Advertisement

Anonymous

Should I apply for Toa Payoh BTO with a combined monthly income of 6.2-6.5k before CPF?

We have just started working for 3 & 1 years respectively and I am worried about if this would be stretching our finances too far given our income. I will most likely be selling it 5-10 years from MOP but I don't know if it is feasible in the first place.

Current have combined 40k in cash & approx 25k CPF OA.

5

Discussion (5)

Learn how to style your text

Reply

Save

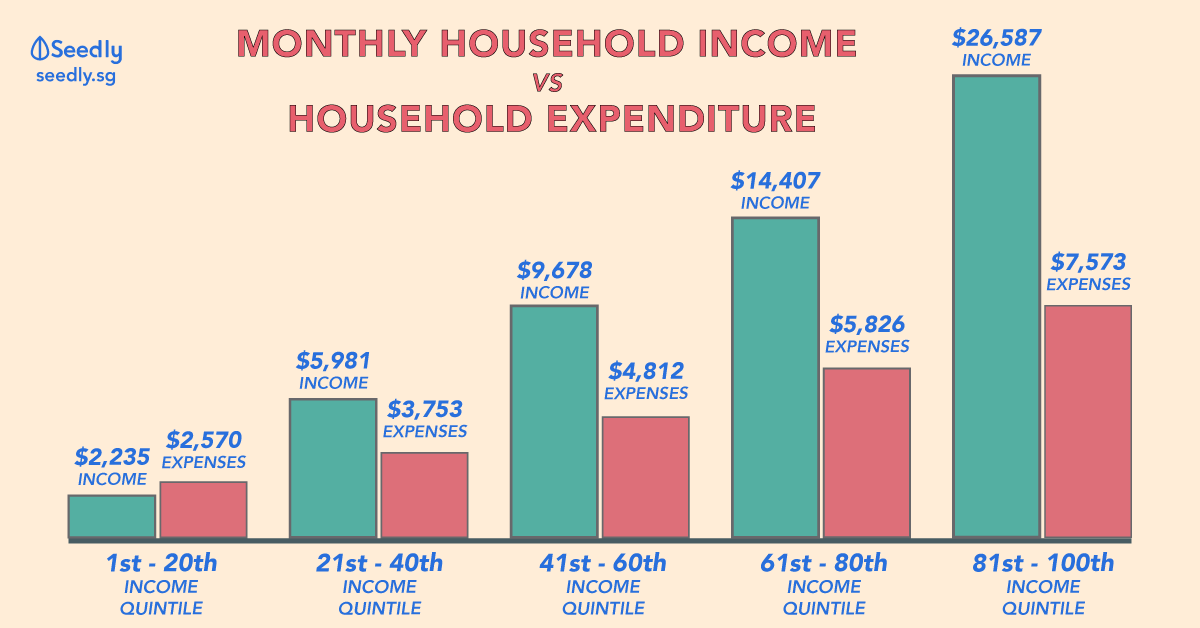

I think a conservative gauge is for your monthly mortgage not to exceed 30% of monthly income (regardless hdb or bank loan). This is to allow some leeway in the event you want to get a car or renovation loan. And you should consider if you can build up your emergency funds while paying for your mortgage, which if important for rainy days.

Also, remember bidadari has plenty of new btos which have met their MOPs and are available for sale by the time you want to sell. So selling at a good time and good price may not be within your control. I would want to avoid situations where I am forced to sell it urgently at a lower than desired price.

Reply

Save

Zac

04 Feb 2021

Noob at Idiots Invest

How many rooms are you looking at? Bidadari is very expensive. Even with an income higher than that,...

Read 1 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

Hi, i can do the maths breakdown for you, and determine how much Cash / CPF you need.

What i need from you is a bit more information.

1) Price of BTO you are buying?

2) Grant possibilities? - near your parents place etcetera

3) your ages