Advertisement

Discussion (5)

What are your thoughts?

Learn how to style your text

Reply

Save

Hi!

Answered a similar question here: https://seedly.sg/questions/what-do-we-need-to-... so do check it out if you want to find out more.

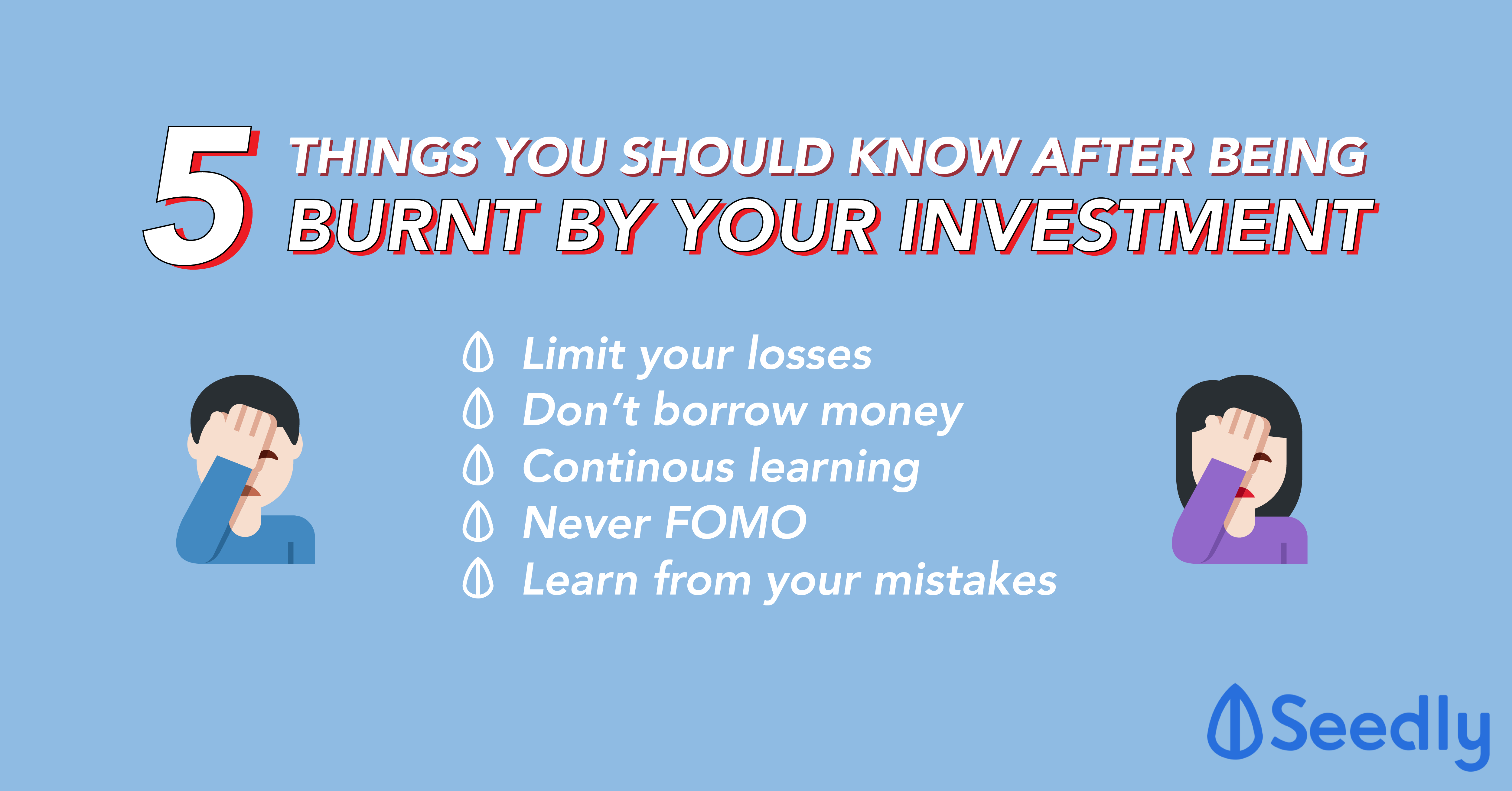

To illustrate further, here's a diagram to help you understand better!

These are the industries that you can potentially look at, before deciding which stocks to buy (at different stages of the business cycle).

Hope that helps!

Reply

Save

View 2 replies

Isaac Chan

07 Mar 2019

Business at NUS

Read 1 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

I am sure that for competent investment in business it is necessary a lot of knowledge to get profit and not just to play an entrepreneur or investor. I think you will also be interested to read the article about how useful requisition numbers are in the procurement process of any company. I also advise you to pay attention to the precoro software which will ensure fast work with procurement and deliveries.