Advertisement

Anonymous

(Stocks Discussion) SGX: Raffles Medical Group Ltd (SGX: BSL)?

Discuss anything about share price, dividends, yield, ratios, fundamentals, technical analysis and if you would buy or sell this stock on the SGX Singapore markets. Do take note that the answers given by our members are just your opinions, so please do your own due diligence before making an investment!

6

Discussion (6)

Learn how to style your text

Reply

Save

Raffles Medical (SGX:BSL) is perhaps one of the most well-known and largest private medical companies in Singapore. Its brand is synonymous with Raffles Hospital situated in Bugis as well as the Raffles Clinics. In the medical line, the reputation of the hospital is vital and acts as a natural moat. Raffles Medical (RM) has done so by establishing its brand name in the private medical market. It currently operates primarily in 2 countries – Singapore and China. As part of its expansion in Singapore,

RM recently opened a new centre in Holland Village in 2016 and

A new wing for the specialist center at its Bugis Hospital branch.

Has businesses in other SEA countries.

Valuation

Based on full year results:

Raffles has a reported earnings-per-share of 4 cents and a dividend of 2.25 cents

From a current price of $1.13 (as of 5 Oct 2018), it points to a 28x PE and a fairly low dividend yield of 2%.

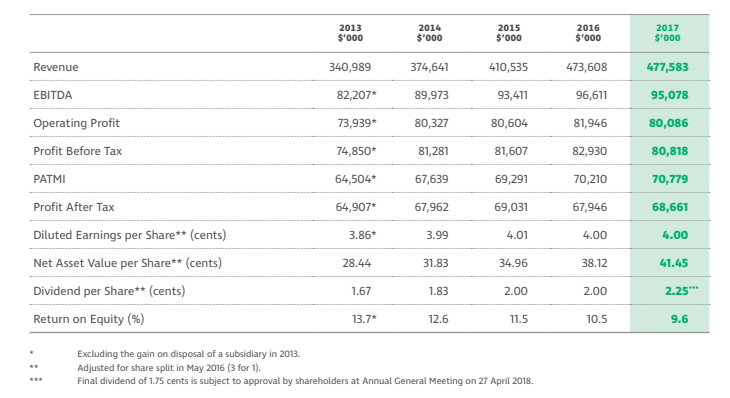

However, it is worth noting that Raffles Medical is very very conservative. Its dividends are sustainable, with the company capping it at below 75% of its payout ratios, unlike Singapore Telecos who pays higher than 75%.  Figure 1: Raffles Medical Past 5 year results (Source: Annual Report) From a cash flow analysis, Raffles Medical has always been paying its dividends out of free cash flow generated by its businesses.

Figure 1: Raffles Medical Past 5 year results (Source: Annual Report) From a cash flow analysis, Raffles Medical has always been paying its dividends out of free cash flow generated by its businesses.

Future growth in Singapore

Raffles Medical has refurbished its flagship hospital in Singapore with a specialist centre. This has led to the increase in the Bugis hospital capacity. With the Ministry of Health (MOH) making it more expensive for foreigners to be referred to public hospitals, and given the Raffles Hospital Branding, the increase in its hospital capacity should be filled. Secondly, RM has been granted the license to be an integrated Healthshield provider in Singapore. RM can definitely reap synergy between its insurance business and brick and mortar health business.

Future Growth in China

Raffles Medical has imported its reputable brand name from Singapore to China as well and has been gaining traction.

Currently operates various medical centres in China cities

Two new Raffles hospitals expected in 2 Chinese cities in late 2018 and 2019.

All in all, one can reasonably expect Raffles Medical to experience earnings growth from this year until 2020. It seems to be a decent stock to own that will provide sustainable dividends under its current management. Personally, I expect its earnings to grow 20% by 2020 and this may also mean future dividends of 2.75-3 cents per share, to be sustained perpetually until its reputation is adversely affected. Based on the above growth prospects, I expect an additional 25% growth in earnings in 2020.

- This probably means RM is priced at 20x its future earnings growth; just about right at the current price.

Management

It is reassuring to learn that its Executive Chairman (Dr Loo Choon Yong) who runs its business is a doctor by training. With the key management being professionals in the medical field, they are more attuned to the running of the ground. Its management has also been very conservative in building up the business.

RM has constantly kept its leverage ratio low, currently at 10%; and pays its dividends in a sustainable manner.

This makes the company a good choice as a dividend stock; even better than telecos who are highly leveraged

Paying a high payout ratio, beyond their free cash flow

The only thing dividend investors have to stomach is its low dividend yield and conservative management. If I may, this comes from the careful and conservative nature of doctors.

Reply

Save

1) margins declining steadily, a really bad sign. Shows that they have decreasing pricing power.

Th...

Read 4 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

Raffles Medical Group https://www.stockmoo.com/stock/sgx-bsl_1494/ reported a profit after tax and minority interest (PATMI) of $90.2 million for FY2023, a 37.1% decrease year-on-year (y-o-y) due to the discontinuance of Covid-19-related activities. Earnings per share dropped to 4.85 cents from 7.71 cents in FY2022. Full-year revenue declined 14.1% to $706.9 million. Cash and cash equivalents stood at $342.5 million as of Dec 31, 2023. The board recommended a final core dividend of 2.4 cents per share.