Advertisement

Anonymous

Would like to seek 2nd opinion on what my insurance agent recommended regarding Aviva My Protector plan.?

I currently have NTUC vivolife 350 and AXA criticare. Both policies cost about $3.5k annually with $213k death benefit, $203k TPD benefit and $130k for CI and ECI from both policies. Another agent is saying the coverage is insufficient and recommend I get the Aviva plan with $1 mil for death and TPD coverage and $900k for CI and $600k for ECI for only $1.4k premium annually. And invest the money I saved will get me $270k when I'm 65 since Aviva plans ends when I'm 65.

3

Discussion (3)

Learn how to style your text

Elijah Lee

11 Sep 2020

Senior Financial Services Manager at Phillip Securities (Jurong East)

Reply

Save

Run your numbers here.

Stick to the guidelines with regards to your income, and you will have a good idea of your cash flow budgets.

You have to note that your current plan is geared towards a lower risk profile. The Aviva plan sounds like a term plan and the suggestion is to invest the rest. If the following suggestion is to take up a 101 ILP, I will be weary on the restructuring due to the exorbitant costs of "investing the rest."

If you truly want to BTIR, get a term plan as suggested, and use Syfe or Stashaway to invest the rest. But keep in mind that your CI will expire at 65. If you do not consistently invest, you will be exposed to zero CI coverage at 65 + 1 day of age.

Truthfully, there is no such thing that BTIR suits everyone, the best would be to simply combine both to get the best of both worlds and manage that risk component when it comes to investments. That is where the above guidelines in relation to income come into play.

Follow me here.

Reply

Save

Hey there!

The rule of thumb for death coverage is 10x your annual income and for CI, it's 5x your ...

Read 1 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

Hi anon,

I am reading it as such (amounts are total), as to the coverage you have:

Death cover: $213K

TPD cover: $203K

CI AND ECI cover: $130K

My question to you would be: How much is enough? To go back to this, we need to look at your needs, first.

Death/TPD: Do you need $1 million coverage? Do you have dependents and liabilities? If not, why would you need this coverage? The only reason I can think of is that you are worried if TPD occurs and you can no longer work, in which case there will be some basis for getting this coverage. If not, it's not strictly necessary.

