Advertisement

Discussion (3)

Learn how to style your text

Jason Sing

23 Oct 2018

School Of Hard Knocks And Life at School Of Hard Knocks And Life

Reply

Save

Usually 10% is consider a reasonable guide to Budget your insurance premium. Like what Kenneth say, it also depend on your liabilities, if you do have Lot of liabilities, you will need to increase the %, usually Insurance Agent will do cashflow exercise with you to find the affordable budget. And for single man(John), he must also get his minimum coverage such as h&s and also term plan. In the event, sickness happen to him, all the problem will not go to him, but to his parent who suppose to retire.

Reply

Save

Kenneth Lou

10 Jul 2018

Co-founder at Seedly

Hello! Thanks for asking this question :)

I think there is no one clear formula to decide this....

Read 1 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

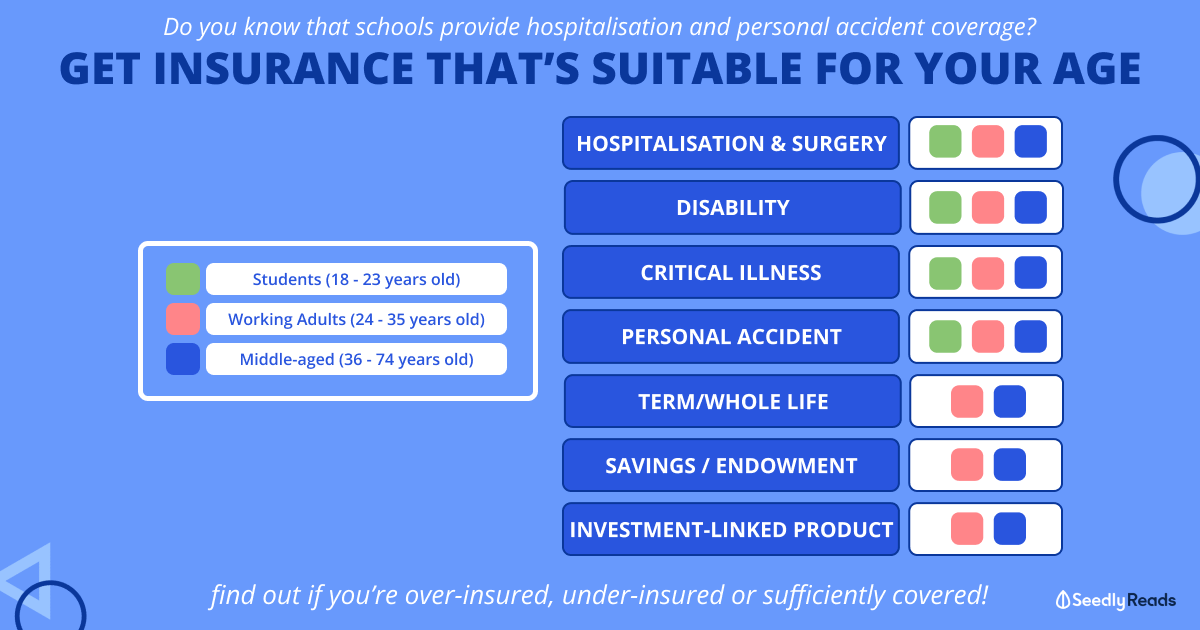

The amount of coverage depends on a lot of factors, whether you are single or married, whether it is for income replacement or leaving a legacy, whether you are buying a term or whole life policy or simply whether you could afford. How much one should spend on insurance really depends on what you need at certain stage of your life. There is no clear cut answers.