Hi Vernice,

Sorry, I saw this question and have been meaning to answer it but it has just been so packed at work that I didn't get a chance till now.

I'm guessing you're referring to individual insurance. Here's my take:

- TPD: There is a very very important clause in TPD coverage that is often overlooked, and that is the fact that TPD will pay out if you are diagnosed with "A disability which is total and permanent and persists continuously for at least 6 months, with the Life Assured incapable of performing any work or engaging in any occupation or profession to earn or obtain wages, compensation or profit, from the time when the disability started" (sample definition)

What does this mean? Simple. If anyone remembers the brickland road incident where the banker earning upwards of $500K a year became essentially a vegetable after he was hit by a car when cycling (https://www.straitstimes.com/singapore/136m-pay...) you will know how much the potential financial impact is if you permanently cannot work. And this extends to your immediate family as well.

TPD is no longer just about losing your arms, limbs or eyes any more.

Given that TPD can be added to a term plan to cover one's working years pretty cheaply, it doesn't make sense for any working adult not to have TPD cover on a term insurance.

- Maternity with transferrable coverage: The transferrable coverage is key. We will never know if our child, when born, will be 100% healthy or not. Securing insurablity (within budget) is something that should be done where possible.

I have met someone who has an issue with the heart since birth and he is totally unable to get coverage now that he started working. It happens. At least some coverage will be better than none.

- Disability Income (DI): Not many insurers offer this. To claim DI requires that you that you cannot perform the material duties of your occupation.

For example, a surgeon who lost a finger might be unable to perform surgical operations and suffer a loss of income. Not every occupation requires DI coverage in my view. If you are very skilled by virtue of training, education or experience and cannot be easily replaced, then disability income may be a good thing to have. If not, this is something that's probably nice to have.

- Self-insurance: The lesser known, less talked about type of impact, is that of the impact that happens to the people around you, especially when you have no coverage of any form and decide to just take on the risk yourself when you could have transferred it to an insurer. In my view, the one insurance that I never want to have if I can help it.

I'll just quote one example. One of my clients had a stroke last year that required brain surgery. The wife had to quit her job to look after him. Just imagine how much financial loss that the family had to go through. Plus the costs incurred for TCM, because they were told that he would never walk again by the doctors. His wife refused to give up on him, so she brought him to TCM every single day. He's now walking with a stick, but still can't speak.

That's a lot of money that they had to burn through.

Now, to provide some context, here's the background: I did do up his CI insurance application in 2020, and it got approved as standard (for a 50+ year old male then, that's about as good as it gets), but he said "That's a lot of money, I can probably find ways to grow it to more than $100K" and decided not to take it up (i.e. self insure).

Could he have grown it to $100K? I don't doubt it, but that's if he was given time. The stroke hit barely 2 years later. Sometimes, we don't know how much time we have left before something happens.

