

1

Discussion (1)

What are your thoughts?

Learn how to style your text

Reply

Save

Write your thoughts

Related Articles

Related Posts

Related Products

DrWealth

4.7

309 Reviews

SaaS Hypergrowth Investing Course

Beginners to Advanced

COURSE LEVEL

4 days

DURATION

Related Posts

Advertisement

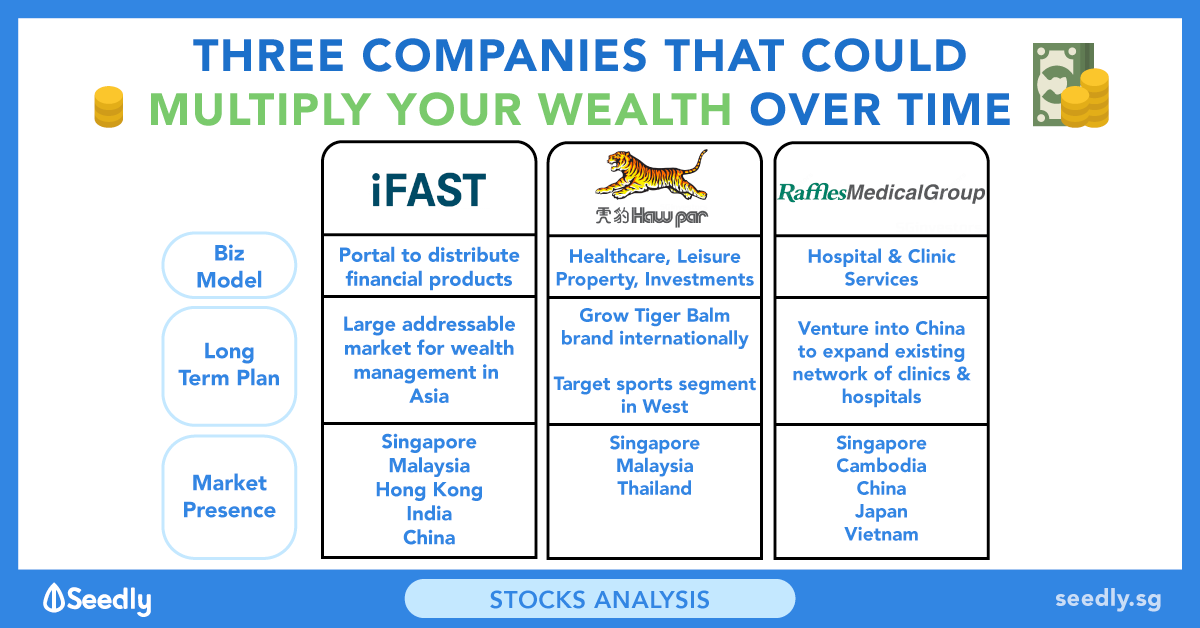

It depends on your strategy.

A deep value strategy like net net where you pay a fraction for the assets, management is not important.

If you buy a founder-led company or an A-grade stock, the business viability and prospect is important, and hence management will play a bigger role. The trap is that investors do not have the ability to discern this properly but they think they know a lot.