TL;DR

Dividend yield of 6.58%. Should you just buy this stock for dividends? Short answer is no, or at least not just for its dividends. Financials look pretty bad in 2018.

Business overview

Pacific Century Regional Developments Limited (PCRD) has interests in telecommunications, media, IT solutions, logistics and property development and investment, in the Asia-Pacific region.

PCRD’S most significant asset is its 22.7% stake in Hong Kong-listed PCCW Limited (PCCW). PCCW’s local media business mainly comprises Hong Kong’s largest pay-TV, NowTV, its OTT extension Now E, and free TV under the brand ViuTV.

Share price

Current share price is $0.350 (as at 12 June 2019). 52-week L/H is $0.330/$0.450.

Financials

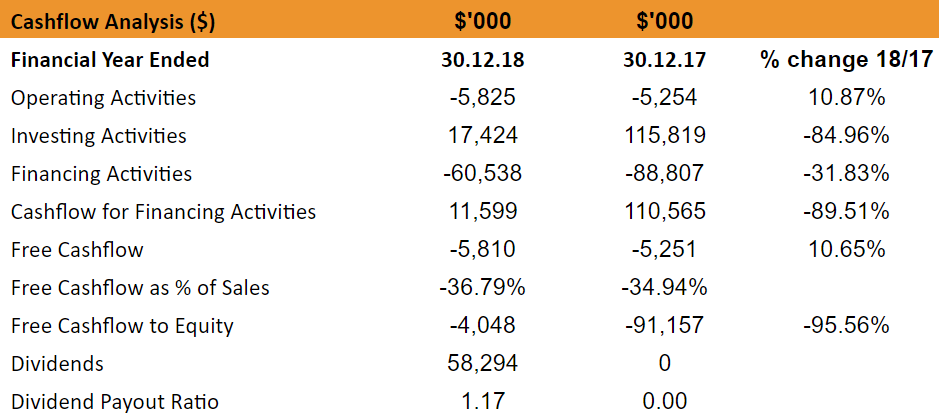

Note that figures below are in thousands (‘000).

Net profit decreased by more than 40% in 2018.

Note here that their revenue is lower than their net profit. This is because they have associated corporations, which accounted for an additional income of $36.5 million, and income tax credit of $6.9million.

Dividends

Paid out a final dividend of 2.20 cents last year. Dividend in 2019 paid out was 2.40 cents. On top of that, had a special dividend of 6.30 cents.

In 2018: Taking their final dividend of 2.20 cents, dividend payout is 117%, more than their net profit (more than what they can afford).

No dividends were paid in 2017.

In 2018,

Number of shares on hand = 2,649,740

A dividend of $0.022 eventually got paid out. $0.022 x 2,649,740 = $58,294

This is a number greater than their net profit and it is unsustainable.

Their debt levels are pretty low and can be covered off with their cash, which is a good thing.

1Q2019

Profit for the period increased, to 7.74m from 4.54m YoY.

Balance sheet overall increased. Net assets increased to 1,448,437,000, from 1,405,334,000.

NAV is $0.547 as at 1Q2019. This is higher than their current share price.

Conclusion

Net profits decreased by more than 40%. Financials are not very strong. Past dividend is high, especially with their special dividend of 6.30 cents. But it is unsustainable given their level of profits. 1Q2019 financials appear to be better YoY. Those looking to get into the stock for dividends will need to take note that dividends paid out in the future probably will not be as high. Yields you see online probably included the 6.30 special dividend, inflating the number. But NAV makes share price seems undervalued. Please do your own due diligence.

TL;DR

Dividend yield of 6.58%. Should you just buy this stock for dividends? Short answer is no, or at least not just for its dividends. Financials look pretty bad in 2018.

Business overview

Pacific Century Regional Developments Limited (PCRD) has interests in telecommunications, media, IT solutions, logistics and property development and investment, in the Asia-Pacific region.

PCRD’S most significant asset is its 22.7% stake in Hong Kong-listed PCCW Limited (PCCW). PCCW’s local media business mainly comprises Hong Kong’s largest pay-TV, NowTV, its OTT extension Now E, and free TV under the brand ViuTV.

Share price

Current share price is $0.350 (as at 12 June 2019). 52-week L/H is $0.330/$0.450.

Financials

Note that figures below are in thousands (‘000).

Net profit decreased by more than 40% in 2018.

Note here that their revenue is lower than their net profit. This is because they have associated corporations, which accounted for an additional income of $36.5 million, and income tax credit of $6.9million.

Dividends

Paid out a final dividend of 2.20 cents last year. Dividend in 2019 paid out was 2.40 cents. On top of that, had a special dividend of 6.30 cents.

In 2018: Taking their final dividend of 2.20 cents, dividend payout is 117%, more than their net profit (more than what they can afford).

No dividends were paid in 2017.

In 2018,

Number of shares on hand = 2,649,740

A dividend of $0.022 eventually got paid out. $0.022 x 2,649,740 = $58,294

This is a number greater than their net profit and it is unsustainable.

Their debt levels are pretty low and can be covered off with their cash, which is a good thing.

1Q2019

Profit for the period increased, to 7.74m from 4.54m YoY.

Balance sheet overall increased. Net assets increased to 1,448,437,000, from 1,405,334,000.

NAV is $0.547 as at 1Q2019. This is higher than their current share price.

Conclusion

Net profits decreased by more than 40%. Financials are not very strong. Past dividend is high, especially with their special dividend of 6.30 cents. But it is unsustainable given their level of profits. 1Q2019 financials appear to be better YoY. Those looking to get into the stock for dividends will need to take note that dividends paid out in the future probably will not be as high. Yields you see online probably included the 6.30 special dividend, inflating the number. But NAV makes share price seems undervalued. Please do your own due diligence.