Advertisement

Anonymous

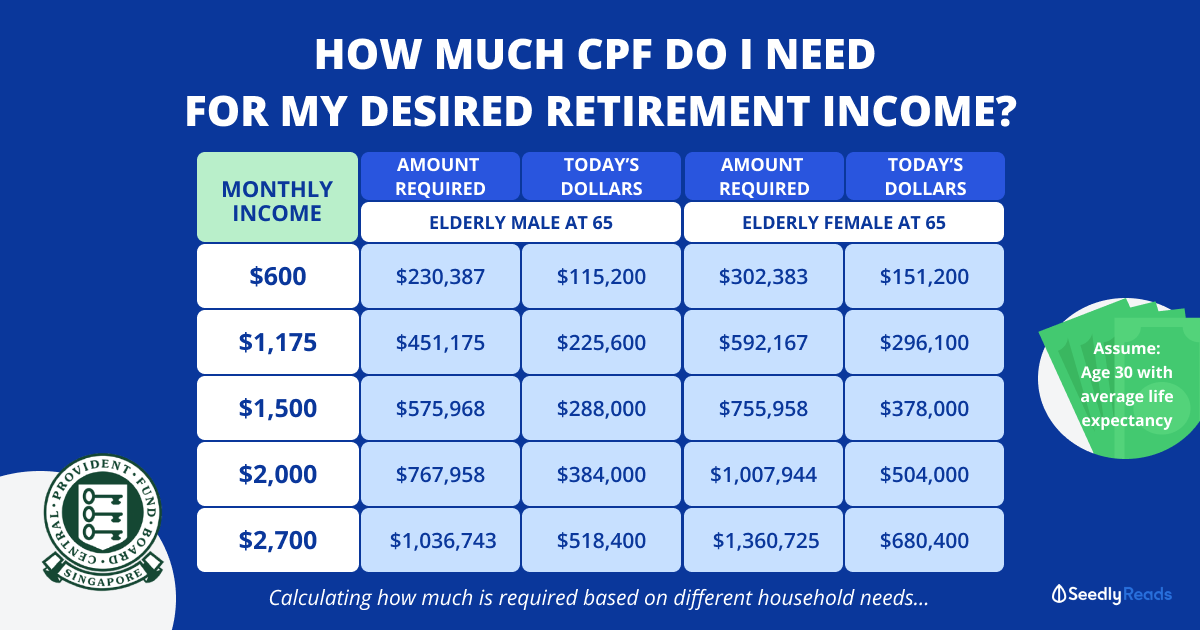

How much do I need to retire if I want a recurring income of $3k monthly? What are the viable investments to yield this cashflow? Property is out of qns due to ABSD. Any advice?

4

Discussion (4)

Learn how to style your text

Reply

Save

Hi there :)

This is a great question to ask, because it literally determines our future and how we plan for it. More people should be asking questions like this for their own benefit.

You may want to dig deeper and ask yourself the following questions:

When do I want to retire?

What is my current savings every month?

How much yield am I getting for my savings every month?

What are some assumptions of the economy that I am making? (eg. inflation rate, savings rate, legacy age,...)

From here, we can start build a retirement plan that deals where you are right now and where you want to be when you retire.

The different viable investments available are given by Elijah, and he has given you some useful estimates to do your own rough calculations.

There are software and tools that can help us derive the amount needed to retire, various paths to achieve the retirement goal, and even include expected big ticket items and life goals within the timeline.

As a side note, planning for retirement is both a science and an art, where we balance precise calculations with unexpected circumstances and changing life goals.

Hope this helps you find what you need to do reach your retirement goal :)

Reply

Save

Elijah Lee

07 Jul 2020

Senior Financial Services Manager at Phillip Securities (Jurong East)

Hi anon,

This depends on the yield of your instruments. Bonds may give around 3% yield, while REITs...

Read 2 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

3 years ago, a colleague invested approx. $200K in a restaurant run by his friend - his share of annual dividends is now est. $80-$90K. Here's a guide on starting a restaurant in Singapore.