Advertisement

Anonymous

I understand that the best thing to do is to hold onto a good company forever. Let's say I need the money out in a decade's time and the company has grown, how do I monetize that paper gain without exiting the position?

3

Discussion (3)

Learn how to style your text

Reply

Save

Chong Ser Jing

14 May 2020

Former Writer/Analyst at The Motley Fool Singapore

Hello! Really interesting question. I think the easiest thing to do will be sell small chunks of the company slowly. That will, you get to still participate in the company's growth for a significant period of time.

Reply

Save

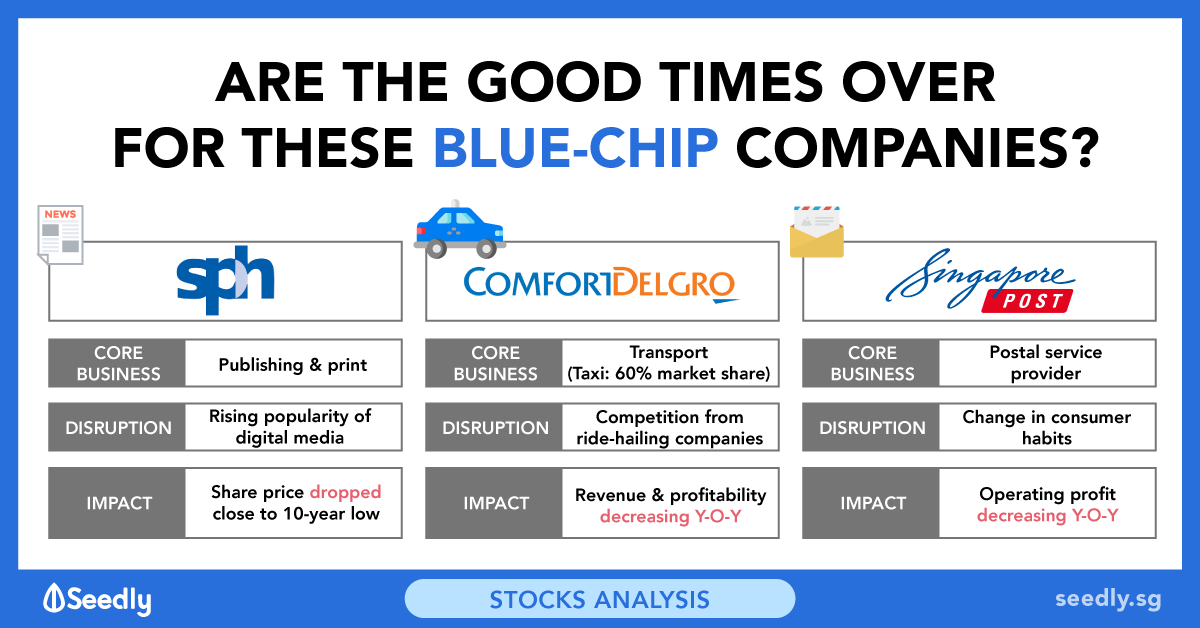

Holding on to a stock long term, yes, but not forever. As decades pass, norms/cultures/habits/techno...

Read 1 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Products

Moomoo Singapore

4.7

487 Reviews

From $0

MINIMUM FEE

0.03%

TRADING FEES

Custodian

STOCK HOLDING TYPE

Saxo Markets

4.5

961 Reviews

Plus500

4.7

144 Reviews

Related Posts

Advertisement

Hello there! When you make an investment, I believe there should an investment objective in mind. One of the possible investment objectives could be to make down payment of a house where you invest in x company so that you can have y return in 5-10 years. When your investment objective has been met, I would say it could be time for you to sell. To be very honest, it is really difficult to know for sure one is a "good company" given that things might be different 10, 20 years down the road.