Advertisement

Retirement investment suggestions for $250K 65 with this sum to invest for 5 to 10 years. Aside from painful FDs, there are options for upto 3.8% by Syfe etc, are there any interesting alternatives?

10

Discussion (10)

Learn how to style your text

Albert Tan

Edited 03 May 2024

Financial Literacy & Partnerships at MoneyOwl

Reply

Save

Ssb, tbills, i think safe for this time horizon.

Reply

Save

Ngooi Zhi Cheng

29 Apr 2024

Student Ambassador 2020/21 at Seedly

For those of us entering our golden years, ensuring our nest egg lasts and continues growing throughout retirement is one of the most important financial priorities. After decades of diligent saving and investing, the last thing anyone wants is to run out of money or miss out on attractive returns.

One of my retired clients found himself in a similar situation to the one described. At 65, he had $250K he wanted to invest for passive income over a 5-10 year time horizon without taking on excessive risk. Having worked with him for years to build his wealth through prudent investing, he trusted me to propose the right solution.

After analyzing his full financial picture - existing income sources, living expenses, future plans, etc. - it became clear that capital preservation paired with a steady income stream should be the primary objectives. Chasing excessive yield would be unwise if it jeopardized his principal investment.

So we crafted a two-pronged income portfolio playing excellent defense while still generating robust returns:

The first sleeve consisted of highly-rated, investment-grade bonds and bond funds from proven managers. This provided continuous cashflow and peace of mind that Uncle Robert's savings were parked in the highest quality credits.

The second allocation was to a globally diversified equity income fund. This world-class portfolio of dividend growth champions allowed for capital appreciation while reliability flowing income through a professionally-managed solution.

In addition to the strong yields generated, having both bonds and equities serving income roles provided welcome diversity and inflation protection for a multi-decade time horizon.

To be sure, there were "sexier" alternatives promising even higher promised yields. But Uncle Robert and I avoided chasing rainbows, instead prioritizing stability, quality, and sustainability aligned with his needs as a retiree. Generating 5%+ with that level of prudence became the "big win."

The key myth I want to dispel is that effective retirement investing always requires taking undue risk or piling into niche, exotic products. For most retirees, a thoughtful portfolio of plain vanilla bonds and dividend growth equities from reputable managers can more than suffice in meeting cashflow demands.

It's about matching the strategy and products to your specific goals and tolerance for volatility, not just swinging for the fences on yield alone. Sure, bonds aren't as thrilling as crypto or tiny REITs. But they provide the certainty and predictability most sensible investors want in retirement.

So as you think about your own retirement investment plan, get crystal clear on your personal priorities and risk parameters first. Then, explore best-of-breed bond and equity income funds that can fulfill those needs in a risk-appropriate, reputable manner.

To stay on top of practical retirement investment tips, be sure to follow me on Instagram @ngooooied. Sharing insights to help hard-working people safeguard their life's savings is hugely gratifying for me.

Reply

Save

At 65yo, you may want to consider safe investments.

returns usually proportional to risks, for safer returns, the risks are not high but it it is capital guaranteed.

Will suggest SSB because it is 100% capital guaranteed by sg govt and you can redeem anytime and get the sum back by the start of the next month of redemption application.

Reply

Save

For a retirement investment of $250,000 with a 5 to 10 year horizon, there are several options to co...

Read 4 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

Decide on whether you are investing for further accumulation or decumulation of your accumulated nest egg. Decide on how much you intend to leave behind at death. Generally people have no problem saving and accumulating, but when it comes to spending it's another story.

Ideally you want to bucket the $250k into at least 3 pots with varying time horizons ranging from immediate usage (income bucket), to 1-3 years (short term bucket), to capital preservation for perpetuity (long term bucket if required).

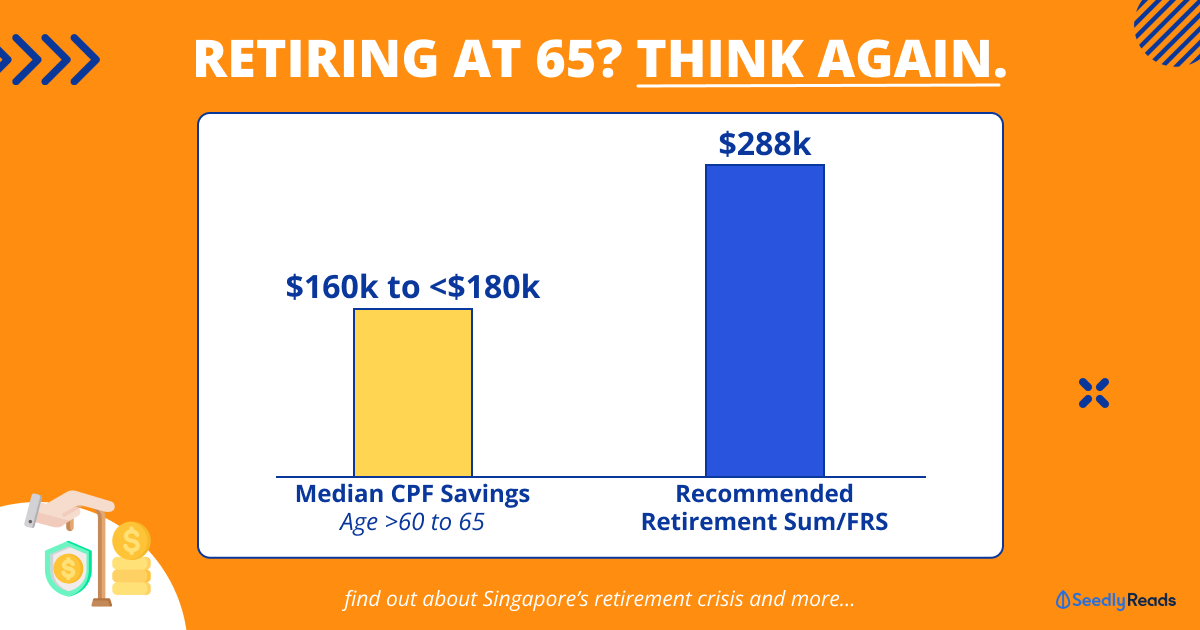

At 65 assuming you have accumulated sufficient in your CPF, it can start streaming monthly payouts into your income bucket along with maybe 1/3 of your $250k invested in dividend paying funds.

Robos like what you are considering are likely cash management alternatives to FDs which i consider to form my short term bucket. Robos also offer potentially higher returns depending on what you are investing in (e.g. equities).

If you are confident and savvy, DIY is not difficult. Otherwise, speaking to a trusted adviser will be much better. Seedly is not a trusted adviser, but an opinion pool. He/She should be able to provide a comprehensive view of your retirement plan as well - factoring in your insurance and estate planning, such that curveballs do not derail your retirement.