Advertisement

Why is it worth to get miles on credit card spend? It seems you have to spend a lot to get miles to earn the trips?

My gut tells me if I keep to my regular spend, I won't earn enough miles for a decent flight. But from the money I didn't spend, I reckon I can save more than the cost of the ticket "earned".

Is there any study to show its actually worthwhile?

Fyi I estimate my own credit spend at about 20k a year, of which 6k are mobile/internet/gym, 3k in travel, 5k in dining/entertainment, 1k in memberships/medical/dental/optical and 5k in shopping/groceries/ pharmacy.

16

Discussion (16)

Learn how to style your text

Reply

Save

Cedric Jamie Soh

24 Dec 2019

Director at Seniorcare.com.sg

Well, a lot of the spendings we do are necessary anyway, you can use cash, nets or credit card but since credit card pay us cashback or miles, we use cards!

The most worthwhile is you earn cashback or miles on the spending that you are doing it anyway with cash or nets.

Don't spend for the sake of earning miles or cashback, as you probably know, its not worth it! no such thing as "save by spending more!"

Reply

Save

Keith Ng

23 Dec 2019

Assistant Digital Marketing Manager at Mandai Wildlife Group

20k/year = 80k miles.

That's enough for a Business Class ticket to Australia / First Class ticket to Middle East.

Save another year and you'll get a First Class to USA.

Is that decent enough for you?

Reply

Save

Bjorn Ng

12 Dec 2019

Business Analyst at 10x Capital

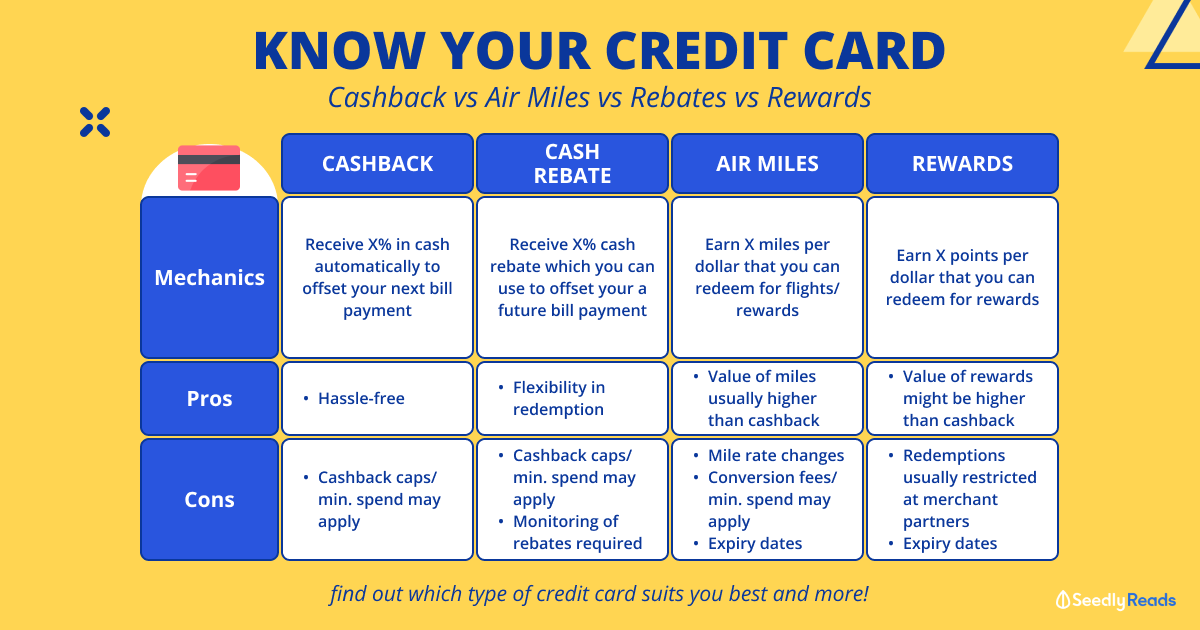

Well honestly, it depends. Miles card is a delayed gratification, and cashback card is an instant rebate back to you. Which do you prefer?

I see that most of your credit card spend are local purchases. For miles card, you will get more miles if you spend in foreign currency, or if you use Grab, some miles card give you a higher Miles Per Dollar (MPD), if not your usual miles cards are 1.2miles/dollar.

Also, it is also more worthwhile to claim miles on long haul flights rather than like to Bangkok, in order to be miles efficient.

I did a rough calculation before, redeeming Krisflyer miles to BKK is equivalent to about 1.5% cashback, assuming all your miles are earned locally.

TLDR: Local spending, I prefer general cashback card (HSBC Advance, Stand Chart Unlimited). Overseas spending, I prefer miles card.

Reply

Save

For fuss-free cards, DBS Altitude and Citi PremierMiles are great options to start off with. Their m...

Read 9 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Products

UOB One Card

4.2

166 Reviews

Get up to 10% cash rebate across 5 categories

CASHBACK

Up to 5% cash rebate on all other retail spend

ALL SPEND

Standard Chartered Simply Cash Credit Card

4.1

175 Reviews

DBS Altitude Visa Signature Card

4.3

97 Reviews

Related Posts

Advertisement

I ll tell you something based on a very easy calc

if you spend $20k a year, lets say all on a basic miles card, you get 24k miles. lets assume you get a sign up bonus, thats about 10k extra.

Assuming you have no bonuses/ category spending whatsoever (which is basically impossible) you still have enough just for a basic flight/ short business flights.

So yes, if you but a bit more effort to this - I think this figure can easily be upto 60-90k miles for your spend