OPINON

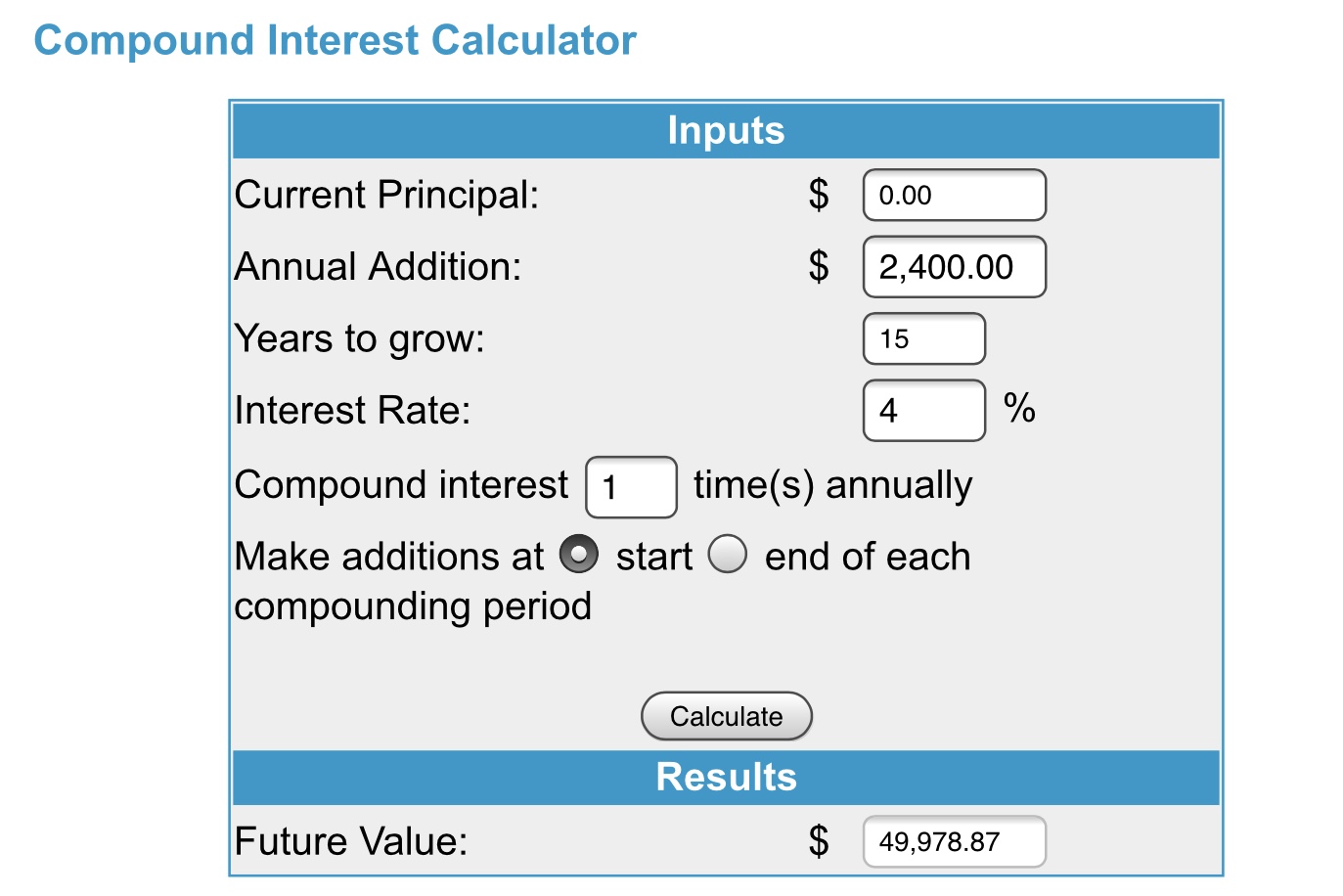

Below is the your target sum(CPF table). With 200 pm. will you able to achieve what your target with extra $50k in 15 year?

if No, are you able to increase your monthly contribution?

You may use cash to invest in ETF to achieve more than 4% return but have risk. Cpf is risk free.

just personal opinon, dont buy retirement insurance plan.

TIPS (in case you don't know)

when you near & before 55 you MUST invest your SA.

Because

you can only transfer OA to SA before 55

@55, RA account is created which is also 4% interest

RA will prioritise in moving your SA into the RA , then OA. Up to FRS

by moving your SA into investment, your SA is empty. RA will then take $$$ from your OA 2.5%

After the process is complete, you then sell your investment and get the $$$ back to your SA.

investment you can do with SA is low risk, low return. So make no sense if you invest early.

http://www.moneychimp.com/calculator/compound_i...

OPINON

Below is the your target sum(CPF table). With 200 pm. will you able to achieve what your target with extra $50k in 15 year?

if No, are you able to increase your monthly contribution?

You may use cash to invest in ETF to achieve more than 4% return but have risk. Cpf is risk free.

just personal opinon, dont buy retirement insurance plan.

TIPS (in case you don't know)

when you near & before 55 you MUST invest your SA.

Because

you can only transfer OA to SA before 55

@55, RA account is created which is also 4% interest

RA will prioritise in moving your SA into the RA , then OA. Up to FRS

by moving your SA into investment, your SA is empty. RA will then take $$$ from your OA 2.5%

After the process is complete, you then sell your investment and get the $$$ back to your SA.

investment you can do with SA is low risk, low return. So make no sense if you invest early.

http://www.moneychimp.com/calculator/compound_i...