Advertisement

Anonymous

What can I do to reduce the taxes for next year? Is my estimated tax payable correctly calculated (based on IRAS 2018 Excel Calculator)?

Hi everyone, I was inspired by a recent D&S article to see how I can reduce my 2020 taxes. As a newbie, I hope to get some advice from others who have done the same.

Employment income= $93,340 (Amount before CPF, with bonuses)

Deductions (CPF) = $20,528

Personal relief (Parent relief)= $18,000

Chargeable income= $54,812

Is there still Personal Tax Rebate included of $200 in 2019?

Tax Payable after Personal Income Tax Rebate= $1386.80

If I were to top up my CPF SA, what would be a good est?

6

Discussion (6)

Learn how to style your text

Shengshi Chiam, CFA

23 Dec 2019

Personal Finance Lead at Endowus

Reply

Save

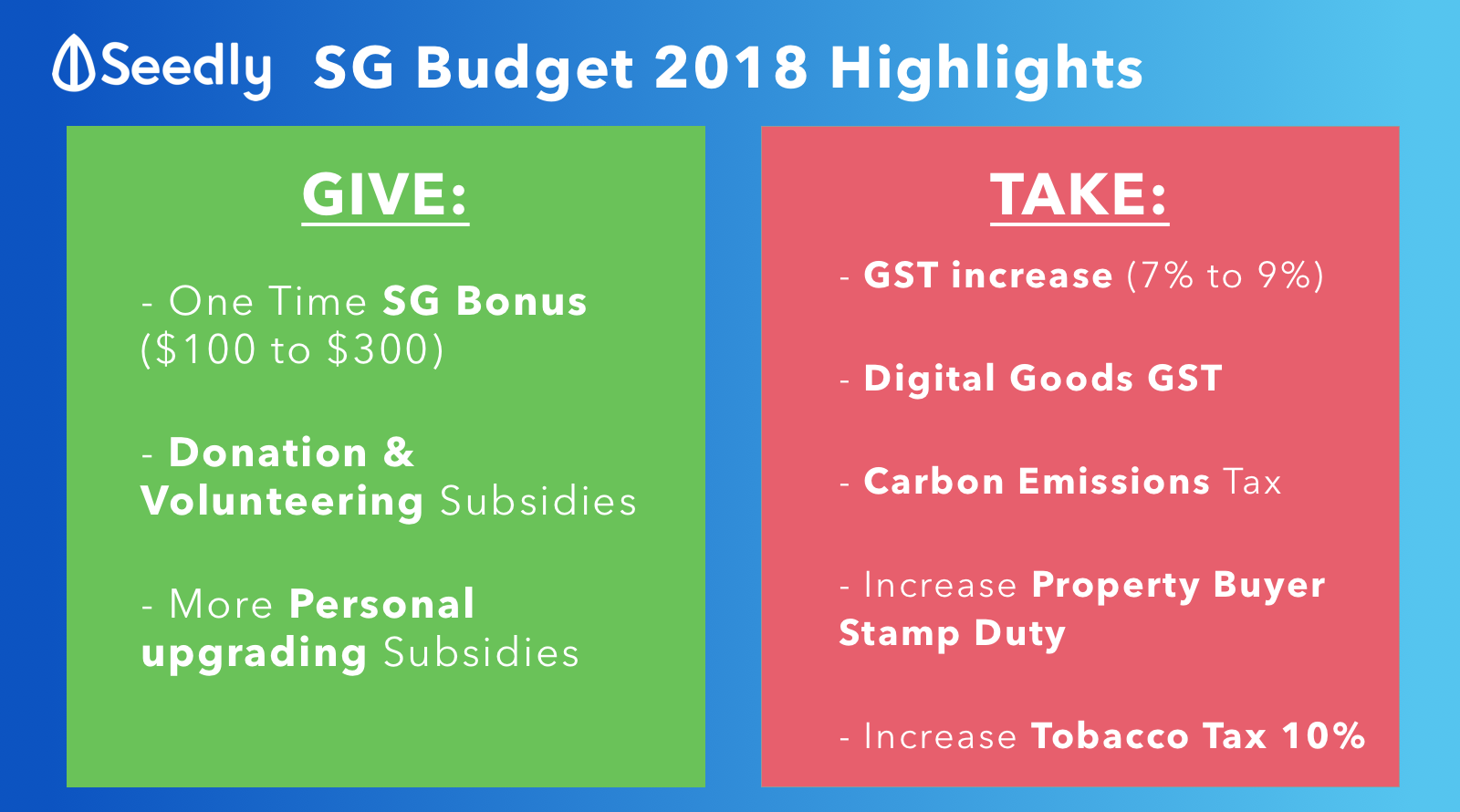

SRS - you can withdraw anytime with penalty. dollar for dollar tax relief

CPF top up - stuck until retire. dollar for dollar tax relief

Donations to approved org - 2.5x donated amount. do note some have minimum amount to qualify.

Reply

Save

SRS, donation, top up special account for parents, spouse, self....

Read 1 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

You are in the 7% tax bracket. Doing SRS or SA top up may make sense if you have no need for the liquidity now.