Anonymous

Which plan should I go for for the long term, assuming my retirement age is 55 and my current age is 24?

I have an ILP, Investment-Link policy which I had since I was young. This one it’s a whole life insurance. Unlike normal whole life, this plan is where part of your premium is invested in some funds to form medium to long term savings.

OR do I let go of the plan, take back the money and get a separate insurance and investment plan? So I paying up lesser for insurance?

Cause if I stay in the current plan, the mortality charges increase over age?

4

Discussion (4)

Learn how to style your text

Elijah Lee

22 Jun 2020

Senior Financial Services Manager at Phillip Securities (Jurong East)

Reply

Save

Nigel Tan

22 Jun 2020

Executive Senior Financial Planner at Great Eastern Life

If you're only 24, usually the increase in insurance cost isn't as high until maybe around early 40s. Some people even buy an ILP at 24 because of the lower charges involved and long term investment horizon.

If you've had it since young, you probably crossed the "painful period". Every policy has a painful period at the start due to high surrender charges. That's why sometimes the "breakeven" period is much much later, like 15 years or something.

Depending on your ILP, some even give bonus allocation of 2-5% units for every year you are paying for your premium. But yes, having said that, it is also good to get something permanent to cover you in your later ages without a continously increasing cost of insurance.

Reply

Save

Hey there!

There are a lot of things to consider. Your life stage, what are your long term needs an...

Read 2 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Posts

Hi anon,

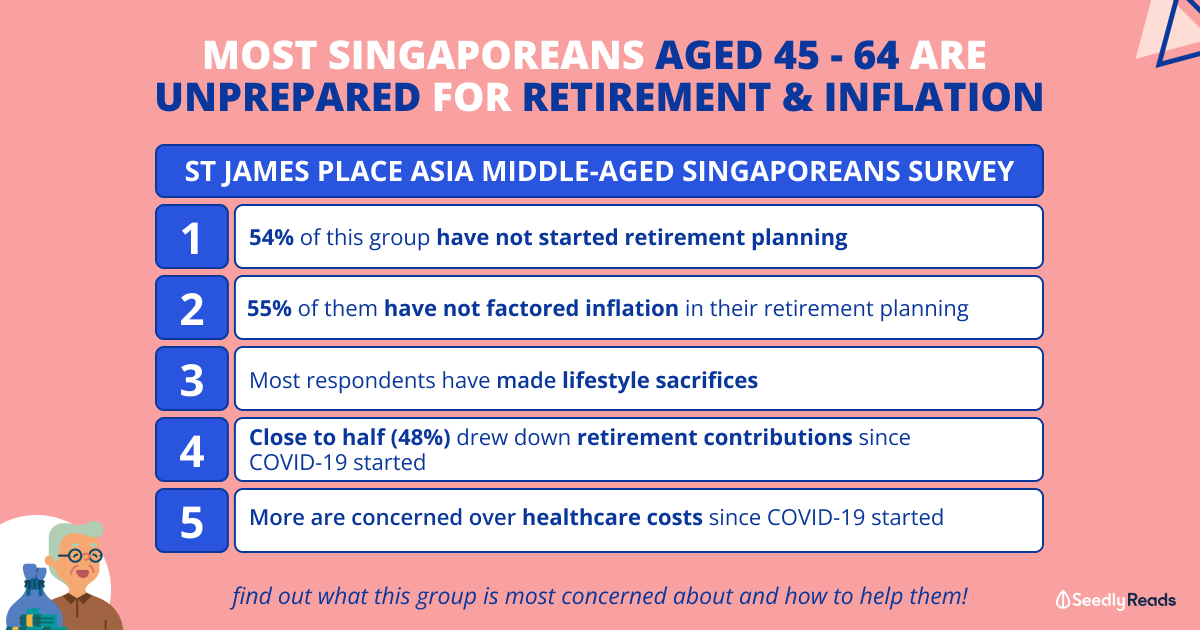

You are right that over time, mortality charges of an ILP will increase. This increase is guaranteed to happen, so if you wish to maintain the same level of coverage, your charges will rise exponentially over time.

This creates an issue whereby your investment returns have trouble in keeping up with your mortality charges as you age. And investment returns are non-guaranteed. There's no way of knowing for sure if your investment returns can offset the rate of increase of the charges. Let that sink in for a moment.

I don't recommend mixing investments with insurance. You might want to speak with an advisor to see what options are available for you at this point.