TL;DR: China Everbright Water Limited (CEWL) has been getting quite a bit of hype lately, after they launched their public offer and got listed on the mainboard of HKSE. There is good revenue growth and profit growth. P/E ratio is low at 8.71.

Business overview

The parent company is Everbright International, and its corporate mission is: “Devoted to Ecology and Environment for Beautiful China”. Here we will look at Everbright Water Limited, their subsidiary, which got a separate listing. CEWL is engaged in water environment management, and water supply and treatment in many parts of China.

Share price

The share price of CEWL is trading at $0.3750 (as of 22 May 2019). The 52-week L/H is at $0.2950/$0.5050.

Financials

(*Note that figures are in HK$)

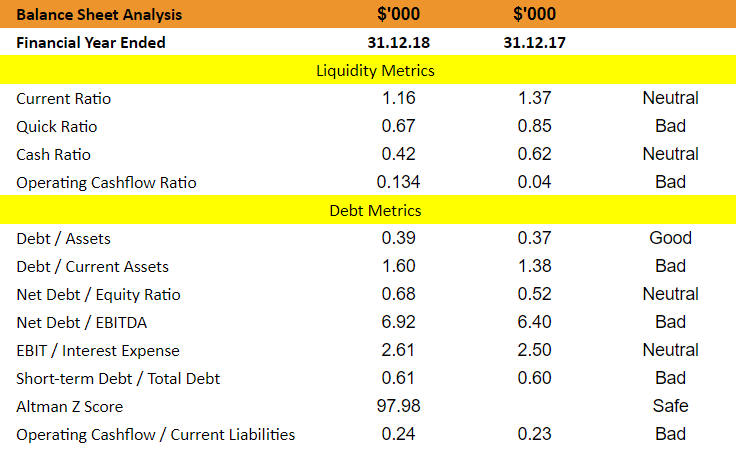

- Gearing ratio (Total Liabilities/Assets) increased from the previous FY, to 55.8%.

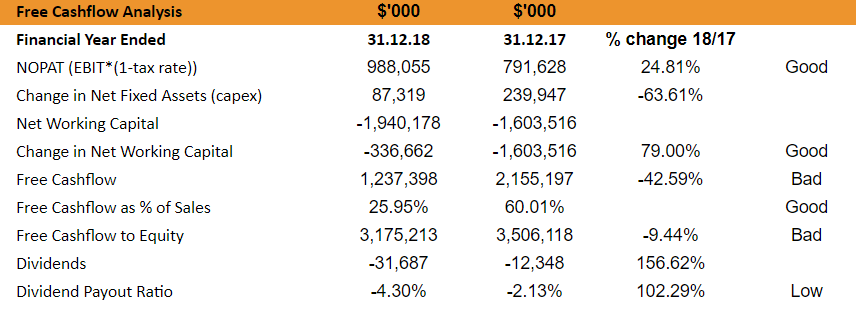

- Revenue increased 33% and profit increased 27%.

- P/E ratio is currently 8.71, which mean that it is undervalued, so we can go ahead and take a look at their outlook.

1Q2019 performance

1Q revenue increased 26% and gross profit increased 18% YoY.

In 1Q2019, they secured two more projects and had some other projects ongoing construction. They also got listed on the mainboard of Hong Kong Stock Exchange. More information can be read here.

Moving forward

Strengths

- Securing and development of projects mean an increase in cost in the short term and a potential increase in revenue in the long term

Opportunities

- Environmental protection industry, increasing corporate social responsibility by firms

Threats (risks)

- They are subject to numerous risks. Some prevalent ones include environmental compliance risk, policy and regulatory risks, credit risks, forex risks, etc. For example, foreign exchange effects turned out to be HK$ -80.2m compared to +88m one FY before.

Conclusion

Their share price saw a peak at $0.50, and has dropped since. The high beta of 0.97 is also a turnoff given the high volatility of the market. With pressure from the economy and the industry facing the industry, whether or not they will benefit or lose out from it will require a more in-depth study. But with negative sentiments, people are selling off their shares... which means share prices are going down. At the price of $0.375, the P/E ratio is 8.71, which is quite low. Also, the fact that more projects are being built will mean higher revenue, making it an interesting stock you may want to look at!

I also talked about Enviro-hub Holdings, a smaller market cap environment stock. You can check it out here if you are interested!

TL;DR: China Everbright Water Limited (CEWL) has been getting quite a bit of hype lately, after they launched their public offer and got listed on the mainboard of HKSE. There is good revenue growth and profit growth. P/E ratio is low at 8.71.

Business overview

The parent company is Everbright International, and its corporate mission is: “Devoted to Ecology and Environment for Beautiful China”. Here we will look at Everbright Water Limited, their subsidiary, which got a separate listing. CEWL is engaged in water environment management, and water supply and treatment in many parts of China.

Share price

The share price of CEWL is trading at $0.3750 (as of 22 May 2019). The 52-week L/H is at $0.2950/$0.5050.

Financials

(*Note that figures are in HK$)

1Q2019 performance

1Q revenue increased 26% and gross profit increased 18% YoY.

In 1Q2019, they secured two more projects and had some other projects ongoing construction. They also got listed on the mainboard of Hong Kong Stock Exchange. More information can be read here.

Moving forward

Strengths

Opportunities

Threats (risks)

Conclusion

Their share price saw a peak at $0.50, and has dropped since. The high beta of 0.97 is also a turnoff given the high volatility of the market. With pressure from the economy and the industry facing the industry, whether or not they will benefit or lose out from it will require a more in-depth study. But with negative sentiments, people are selling off their shares... which means share prices are going down. At the price of $0.375, the P/E ratio is 8.71, which is quite low. Also, the fact that more projects are being built will mean higher revenue, making it an interesting stock you may want to look at!

I also talked about Enviro-hub Holdings, a smaller market cap environment stock. You can check it out here if you are interested!