Advertisement

Anonymous

What are the main changes that have made the Standard Chartered BonusSaver account less attractive?

Heard that it used to be pretty good and the sign-up gifts were great as well.

1

Discussion (1)

Related Articles

Related Posts

Related Products

Standard Chartered Bonus$aver Account

3.0

17 Reviews

Up to 4.88% p.a.

INTEREST RATES

$0

MIN. INITIAL DEPOSIT

$3,000

MIN. AVG DAILY BALANCE

Standard Chartered JumpStart Account

4.8

785 Reviews

DBS/POSB Multiplier Account

4.3

329 Reviews

Related Posts

Advertisement

Hi Anon,

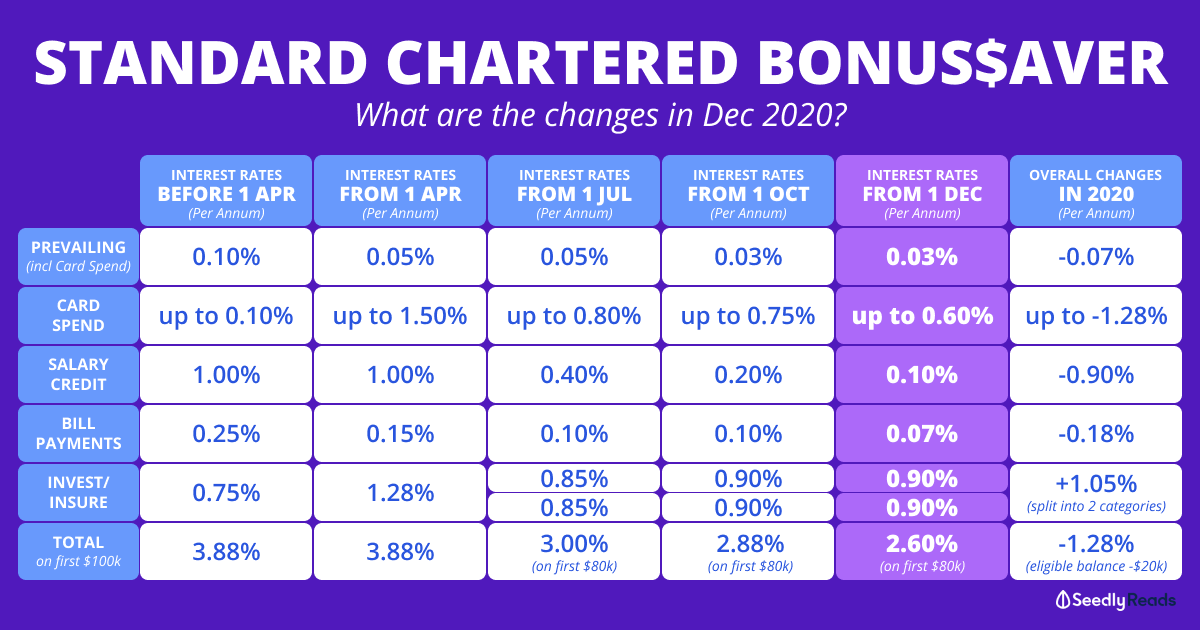

They just changed their interest policy. On the whole if you are able to fulfil all their criterias, you can still get 3.88% p.a. on the first $100k in the account. But if you can't, take note of the following changes effective 1 April 2020:

Base interest rate:

0.1% in old policy, vs 0.05% in new policy

Minimum spending:

$500/mth -- 0.88% in old policy, vs 0.50% in new policy

$2000/mth -- 1.88% in old policy, vs 1.50% in new policy

Salary credit:

Same in old and new policy (1%)

Bill payment:

0.25% in old policy, vs 0.10% in new policy

Invest / Insure:

0.75% in old policy, vs 1.28% in new policy

TLDR: Basically, their extra interest is shifted more to the invest/insure condition, so if you don't do any investment/insurance under SCB, then the interest you get will be worse off than before.