Advertisement

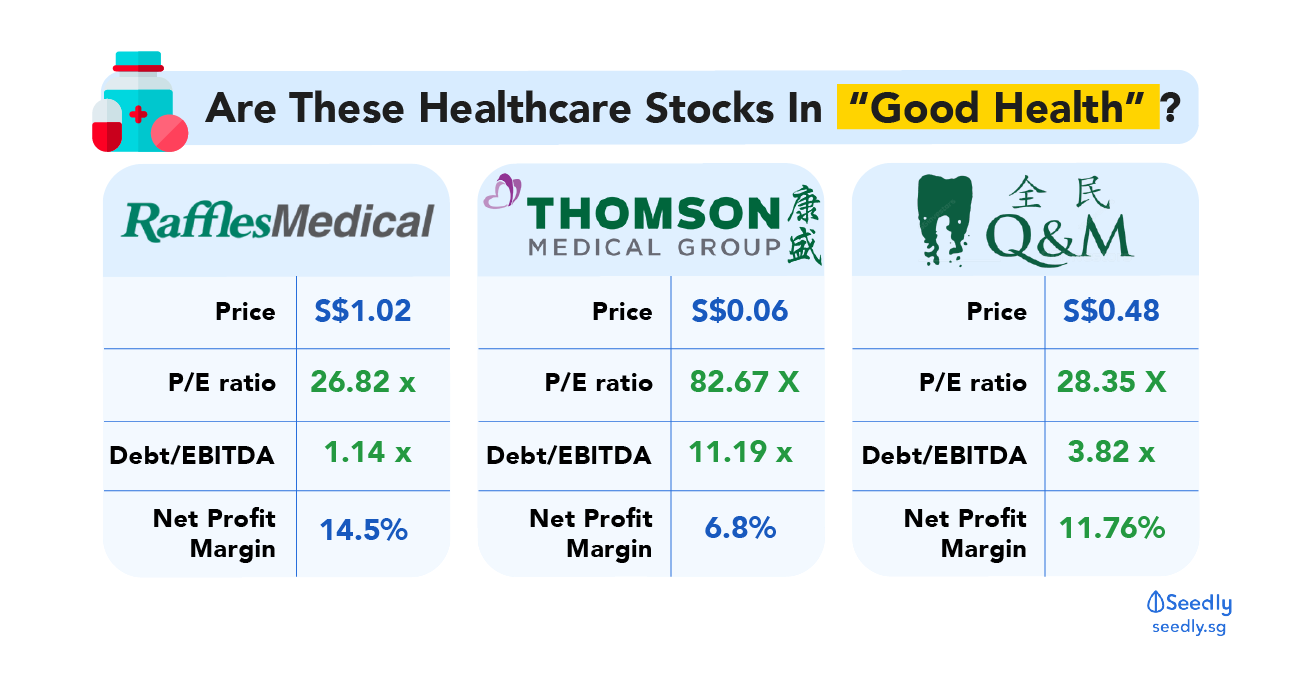

May I know how to find an undervalued stock which health, profitability, dividend are good to buy now?

5

Discussion (5)

Learn how to style your text

Benson Ng

19 Nov 2020

Financial Advisory Consultant at Phillip Securities Pte Ltd

Reply

Save

When it fall below its intrinsic value.

How do i know the intrinsic value? Discount cashflow model

But easy say then done. Emotion.

BABA now plunging you dare to buy?😏

Reply

Save

Sharon

15 Jun 2020

Life Alchemist at School of Hard Knocks

Looks like you are dividend hunter.

I would consider market cap ($500m) as one of the metrics. It i...

Read 3 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Products

Moomoo Singapore

4.7

487 Reviews

From $0

MINIMUM FEE

0.03%

TRADING FEES

Custodian

STOCK HOLDING TYPE

Saxo Markets

4.5

961 Reviews

Plus500

4.7

144 Reviews

Related Posts

Advertisement

You can considering using value investing. Using Price to earnings, price to book value, etc.. You can read the classic The Intelligent Investor for more information. Have fun investing! 😊