Advertisement

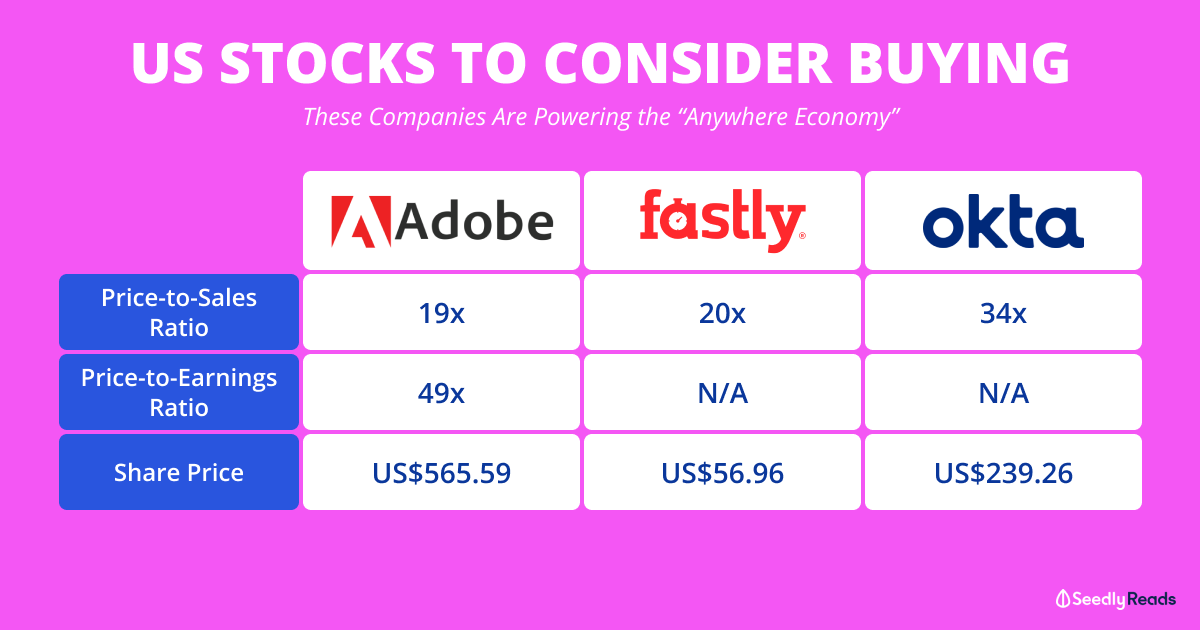

[US Stocks] - Is it better to buy growth stock rather than dividend stock, since dividend stock has 30% withholding tax?

Dividend stock is subject to 30% withholding tax, whereas capital gain is not taxable. Assuming the return from both stocks are the same, growth stock is better.

8

Discussion (8)

What are your thoughts?

Learn how to style your text

Gabriel Tham

03 Sep 2019

Tag Team Member at Kenichi Tag Team

Reply

Save

View 7 replies

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

Don't forget there are estate taxes for assets above $60k. So, if you are buying stocks long term, do take note of this, the tax is about 40%.

If not, you can still trade US stocks for capital gains.