Advertisement

Anonymous

How to get your partner to be interested in family finances and more responsible with money and expenditures?

Hi everyone,

I am the sole breadwinner while my wife is currently studying and taking care of the kids. Our relationship is great as long as we don't talk about money as it will result in an argument or fight.

She spends too much and has 0 interest in our finances. I work in finance which does not make it easier as it is my daily work to talk about budgets and expenses. She feels that I am the problem while I feel vice versa.

Any idea how to tackle this and how I can change it?

4

Discussion (4)

Learn how to style your text

Reply

Save

I saw an episode of "Till debt do us part", and the wife did an empty board and made her husband fill in the blanks for the bills. I think its a good idea if you attempt something similar.

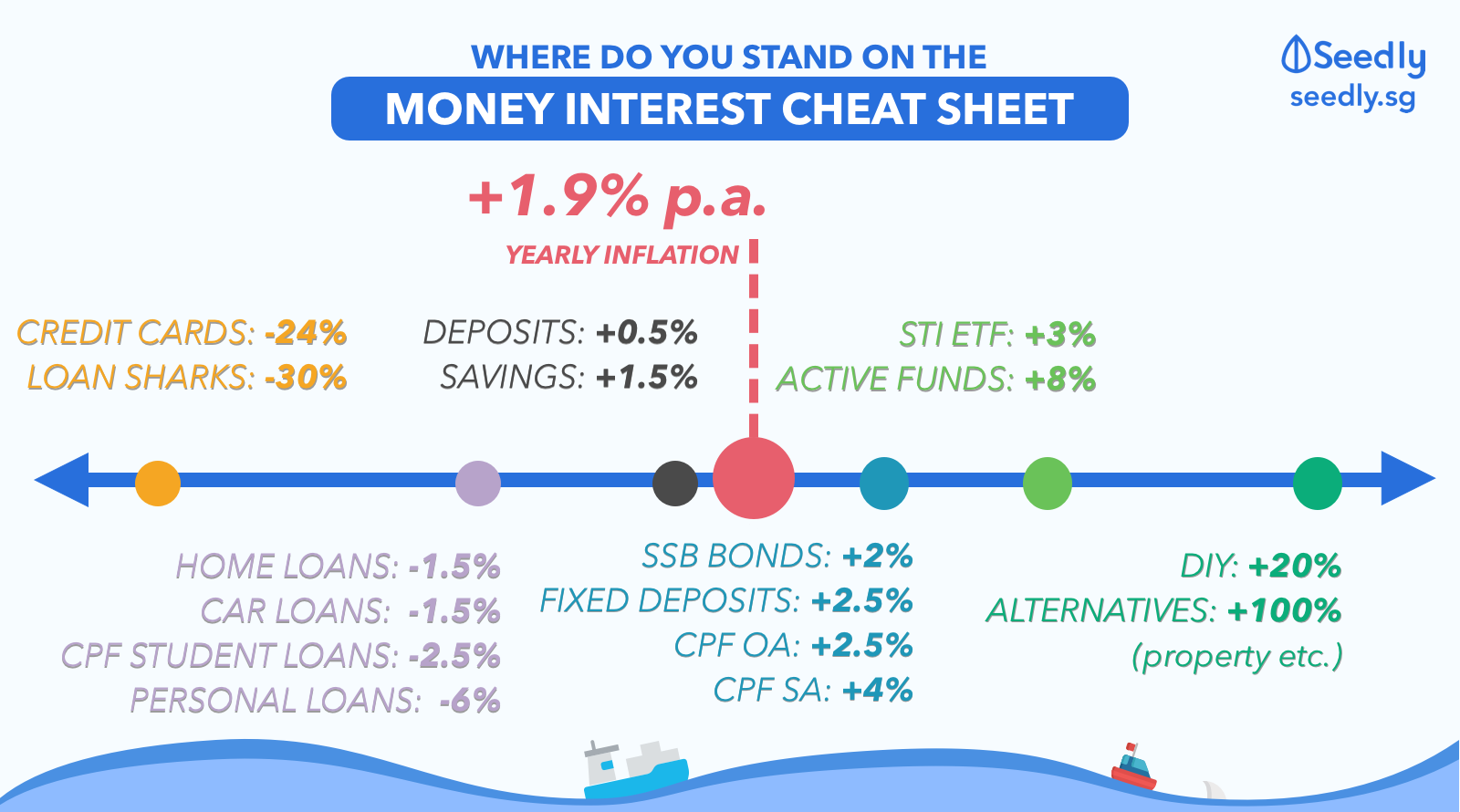

You could have the empty sheet start with

- last last month (eg Nov) bank account closing balance

- let her fill in the expenses for December

- let her fill in the incoming cashflows be it your salary / interest / dividends

- let her total up and get the ending balance

- let her calculate the change in cash

If your change in cash is negative (ie less cash than before), this exercise would be helpful in visualizing how far your cash would last

If your change in cash is positive, ie there is savings, it would be more difficult to visualize how bad the situation would be, but if you want to make a point, you could raise an example of what if you got retrenched or into an accident tomorrow, and then she can think about how far that bank balance can go.

Not too sure if it helps, but I think letting them do it one round, hands on, helps them see the picture in more clarity...

I think 2020 will be a mild recession year slightly worse than 2019, not unbearable, but if you were to lose your job, it could be harder to find one that pays as well as your last job, so maybe you can use this to support the exercise.

I did two budgets this year, one assuming normal pay with minimal increment, and one assuming 20% pay cut. Trust me, attempting the budget with 20% pay cut was horrifying, but I feel better knowing what to do if I did get a pay cut...

Reply

Save

Ask her if she wish for her children to become "sand-wiched" generation when they grew up due to fis...

Read 2 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

Communicate. And do a numbers breakdown for her, and show her which aspects of the expenses could be minimised for a better future for the kids and you guys.

Also, another thing is about mutual respect and support. Instead of pointing fingers at one another, sit down and talk it through.