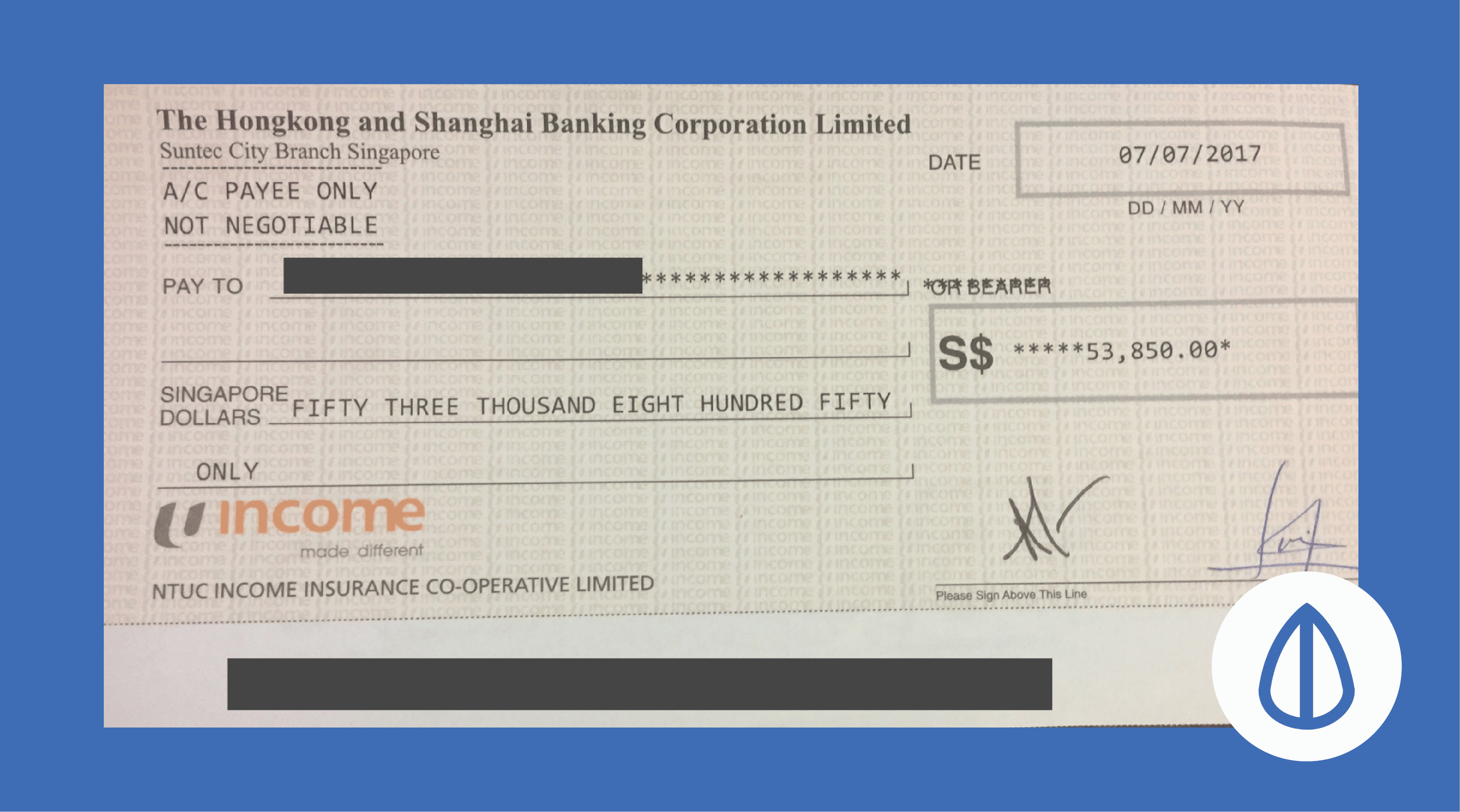

I would have paid out $100K to him in exchange for 2 years of premiums (about $9K total). No one can transform $9K to $100K in 2 years. Only insurance can do that.

If there's any message to be had here: Self insurance, should really be your last resort.

Hi Vernice,

Sorry, I saw this question and have been meaning to answer it but it has just been so packed at work that I didn't get a chance till now.

I'm guessing you're referring to individual insurance. Here's my take:

What does this mean? Simple. If anyone remembers the brickland road incident where the banker earning upwards of $500K a year became essentially a vegetable after he was hit by a car when cycling (https://www.straitstimes.com/singapore/136m-pay...) you will know how much the potential financial impact is if you permanently cannot work. And this extends to your immediate family as well.

TPD is no longer just about losing your arms, limbs or eyes any more.

Given that TPD can be added to a term plan to cover one's working years pretty cheaply, it doesn't make sense for any working adult not to have TPD cover on a term insurance.

I have met someone who has an issue with the heart since birth and he is totally unable to get coverage now that he started working. It happens. At least some coverage will be better than none.

For example, a surgeon who lost a finger might be unable to perform surgical operations and suffer a loss of income. Not every occupation requires DI coverage in my view. If you are very skilled by virtue of training, education or experience and cannot be easily replaced, then disability income may be a good thing to have. If not, this is something that's probably nice to have.

I'll just quote one example. One of my clients had a stroke last year that required brain surgery. The wife had to quit her job to look after him. Just imagine how much financial loss that the family had to go through. Plus the costs incurred for TCM, because they were told that he would never walk again by the doctors. His wife refused to give up on him, so she brought him to TCM every single day. He's now walking with a stick, but still can't speak.

That's a lot of money that they had to burn through.

Now, to provide some context, here's the background: I did do up his CI insurance application in 2020, and it got approved as standard (for a 50+ year old male then, that's about as good as it gets), but he said "That's a lot of money, I can probably find ways to grow it to more than $100K" and decided not to take it up (i.e. self insure).

Could he have grown it to $100K? I don't doubt it, but that's if he was given time. The stroke hit barely 2 years later. Sometimes, we don't know how much time we have left before something happens.

I would have paid out $100K to him in exchange for 2 years of premiums (about $9K total). No one can transform $9K to $100K in 2 years. Only insurance can do that.

If there's any message to be had here: Self insurance, should really be your last resort.