Advertisement

Anonymous

We are Singaporeans, 400k BTO (HDB loan + ready in 2 years). $3.7k household income (no kids). Will HDB recalculate our loan eligibility and income might be insufficient?

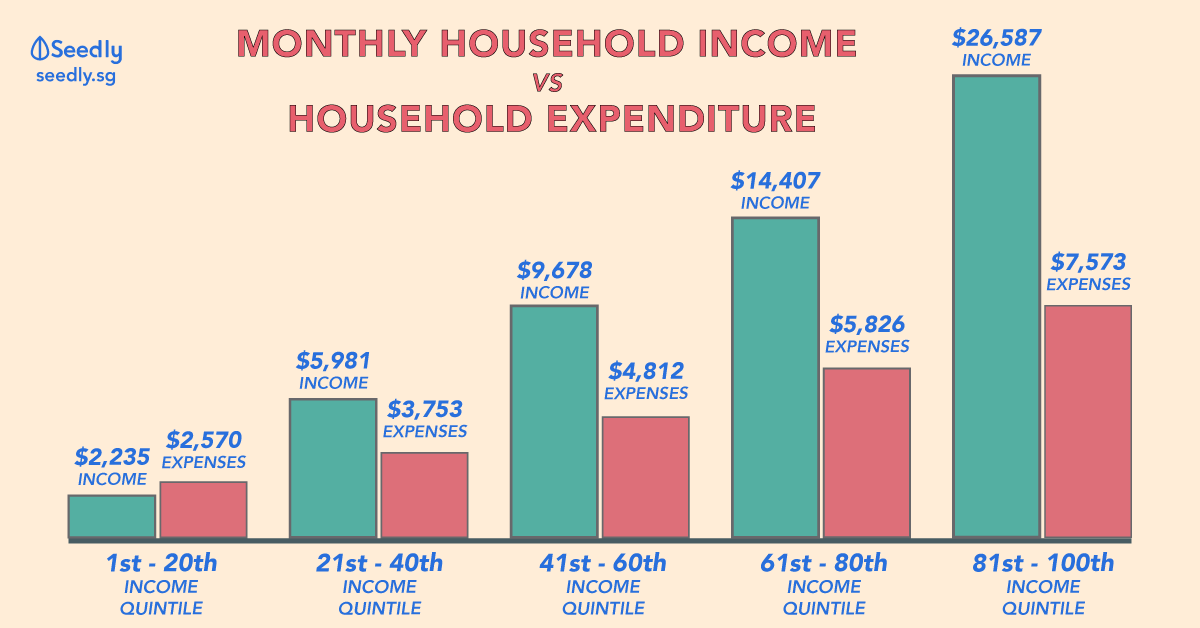

We are not spendthrift and total expenses adds up to approx $1k/mth.

Current total cash savings: $50k.

Are we able to survive and live on a household income of $3.7k?

Will we be able to service the BTO flat? We managed to get a 30k housing grant. So after grants, the balance for the flat is $370k

3

Discussion (3)

What are your thoughts?

Learn how to style your text

Reply

Save

Jiayee

06 Jan 2021

Salaryman at some company

Have you considered your CPF? Can use that to offset the instalment.

Even without CPF, it's still possible to pay your instalments with cash, especially if you take the max loan tenure.

Reply

Save

View 1 replies

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

Hi,

Assuming you are below 40 years old,

Your maximum loan will be at $220,000 for 25 years at $999 a month

(2.6% HDB loan)

This means every month you should need to fork out around $150 in cash for the mortgage and the rest should be from your CPF OA contribution monthly.

So now on the purchase

You bought at $400k

You have $30k in grants.

and $220k in loans

This means you need to save another $150k in CPF OA and Cash in total in the next 2 years, and also please set aside some $ ($20k-$30k) for renovation.

Hope this helps.