Advertisement

Anonymous

Where can my retiring parents park their nest egg?

Both retiring in abt 2 years, they will be abt current retirement age at that point

Total Nest egg above 200k when I last checked, CPF is slightly higher

So I’m seeking any methods to extend the longevity of their reserves

Fixed deposit certainly the worst option, but can they still touch securities at their age?

3

Discussion (3)

Learn how to style your text

Loh Tat Tian

19 Apr 2021

Founder at PolicyWoke (We Buy Insurance Policies)

Reply

Save

Zac

13 Apr 2021

Noob at Idiots Invest

You need to ask if they plan to touch this nest egg, or if they have income coming in from somewhere else. If they need to touch the nest egg, avoid illiquid products.

Reply

Save

PolicyWoke

13 Apr 2021

Turbo-charge Your Savings with REPs at PolicyWoke

Hi Anonymous,

If your parents are risk-averse, one option is to save in [2nd-hand endowment policie...

Read 1 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

If they are ok with the 2.5% and 4% (through Voluntary Contribution to CPF) with annual limit of $37,740 currently (if they are working, its lower), they can do voluntary contribution if they did not do the CPF SA Shield.

Then they can just draw the interest every year instead of taking from SA.

There is a way to transfer OA to RA through cross transfer to get higher interest from RA.

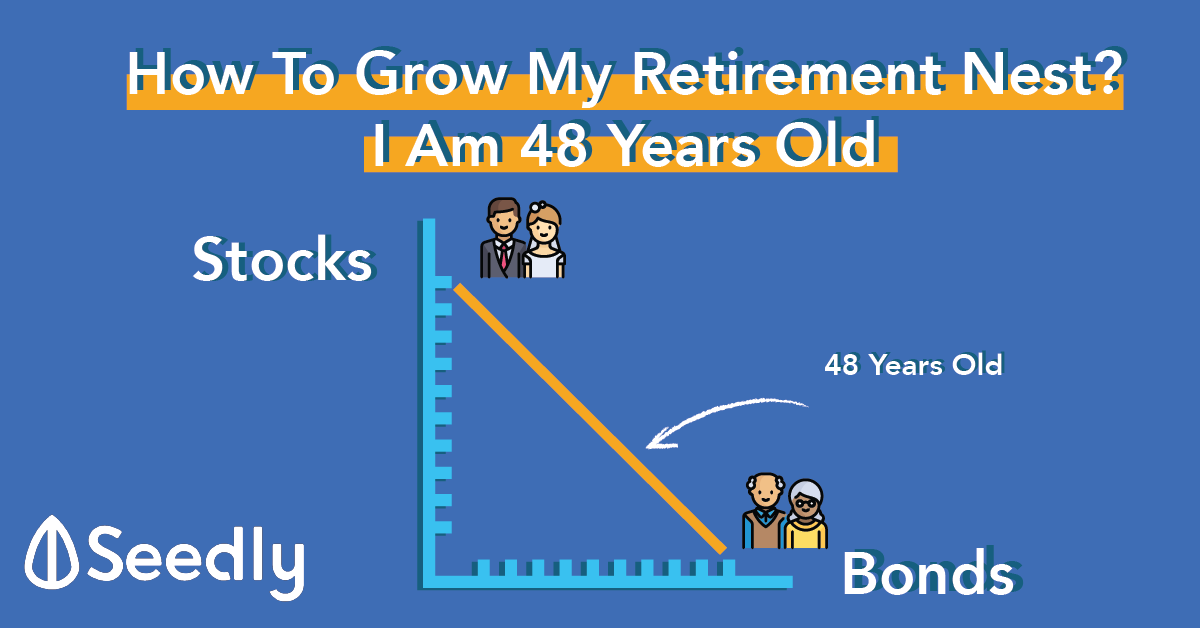

Else, they could also do leveraged annuties or other ways (depending on their risk appetite). There are 101 ways to ROME, and some are more "adventurous" as compared to "slow and steady" deposits. Though we usually suggest risk-adverse options for retirees.