Advertisement

Discussion (6)

Learn how to style your text

Jonathan Chia Guangrong

25 Jan 2019

SOC at Local FI

Reply

Save

Luke Ho

24 Jan 2019

Founder and Director at CFX Money Maverick Pte Ltd

How did I miss this one?

Being one of those advisors, I can openly answer the question lol.

The answer to that question is that there are no benefits to someone who claims. Obviously if this is true you get to be the successful recipient of those claims. So you can really only create a 'pro' and 'con' list if it is true, which means you need to ascertain truth first.

Confidence is a good start, though it could easily be trickery or misbelief. But it is a good start.

Justifiable confidence next. Meaning that you get them to justify how they plan on accomplishing this. At the very least, they should show you some historical returns and justification for those historical returns being around.

They should also provide measures of safety for your portfolio. How well it's diversified/concentrated and why? How will they value add as an advisor, who is not a fund manager?

They should also KNOW measures of safety for your portfolio. What happens during a market crash, what kind of action would they take or talk to you about? They should also be familiar with the investment product so they can talk to you about how liquid or illiquid your investment is.

They also need to provide you a safety margin of time horizon for your portfolio - if you're trying to make x amount in 15 years, the volatility may imply that you need a +/- 5 additional years and you shouldn't do the investment without accounting for this. (which is why Ive reluctantly turned down some investors with a 5 - 10year time frame - good chance I might not deliver)

They also need to know the Trifecta. Buy/Sell/Hold.

Stuff like that.

If you're assured, go nuts. Even then, the FA might have been a pretty sweet talker (though someone with that kind of technical knowledge rarely is). But most likely, the pro will be that you get what you want.

Well. Wait no further. XD You can drop me a message!

Reply

Save

Hi there,

Investing on advice of financial advisors is quit risky to assume. But if you are taking...

Read 4 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

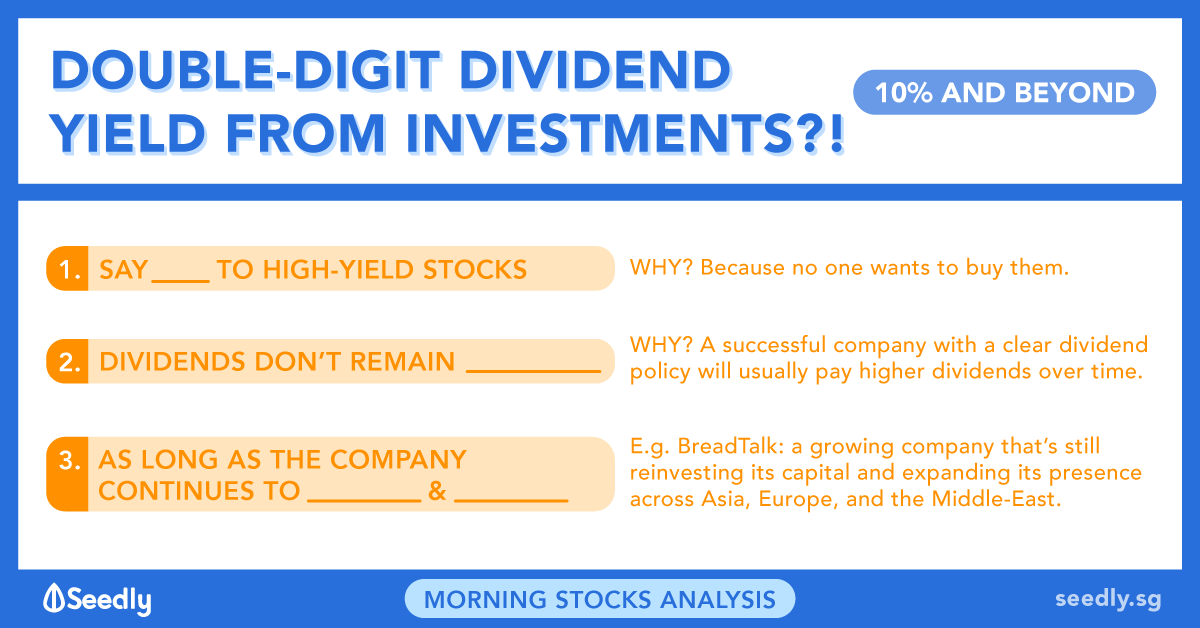

What's their track record and what are the underlying instruments? Are the returns guaranteed and if so who is backing the guarantee? Learning to manage your own portfolio would be a better idea. You gain a life long skill and your returns will be much higher as you don't need to account for advisory fees. Btw, 5% pa returns is peanuts and nothing to shout about. Same for small double digit growth.