Advertisement

Anonymous

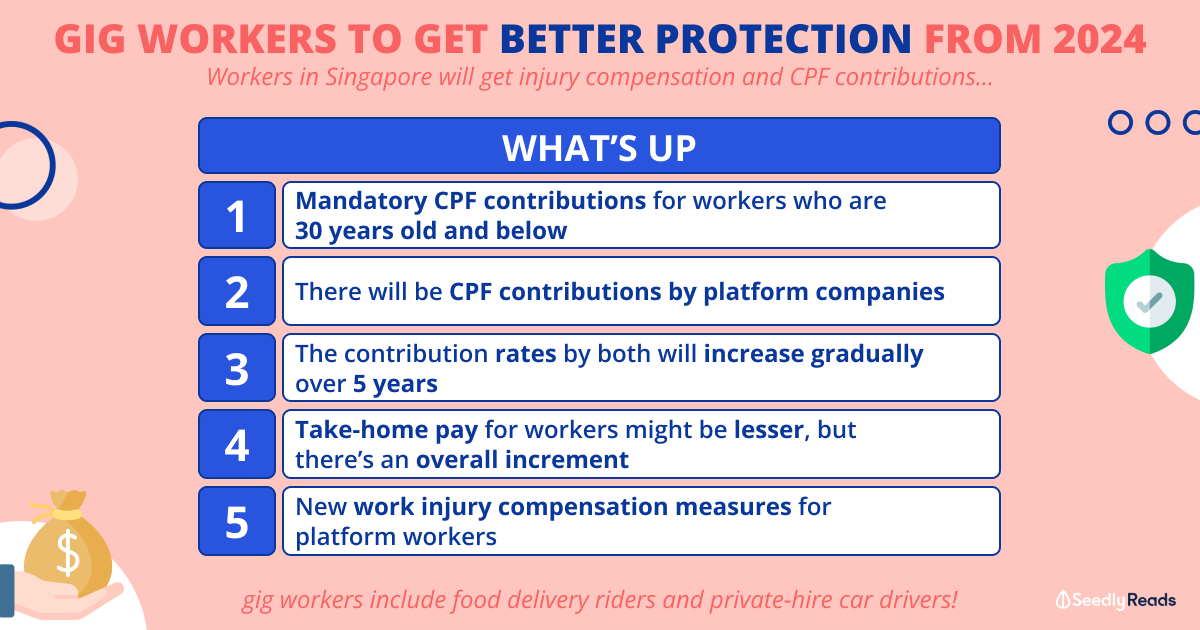

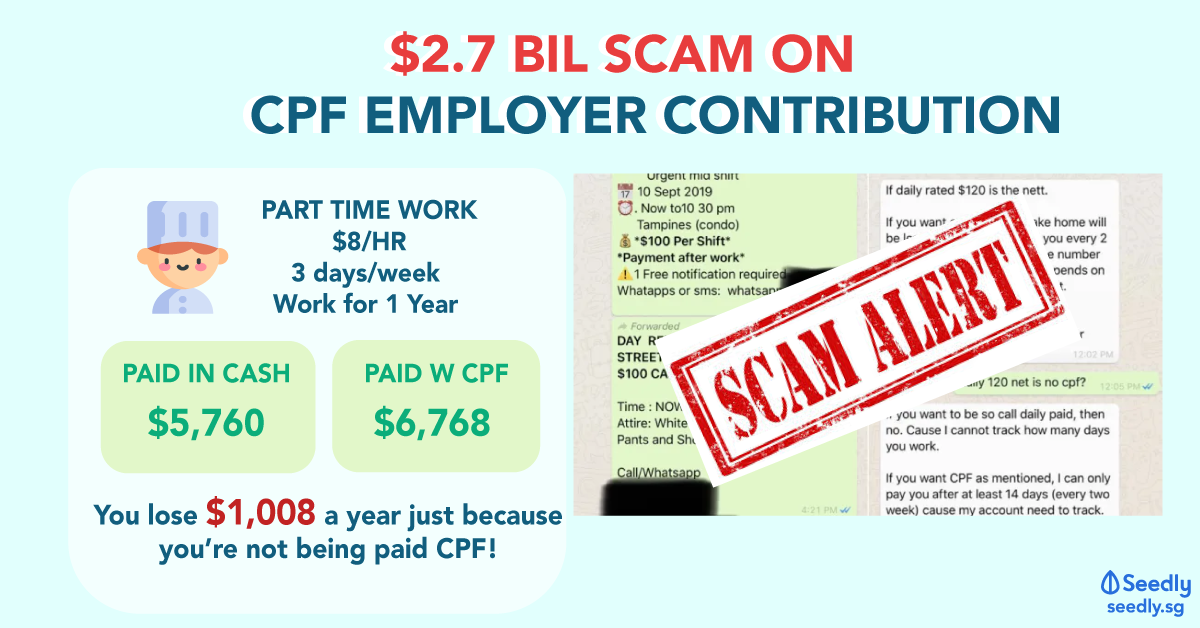

How does one make the most of their income if their salary does not come with CPF contributions?

My job contract isn’t entered in Singapore hence my employer does not have to make contributions to my CPF. Hence, I am seeking advice on how does one make the most of their income and make up for the loss of employer CPF contributions. Is it better to still make personal contributions to CPF or are there better options available?

2

Discussion (2)

Learn how to style your text

Chin Guo Qiang (CSM / CAL / ITIL4)

19 Jan 2020

Principal Engineer at Defence Science & Technology Agency

Reply

Save

Luke Ho

02 Feb 2019

Founder and Director at CFX Money Maverick Pte Ltd

If you're the safe type, it's better to keep making those contributions. You can also consider a private retirement plan, where you can customize when you want to get paid, how much you want to get paid and the rest without CPF changing the terms and conditions every time. https://www.moneymaverickofficial.com/posts/are...

If you want more money, you should just invest it in a diversified portfolio aiming to make between 6 and 9% annualized net of fees, compared to the paltry amount that CPF is giving. I'm self employed, so I don't get CPF either and this strategy is working extremely well for me and will continue to do so.

You can drop me a message either way, and I'll design something specifically tailored for your preference that makes you happier and wealthier.

Reply

Save

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

Use the 50-30-20 rule, but for me, it is 20-60-20 rule.

20% for fixed expenses (set fixed Budget)

60% for savings before any other plans.

20% for misc. expenses.

Without CPF, the 60% ratio is very important as you don't want to lose out on another chunk of interest payable, after CPF is thrown out of the equation. :)