Advertisement

Anonymous

What insurance should my approaching 60-year-old parents get? And how can I help with their retirement?

Only has healthcare rider and currently still working part-time. Fortunately still healthy but age is catching up.

2

Discussion (2)

Learn how to style your text

Tan Li Xing

27 Mar 2020

Financial Consultant at Prudential Assurance Company (Singapore)

Reply

Save

Pang Zhe Liang

27 Mar 2020

Lead of Research & Solutions at Havend Pte Ltd

Firstly, one of the most important things to do is to have a complete understanding of your existing insurance portfolio. Through this proces, we will evaluate the rider that you have, and whether any enhancement is required.

Key Reasons Why:

Why Every Client needs an Insurance Policy Summary

Next, you may wish to look into personal accident coverage to protect against medical bills for injuries that require extended treatment, including TCM. Moreover, you may also consider one with coverage for certain medical conditions such as Alzheimer’s or Parkinson’s Disease Benefit.

All in all, these are some general things that you can look out for and consider. In order to give you a specific advice, it will be good to spend quality time to understand your needs and how you intend to plan for your future. It is only thereafter when we can give you responsible advice that works.

I share quality content on estate planning and financial planning here.

Reply

Save

Write your thoughts

Related Articles

Advertisement

Hi Anon,

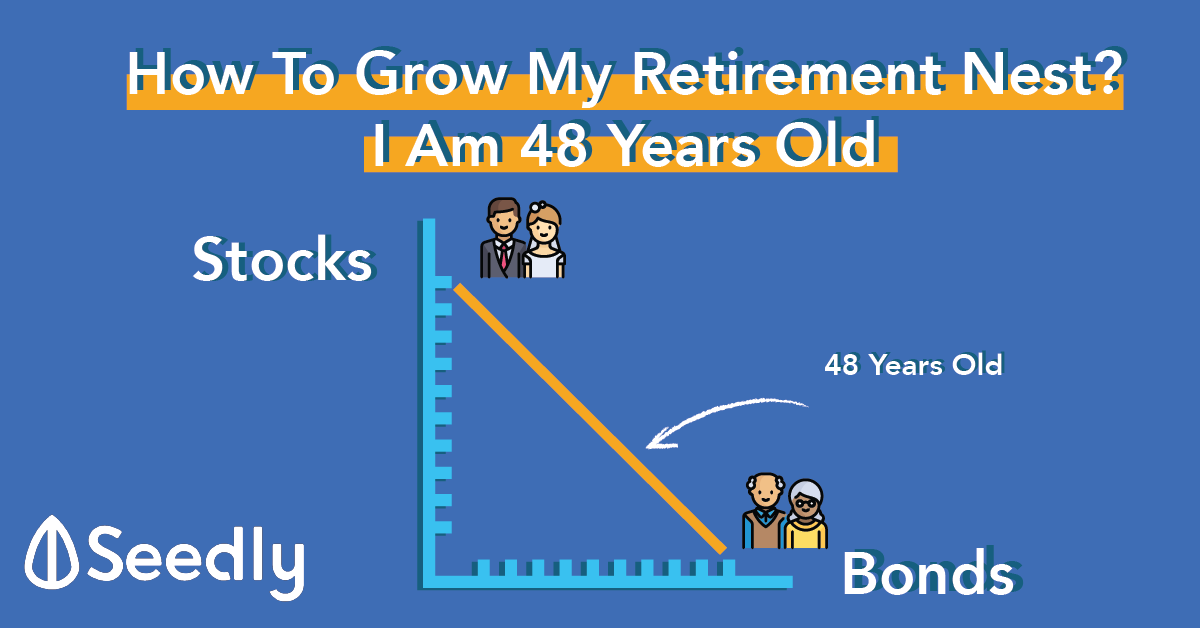

Based on the mentioned age, in regards to retirement, it might be good to find short term savings policies, as that would provide certain extend of coverge for your parents, and at the same time, at maturity there is a lump sum payout for your parents, that can provide some finances to add on to CPF Life.

I would also advise maybe to do some investing on their CPF monies to increase their CPF, however with the current situation, that wouldn't be a smart move, and might end up affecting their CPF monies instead.