TL;DR: UMS Holdings stock looks like it's going on a downward trend. When the stock trades even closer to its 52-week low it will be an attractive stock you may want to look at.

Business Overview

Incorporated in Singapore, UMS Holdings Limited provides equipment manufacturing and engineering services to Original Equipment Manufacturers of semiconductors and related products. Headquartered in Singapore, the Group has production facilities in Singapore, Malaysia and California, USA.

Share price

Credits: Yahoo Finance

The share price of UMS is trading at $0.590 (as of 28 May 2019). The 52-week L/H is at $0.540/$0.935. Pretty close to its 52W low.

Dividend

4.5 cents per share.

Financials

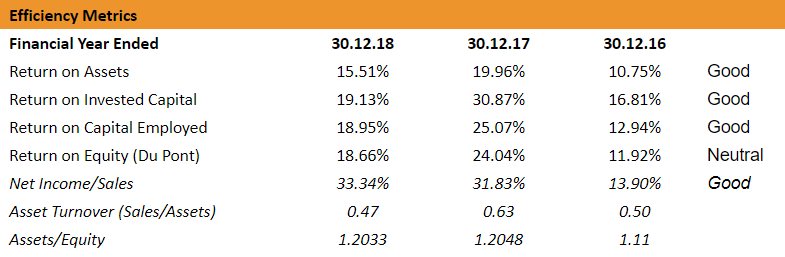

The revenue and profit growth from 2016 to 2017 is good, but in 2017 to 2018, revenue and profit faced a decline. But can we look at their margins here. It’s really good.

Their balance sheet is also strong. Low total debt in general. Mostly short-term debt.

Increase in investing and financing activities. Increase in dividends paid.

ROA and ROE are pretty good.

Low P/E ratio. Cheap now? But Beta is really high though.

Moving forward

The near-term outlook continues to be challenging due to much uncertainty in customers’ order flows amid the ongoing China-US trade tensions which affected demand from semiconductor chipmakers.

The longer-term outlook however, is good. SEMI, the global industry association for the electronics manufacturing supply chain reported that worldwide sales projected to dip 4% in 2019, but will bounce back to 20.7% in 2020.

Conclusion

Financials of UMS are good. Profit margin is very high. Low P/E ratio, but the beta is very high at 1.40, subject to high volatility. At the share price of $0.59, looking at the current trend, there is a concern that share price may continue going down further so need to look out first.

TL;DR: UMS Holdings stock looks like it's going on a downward trend. When the stock trades even closer to its 52-week low it will be an attractive stock you may want to look at.

Business Overview

Incorporated in Singapore, UMS Holdings Limited provides equipment manufacturing and engineering services to Original Equipment Manufacturers of semiconductors and related products. Headquartered in Singapore, the Group has production facilities in Singapore, Malaysia and California, USA.

Share price

Credits: Yahoo Finance

The share price of UMS is trading at $0.590 (as of 28 May 2019). The 52-week L/H is at $0.540/$0.935. Pretty close to its 52W low.

Dividend

4.5 cents per share.

Financials

The revenue and profit growth from 2016 to 2017 is good, but in 2017 to 2018, revenue and profit faced a decline. But can we look at their margins here. It’s really good.

Their balance sheet is also strong. Low total debt in general. Mostly short-term debt.

Increase in investing and financing activities. Increase in dividends paid.

ROA and ROE are pretty good.

Low P/E ratio. Cheap now? But Beta is really high though.

Moving forward

The near-term outlook continues to be challenging due to much uncertainty in customers’ order flows amid the ongoing China-US trade tensions which affected demand from semiconductor chipmakers.

The longer-term outlook however, is good. SEMI, the global industry association for the electronics manufacturing supply chain reported that worldwide sales projected to dip 4% in 2019, but will bounce back to 20.7% in 2020.

Conclusion

Financials of UMS are good. Profit margin is very high. Low P/E ratio, but the beta is very high at 1.40, subject to high volatility. At the share price of $0.59, looking at the current trend, there is a concern that share price may continue going down further so need to look out first.