Advertisement

Anonymous

Currently using DBS Remix eSavings Plus earning 0.05% interest. Should I open CIMB FastSaver and transfer my money over to earn 1% interest instead? Will there be a huge difference in the interest earned?

I currently have about $9500 inside

1

Discussion (1)

What are your thoughts?

Learn how to style your text

Luke Ho

22 Aug 2018

Founder and Director at CFX Money Maverick Pte Ltd

Reply

Save

Write your thoughts

Related Articles

Related Posts

Related Products

CIMB FastSaver Account

4.3

207 Reviews

Up to 2.20% interest p.a.

INTEREST RATES

$1,000

MIN. INITIAL DEPOSIT

$1,000

MIN. AVG DAILY BALANCE

Standard Chartered JumpStart Account

4.8

785 Reviews

DBS/POSB Multiplier Account

4.3

329 Reviews

Related Posts

Advertisement

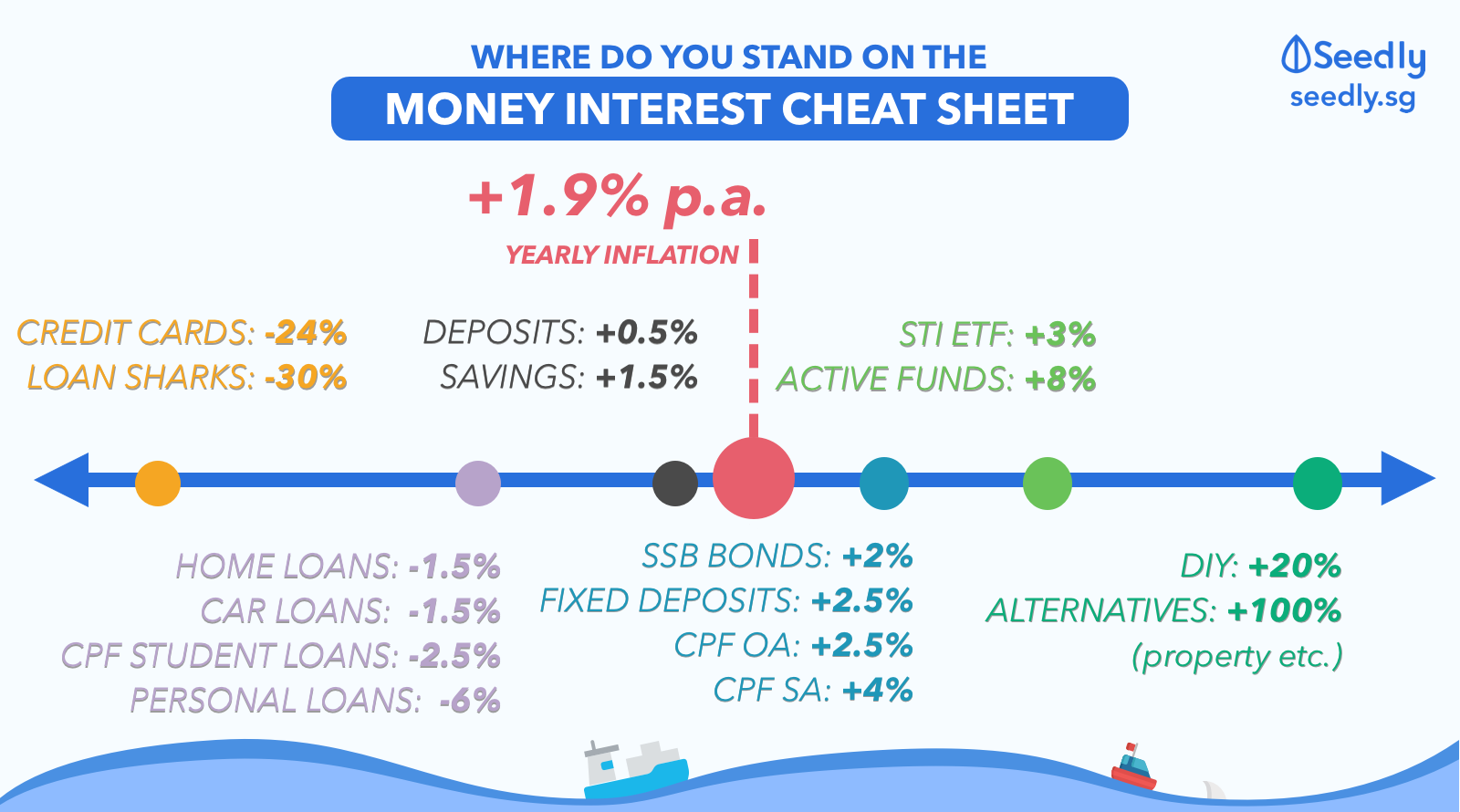

I give the same answer each time for this question - time is money. IF CIMB became more convienient and time-efficient, I would use it. Otherwise, that $9500 is not exactly going to make a dent in terms of interest made yearly because you want it to be as liquid as possible (I'm going on this assumption safely). If you were truly interested in building interest with some conditions, with that kind of money you could probably open a DBS Multiplier account, or you could just..invest it, toss it in a proper savings plan, etc. Illiquid money/Commitment always breeds wealth, but if you want it liquid, convenience/time is money, not money.

Please keep that in mind.