Advertisement

Anonymous

Setting a budget as a uni student

There's a lot of articles about setting a budget as a working adult but not as a uni student. I am starting year 1 soon and want to know how everyone does their budgeting. Will be great to hear from everyone about their budgeting plans as a student.

- Pre-Covid

- Currently

Context: I do have a monthly allowance of $500 from my parents.

12

Discussion (12)

Learn how to style your text

Reply

Save

Sabrina Wong

21 Jan 2022

Communications at University at Buffalo

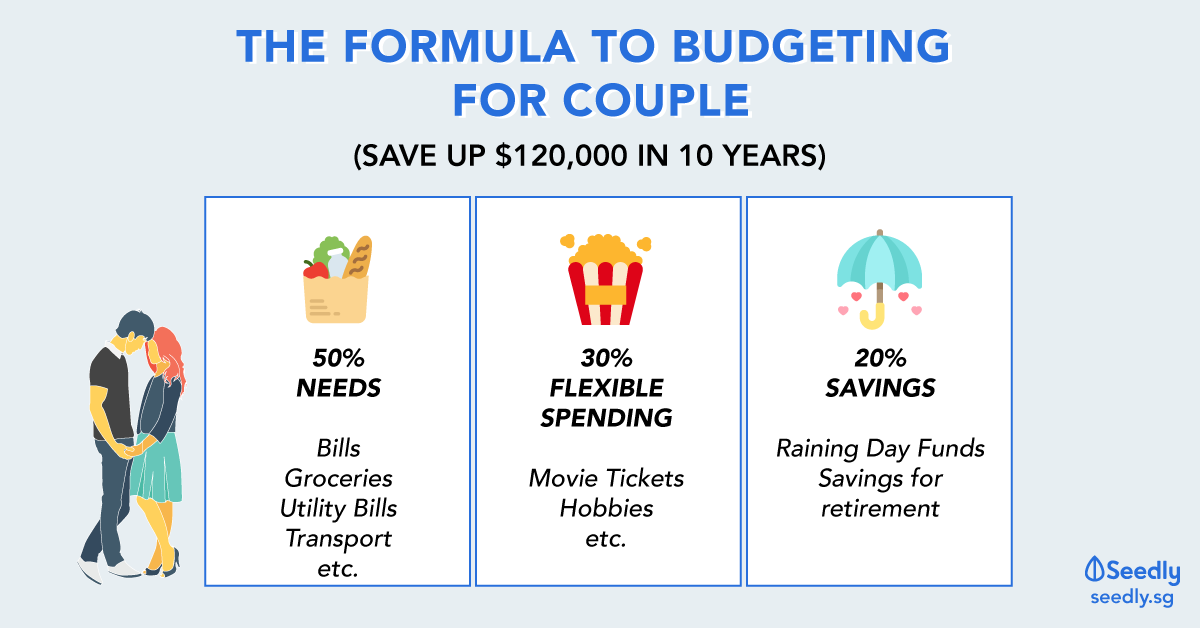

In fact, I was just reading an article recently on 7 strategies to building your wealth in your 20s and found it insightful. It seems to be all about building healthy saving & spending habits and just being mindful.

1. Start Investing

2. Cut Expenses

3. Increase Your Income

4. Review Your Account Vehicles

5. Negotiate Your Bills

6. Refinance

7. Delay Gratification

Reply

Save

For me personally, I use those budgeting and personal finance apps to keep track of my budget and spendings because I tend to forget the little things I spend money on everyday haha. My fav has to be this app called Planner Bee! It’s quite cool how they let you sync your bank accounts to the app (don’t have to waste time manually keying in your expenses everyday). I really like their budgeting feature too, because I can set a budget within the app for a specific category (eg. food/dining) and they’ll keep track of how much I spent for that category, and tell me how much I should spend everyday to stay within the budget.

Reply

Save

JK

31 May 2021

Salaryman at Random Company

Hi,

It is very helpful to still receive allowance when in Uni. You will even be able to save a bit, should you stick well to your budget.

Some expenses you will incur includes:

Printing of Notes/Assignments & Purchasing Textbooks

Food - Normal Meals

Transportation

Entertainment & Comfort/expensive meals

Savings

Pre-Covid:

S/N 1 depends on your school, course, and of coz, font size. haha. I used to print 8 slides per A4 page, and since the print shops charge by per-printed-page, I printed only 1-sided, so allow blank page for notes taking.

S/N 2 depends on where your school is. I was from NTU, and I was able to get $2 caifan for daily lunch for my 4 years in school. Imagine if you are in SMU, in the heart of town, it will be impossible to get that kind of price for your daily meals, I think.

S/N 3 depends on your distance from school, and mode of transport to school. If you only needed to take train to school, you can get MRT concession. However, if you need to take both Bus & Train, e.g. SIM, you will need hybrid concession. Of course, do the math to see if concession is worth it or not, especially if you do not need to go to school daily. I used to take NTU's shuttle bus to school, so I'll save up on the trip to school, though it means waking up early to catch the bus.

S/N 4 depends on yourself and your circle of friends. My clique of friends are all gamers, and we spend more time playing DOTA/LoL in school than anywhere else, so this was really low for me.

S/N 5 depends on your target & situation above. Back in uni, I did not have steady income/allowance, so this was fluctuating. My aim then was just to minimise spending.

Reply

Save

Hi Anon,

i receive half of the amount you get from your parents as allowance.

Pre-covid:

- i spen...

Read 6 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

Spend the minimum for your food, transport and daily necessity. Spurge less on going out to malls etc.