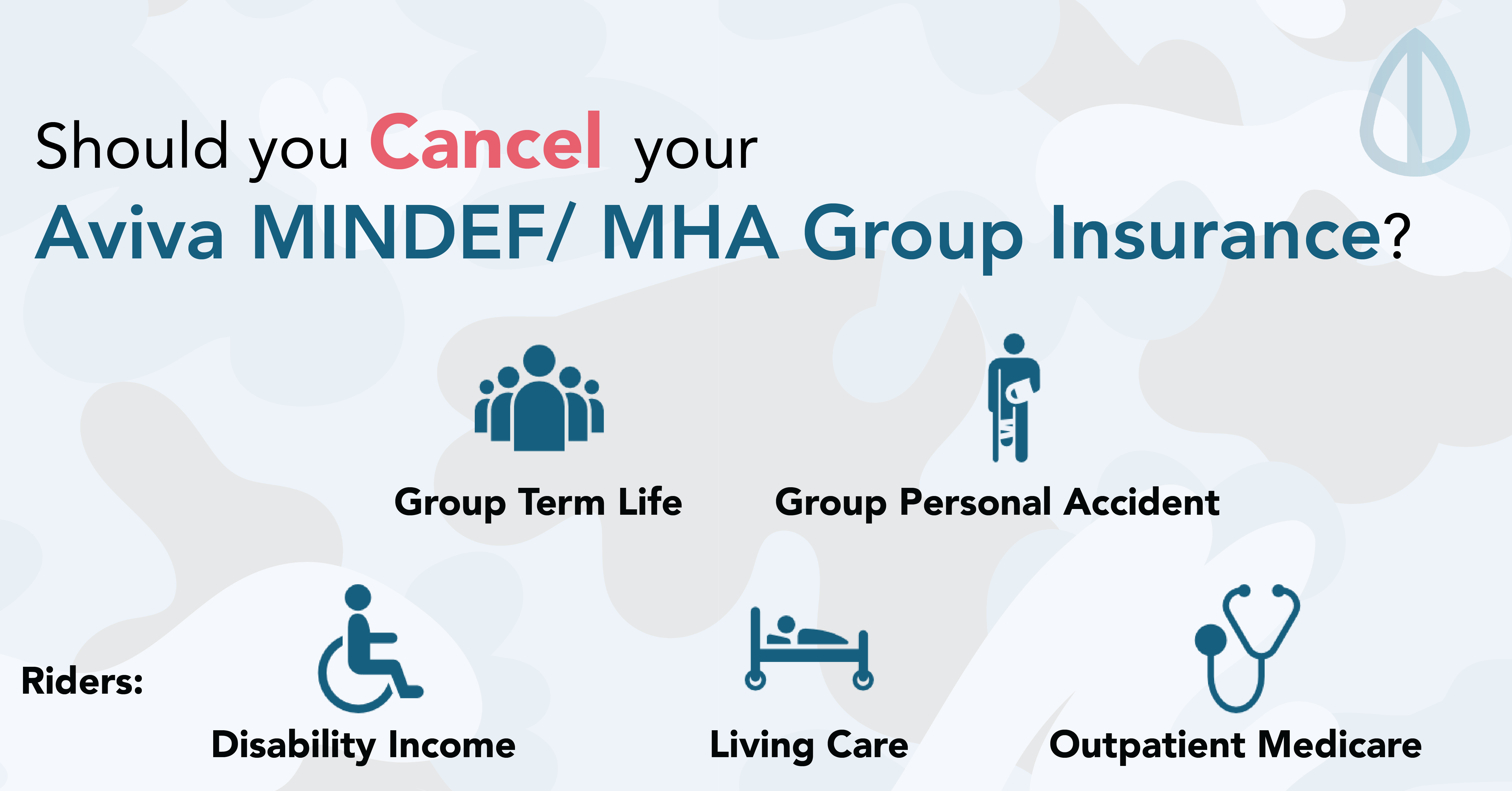

Critical Illness: Based on what you described, you were being recommended a $100K sum assured multipay CI IV rider added on to Aviva's MyProtector Term plan. Be aware that $900K claim for CI is extremely unlikely as it would require you to strike critical illness repeatedly (like, at least 4 times??) before you can get the payout.

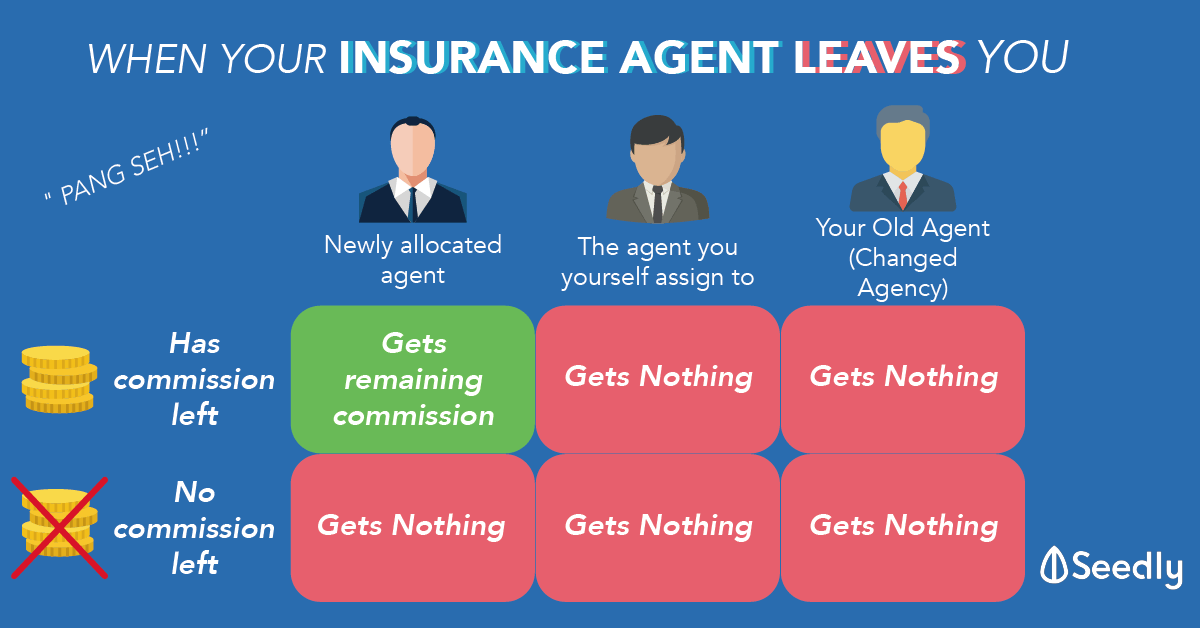

You were likely recommended to get a 101 ILP investment plan (correct me if I am wrong). You should separate investments from insurance but that's a separate topic and I'll link you to my views here.

Furthermore, I am guessing that you were asked to surrender NTUC Vivolife 350 and/or the AXA criticare plan. That would mean that you have no guaranteed CI cover in your retirement years. Be aware that investing the money you saved has, by no means, any guarantee of reaching a certain amount by the time you are 65 + 1 day. Your Vivolife plan also has cash value bonuses already accumulating in the policy and this only compounds over time. To surrender would be to give up these.

You need to continue to manage this amount in retirement in order to continue to grow it to hedge inflation, whereas in a whole life plan, this amount will grow over time naturally as the insurer manages the par fund and credits the bonuses to your policy. If you suffer a critical illness in retirement and during a market crash, your portfolio is devastated and you might have to liquidate at a loss (that is volatility that you have to accept unless you want to completely shift your investment portfolio to bonds). A life plan does not have this issue as payouts and credited bonuses are guaranteed already.

So, what's the conclusion? If you really need death/TPD coverage, get a term plan by all means. If you need more CI/ECI coverage, then get either a standalone multipay, a small additional wholelife plan (e.g. $50K x 2 multiplier), or add a small CI rider to your death/TPD term. There is no reason to terminate an NTUC plan that has been running for likely 3 or more years unless the numbers can be justified. Remember, insurance is about guarantees of protection that you get if anything happens. Investments have none of that.