Advertisement

Which AXA fund should I choose for my AXA Wealth Accelerate ILP?

I currently have a ILP with AXA wealth accelerate for 30 years. The reason for it is cos of the 200% and breakeven charges of 0.3%. However, I am unsure which fund to choose as there are so many in AXA website. Could anyone advice on how to choose and what should I be looking out for? Thank you!

5

Discussion (5)

Learn how to style your text

Reply

Save

Tan Choong Hwee

11 May 2021

Investor/Trader at Home

This is the reason why I won't invest in ILP. While you can seek advice from the financial advisor who sold you the ILP, you still need to do your own assessment on whether his/her advice suits you, unless you trust his/her competency.

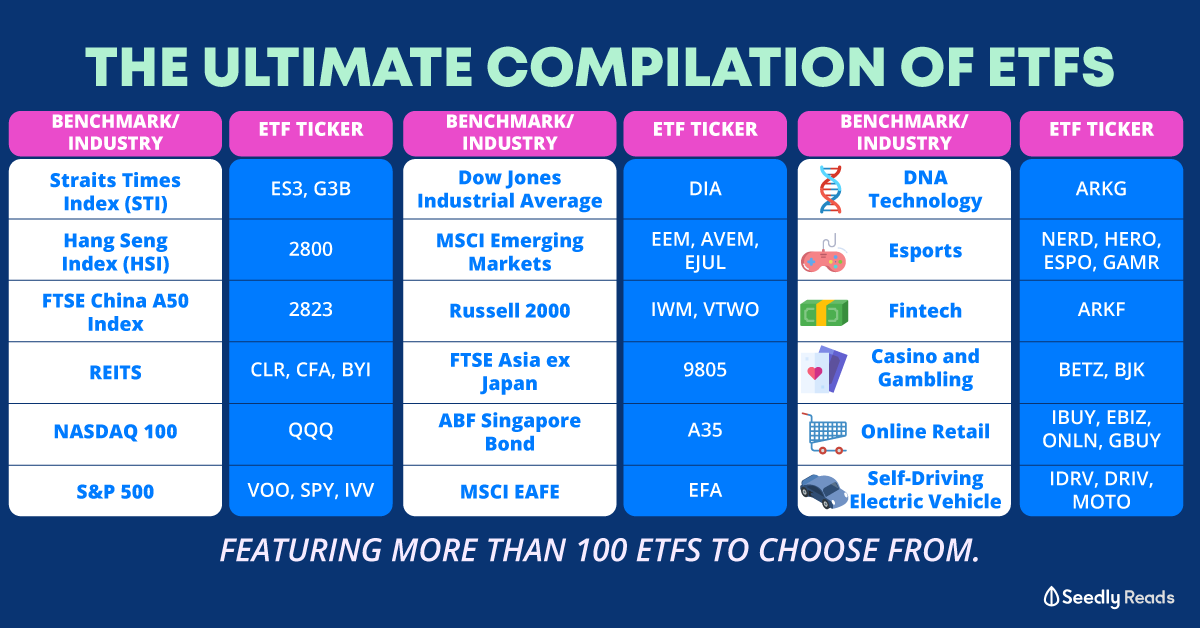

And if you are prepared to spend time studying the funds, you would be better off investing in the selected funds via zero-fees platforms (e.g. POEMS, dollarDEX) than paying relatively high fees thru ILP.

Reply

Save

Kylie Ng Kai Li

11 May 2021

Senior Premier Consultant at AIA Insurance Pte Ltd

Hi Tokyofood,

Understand that advisors are not liable to give any recommendations or help you to c...

Read 3 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

These mixed instruments (investing + insurance) to me never seem a good idea with intransparent costs and very probably underperformance