Advertisement

Anonymous

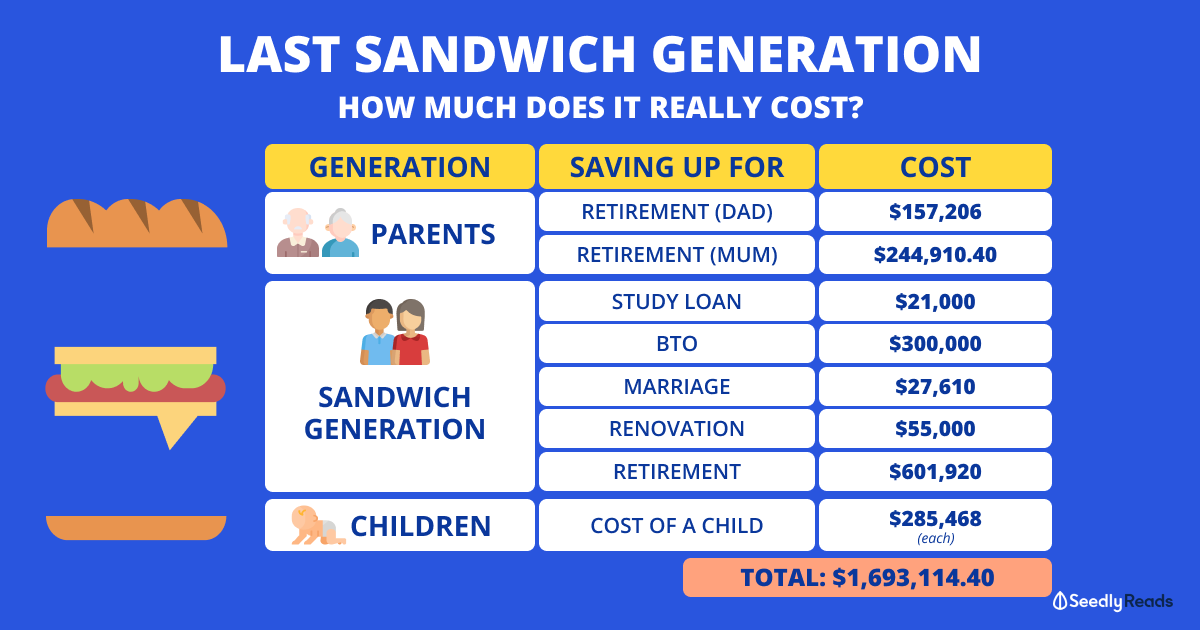

Sandwich generation squeeze

Mid-career PMET, married with 2 kids (childcare/enrichment), still paying mortgage. Parent’s health takes a turn and now it’s $600–$1,200/month for meds, appointments, transport + time off work.

I’m trying to keep things from spiralling by setting up a separate “care fund” (I’m using an OCBC account just to isolate these expenses), but it still feels like the budget is wobbling.

How would you handle this without burning out?

3

Discussion (3)

Learn how to style your text

Reply

Save

Visibility of monthly cash flow becomes crucial part of daily life. list down all the expenses, budget for the essential expenses and delay the wants during this challenging time. focus on the intangible and quality family bonding time as source of blessings & happiness to keep oneself grounded

Reply

Save

Increase liquid cashflow

- Children enrichment can cut if budget really tight.

- Mortgage can u...

Read 1 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

Start multiple income stream