Advertisement

UOB ONE Credit Card vs OCBC Infinity Cashback Card vs SC Simply Cashback card

Hello everyone. I would like to know which credit card is recommended for me.

Im in my early 20s, and I have the 3 existing credit cards for no reasons 😂

Usually I spend about $600-$1000 monthly on retails, grab, dining (personal expenses)

$500 for insurance plans

$120 utility bill

I have read up on the different T&C for the cards but still in a dilemma on which credit cards to keep or cancel.

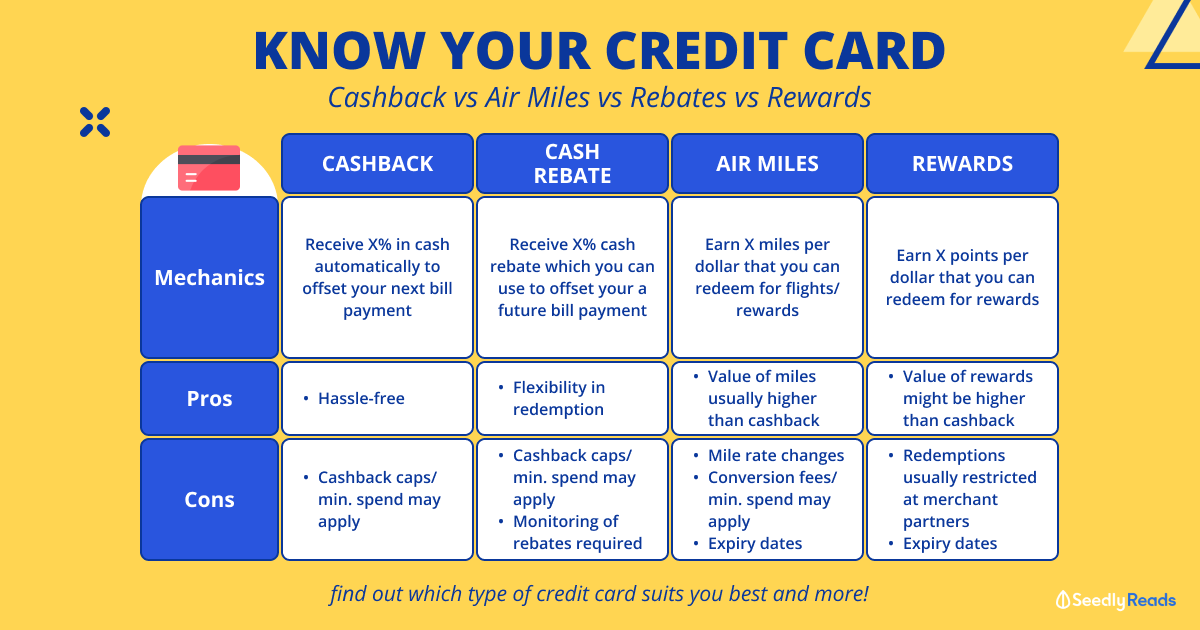

based on my understanding,

1.6% Cashback for OCBC Infinity Cashback Card

1.5% Cashback for SC Simple Cashback Card

3.3% eligible spending for UOB ONE card

do teach me if I miss out anything.

4

Discussion (4)

Learn how to style your text

Reply

Save

Tony

10 Jun 2024

Computer Engineering at Nanyang Technological university

Payment for insurance plan, top up for ditigtal wallet are not qualified for cashback. if you can hit 500 per month for retail/dining spending and more than 3 transactions per month, then UOB one for the 3.3% cashback. Get uob one account, credit your salary into it to have high interest rate for your savings.

if tracking expense is too much a hassle then ocbc or sc cashback card..

Reply

Save

Ur 500 include into ur 600-1000 per month? If no, uob one, if yes use sc cash back...

Read 2 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

I dont think insurance are eligible expenses for cc esp UOB. but i would use UOB ONE until its cap (500/1000) and the rest on OCBC/ SC depending if there are any whitelist/ blacklist categories.