Advertisement

Anonymous

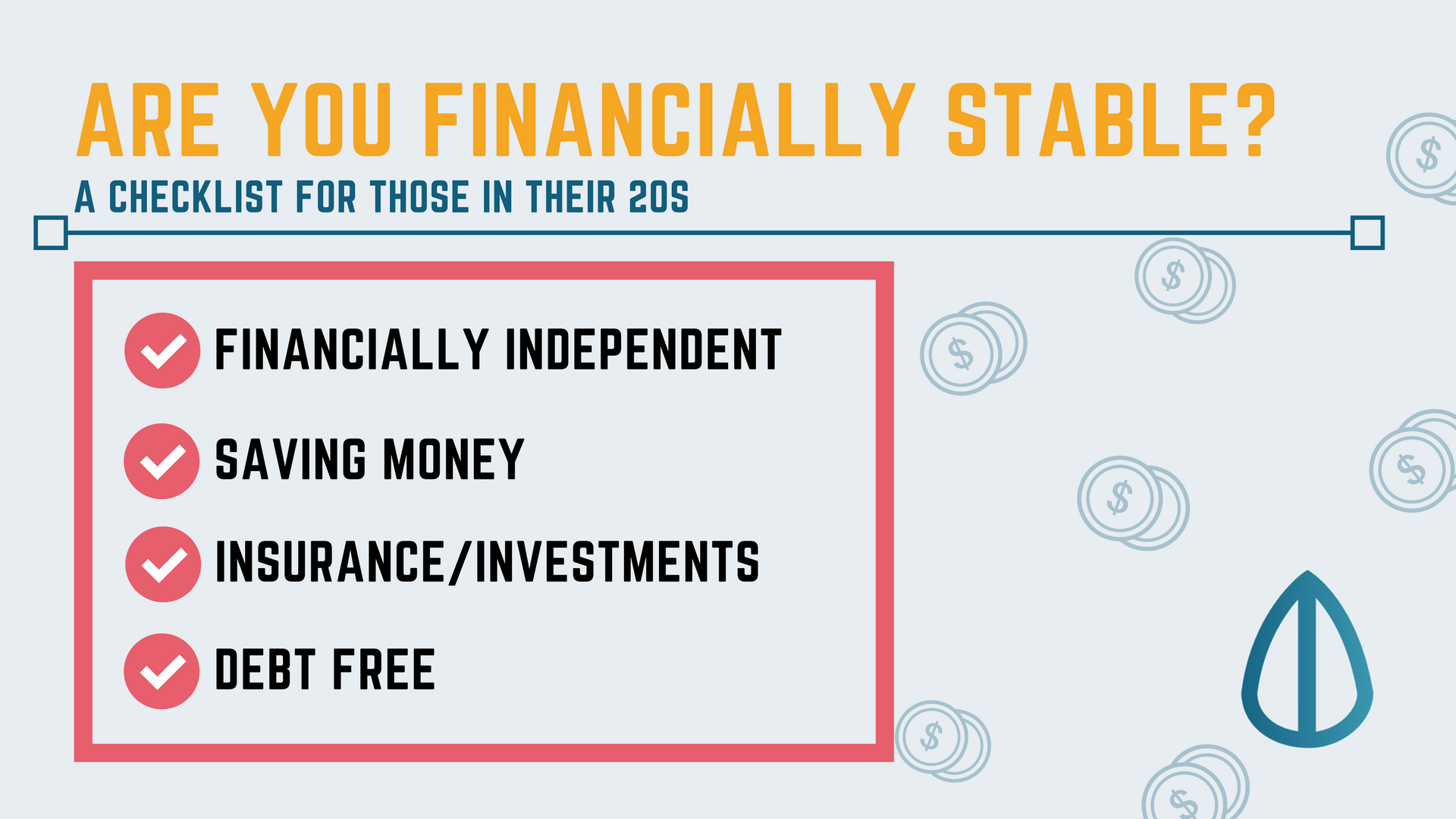

Am I on the right path in terms of savings?

Am I on the right path, or am I spending too much?

-I'm 27, with a savings of 65K (in the bank)

-with life insurance & p.a

-Invested slightly less than 8K in total in my company shares from 2015 (now worth roughly 12-13K in 2019)

-Invested $300 monthly in axa ipl sub-fund, min. commitment of 18 months in my 3rd month

-I spend monthly roughly 1.3K (membership, rent, food and bills)

10

Discussion (10)

Learn how to style your text

Luke Ho

Edited 26 Apr 2022

Founder and Director at CFX Money Maverick Pte Ltd

Reply

Save

Kenichi Xi

18 Jun 2019

nᴉʍ oʇ dǝnᴉʇsǝd 不能说的秘密 at Tag Team with Gabriel Tham

Am I on the right path?

By income, u are on the right track but do u know understand the ILP u r committed to?

By savings of $65k, u r doing quite ok after all the expenses so far.

By shares in your own company, are u getting it free or u are buying at ur own time on target?

Am I spending too much?

By life insurance, is your coverage sufficient and at the right price?

By ILP, is not just about the commitment but what is ur exit strategy before it become too costly by age?

By spending around 30% and saving 70%, the saving track record is good so far.

Hope my replies help!

Reply

Save

Cherie Julianne Tan

18 Jun 2019

Marketing at MoneyOwl

Read 4 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

You're doing really well so far. What's your monthly savings though?

You should really consider investing more of what you have in the bank.

With savings like that, there's a decent chance your OA has been fairly filled and will mitigate most, if not all the downpayment already - so you're holding onto too much cash unless you really want to spend it all on your wedding + reno...which I think you'd consider really excessive.

Especially seeing as how you're concerned that 65k at 27 years old + investments + insurance might not be enough.

I offer formal investment advice with a strong track record - you can read this if you think it might help.

Good luck!