Advertisement

Anonymous

Should i invest in a ILP or just buy ETFs on my own? It seems that both are just funds that do the same thing?

3

Discussion (3)

Learn how to style your text

Jonathan Chia Guangrong

28 Mar 2019

SOC at Local FI

Reply

Save

ILPs are very expensive as you need to pay loads of fees.

The Tyranny of Compounding Costs.

Feescompound over time, just like investment returns. But rather than push the value of portfolios higher over the long run, fees do the exact opposite. They eat away at the value of your portfolio.

Anyway, no sane investors will buy an ILP for investment. It is totally nonsense.

Reply

Save

Nicholes Wong

28 Mar 2019

Diploma in Business Management at Nanyang Polytechnic

They are not the same thing. ILP do things for you at a higher cost and they offer active and passiv...

Read 1 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

ILPs invest in unit trusts or sub funds which are not actively traded. You will need to submit a request to buy or sell your holdings and this usually takes 2 working days to process. You will not know the full extend of the stocks being held in the fund as well.

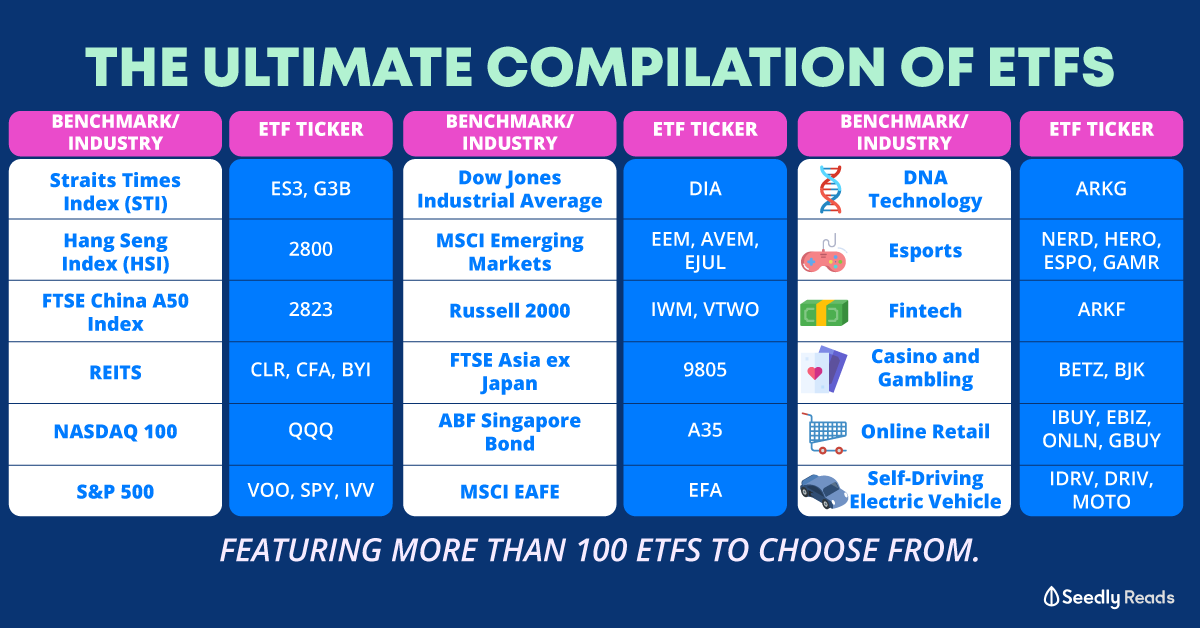

Etfs on other hand are traded on a stock exchange. The price is fully transparent, and you will know what are being held in the fund. Fees wise etfs have a superior advantage over ILPs, as it is much lower.

Over the long term, investing in etfs will be better as the lower fees will not eat up a big portion of the profits as compared to ILPs. Hope this helps