Advertisement

Anonymous

Hi can I find out why so little information is provided on the investment fact sheets?

It seems quite hard to make investment decisions like that when I don't have enough information

4

Discussion (4)

Learn how to style your text

Reply

Save

Alex Chua

20 Jul 2019

Seedly student Ambassador 2020/21 at Seedly

May I ask how much is enough information to you? What other information you would like to have? Remember that borrower has their privacy concerns too and the platform would need to strike a balance.

Honestly, I personally feel that the fact sheet is sufficient enough to deduce payment behaviour and ability of the borrower. You could always opt out the loans if it is not within your risk appetite. Do note that most loans are catered towards SMEs with short business history.

P. S I myself also would like to have more information

Reply

Save

Fan ZD

11 Jul 2019

Employee at A Bank

Honestly, I find the fact sheets meaningless. What's more important is the rate of defaults for the ...

Read 1 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Products

Funding Societies

4.1

565 Reviews

18% on interest earned

INVESTOR FEES

$20 per campaign ($100 initial deposit)

MINIMUM INVESTMENT

1.26%

DEFAULT RATE (2020)

Minterest P2P Lending

4.5

62 Reviews

BRDGE P2P Lending

4.1

251 Reviews

Related Posts

Advertisement

Mostly the fact sheets are quite comprehensive.

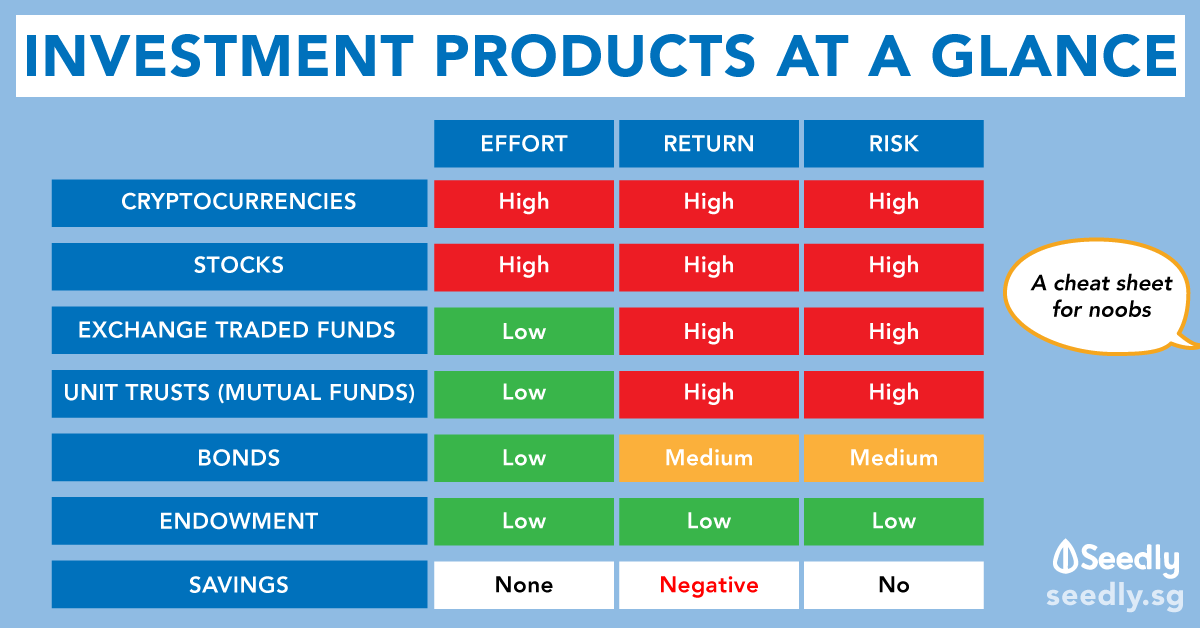

Avoid mutual funds anyway.

Sometimes in the charts of the fund/ETF you cannot find a graph of

the defined benchmark for direct comparison.

The most important criteria relevant to buying decisions/selection are:

-Area under Management (should be very high)

-Total Expense Ration (should be as low as possible)

-for ETFs: replication method (should be physical or sampling, NOT: synthetic)

-5 and particularly 10 year (= long term) performance, importantly with simultaneous mentioning of the benchmark index for direct comparison

-domicile (important b/o Taxes, f.ex. USA versus Ireland)