Advertisement

Anonymous

Who's going to ipo for Elite Commercial REIT? Why or why not?

What are the pros and cons?

3

Discussion (3)

Learn how to style your text

Reply

Save

Billy

30 Jan 2020

Development & Acquisitions Manager at Real Estate Private Equity

Seedly did generate a rather thorough analysis of the Elite Commercial REIT IPO here

I am rather tempted to buy in given how it's leased to the government and the leases only expire in 2028 and the yield of 7.1% is rather generous and given the small pool of stock allotted for this IPO exercise, I foresee demand to be high.

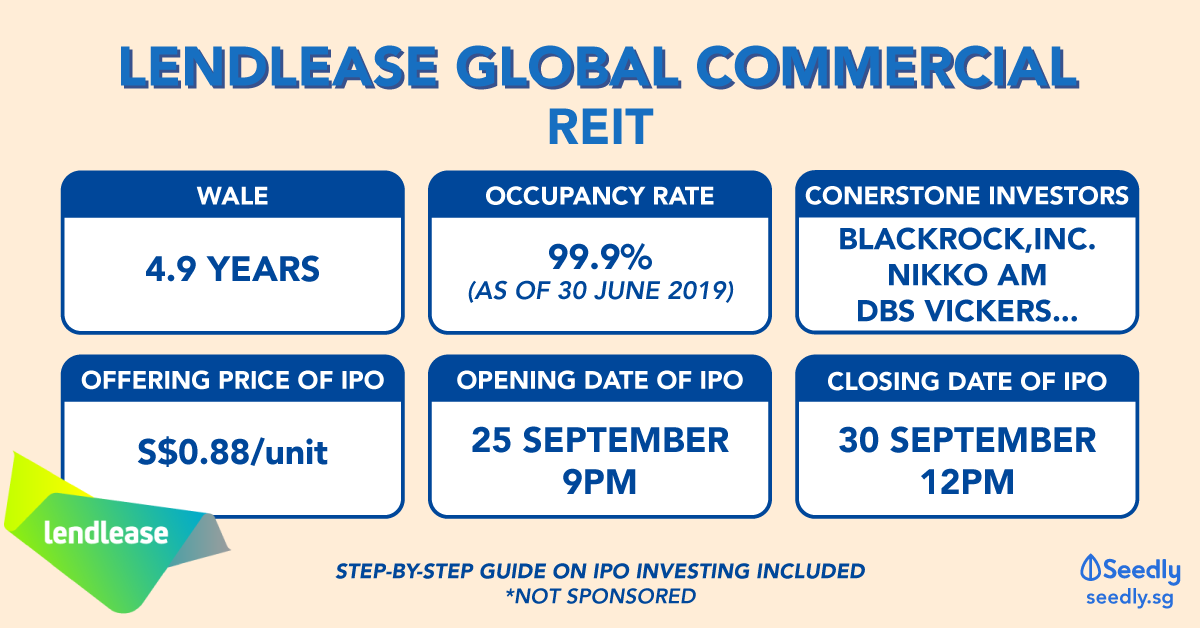

However, what I don't like about this IPO is the high price, usually REIT IPOs are priced approx $0.80 - $1, whereas this is at $1.21. Also, pound-denominated dividends / trading adds on to my resistance when deciding if I want to apply for this IPO. Too much uncertainty. Also given how the Wuhan virus is shaking market sentiments, launching an IPO at this time may not be well sought after.

Since the closing date is 4th Feb, I'll probably hold up till 3rd Feb before making a decision

Reply

Save

Just Being Ernest

30 Jan 2020

Content Creator at www.youtube.com/c/JustBeingErnest

Personally I will not go for the ipo

3 reasons

High concentration risk in terms of tenants and loc...

Read 1 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

Difficult to judge...

could be good, could be bad

on the plus side: government tenant

risk: Brexit associated things?

(I imagine that after Brexit the U.S., particularly the current president, will be supporting the UK by way of favorable treaties to diminish Brexit fallout ...)