Advertisement

Anonymous

(Stocks Discussion) SGX: Mapletree Industrial Trust (SGX: ME8U)?

Discuss anything about share price, dividends, yield, ratios, fundamentals, technical analysis and if you would buy or sell this stock on the SGX Singapore markets

Also, these questions just represent opinions, so before you invest, please do your own due diligence.

4

Discussion (4)

Learn how to style your text

Reply

Save

Another one of my favorite REITs! Very good management and stock has good solid history. I like their expansion into data centres. I have been adding on positions whenever there is a dip.

Reply

Save

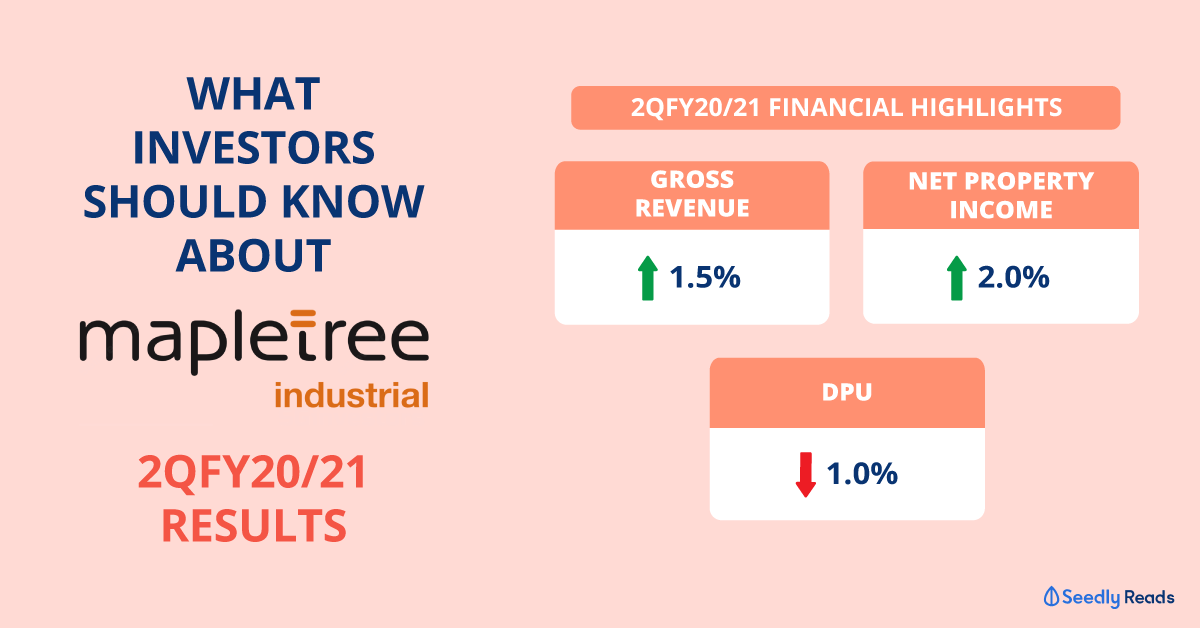

Let’s look at the key financial numbers from the REIT’s fiscal first-quarter results (three months e...

Read 2 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

Love this reit! It has foresight and is growing and expanding...😄👏👍