TL;DR: FY2018 net profits declined slightly but 1Q2019 profits increased. P/E ratio is high at 19.27.

Business overview

Wilmar International is a global leader in processing and merchandising of edible oils, oilseed crushing, sugar merchandising, milling and refining, production of oleochemicals, specialty fats, palm biodiesel, flour milling, rice milling and consumer pack oils. They have over 900 manufacturing plants in 33 countries and regions.

Share price

Credits: Yahoo Finance

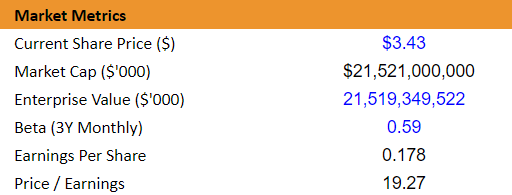

The share price of Wilmar is trading at $3.43 (as of 24 May 2019). The 52-week L/H is at $2.970/$3.690.

Financials

Total dividend for FY2018 is S$0.105/share, an increase from S$0.10/share. This gives a dividend payout of about 43%. At the current price of $3.43 and assuming constant dividend payout of $0.105, that gives a dividend yield of 3.06%.

Revenue increased slightly, by 2.12%. Net profit decreased by 4.39%.

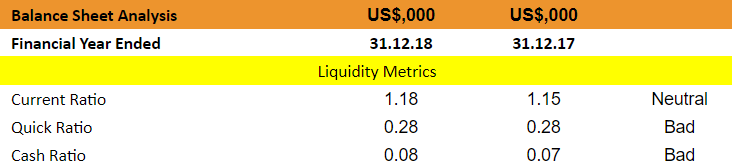

Balance sheet ratios are not good either. Their cash as a percentage of current liabilities is very low, showing that Wilmar is not liquid.

Although this stock's beta is not close to one, but the operations are subject to market fluctuations.

Revenue portfolio

Global presence

1Q2019

Their revenue in 1Q fell but profits increased slightly. Their sugar segment did well, but there is a decline in performance in Tropical Oils, Oilseeds and Grains.

Moving Foward

Bad

- They are subject to changing commodity prices.

- There is volatility in the soybeans market arising from the US-China trade tensions.

Good

- Global demand for palm oil will continue to grow in tandem with the world population. They are continuously working towards sustainable palm oil.

- The Group’s strategy in 2018 was to develop a more stable downstream processing and branded consumer products. If they continue this strategy forward, their growth will improve. But of course, they also need the commodity prices and volatility movements to move in their favour to attain positive overall performance.

Conclusion

P/E ratio of 19.27 is too high for me, and I personally wouldn’t enter this stock now amidst so much market uncertainty. Their financials don’t look very good either. As much as this is a blue-chip stock, it is too expensive to enter now.

TL;DR: FY2018 net profits declined slightly but 1Q2019 profits increased. P/E ratio is high at 19.27.

Business overview

Wilmar International is a global leader in processing and merchandising of edible oils, oilseed crushing, sugar merchandising, milling and refining, production of oleochemicals, specialty fats, palm biodiesel, flour milling, rice milling and consumer pack oils. They have over 900 manufacturing plants in 33 countries and regions.

Share price

Credits: Yahoo Finance

The share price of Wilmar is trading at $3.43 (as of 24 May 2019). The 52-week L/H is at $2.970/$3.690.

Financials

Total dividend for FY2018 is S$0.105/share, an increase from S$0.10/share. This gives a dividend payout of about 43%. At the current price of $3.43 and assuming constant dividend payout of $0.105, that gives a dividend yield of 3.06%.

Revenue increased slightly, by 2.12%. Net profit decreased by 4.39%.

Balance sheet ratios are not good either. Their cash as a percentage of current liabilities is very low, showing that Wilmar is not liquid.

Although this stock's beta is not close to one, but the operations are subject to market fluctuations.

Revenue portfolio

Global presence

1Q2019

Their revenue in 1Q fell but profits increased slightly. Their sugar segment did well, but there is a decline in performance in Tropical Oils, Oilseeds and Grains.

Moving Foward

Bad

Good

Conclusion

P/E ratio of 19.27 is too high for me, and I personally wouldn’t enter this stock now amidst so much market uncertainty. Their financials don’t look very good either. As much as this is a blue-chip stock, it is too expensive to enter now.