Advertisement

Anonymous

Question on the Standard Chartered e$aver criteria?

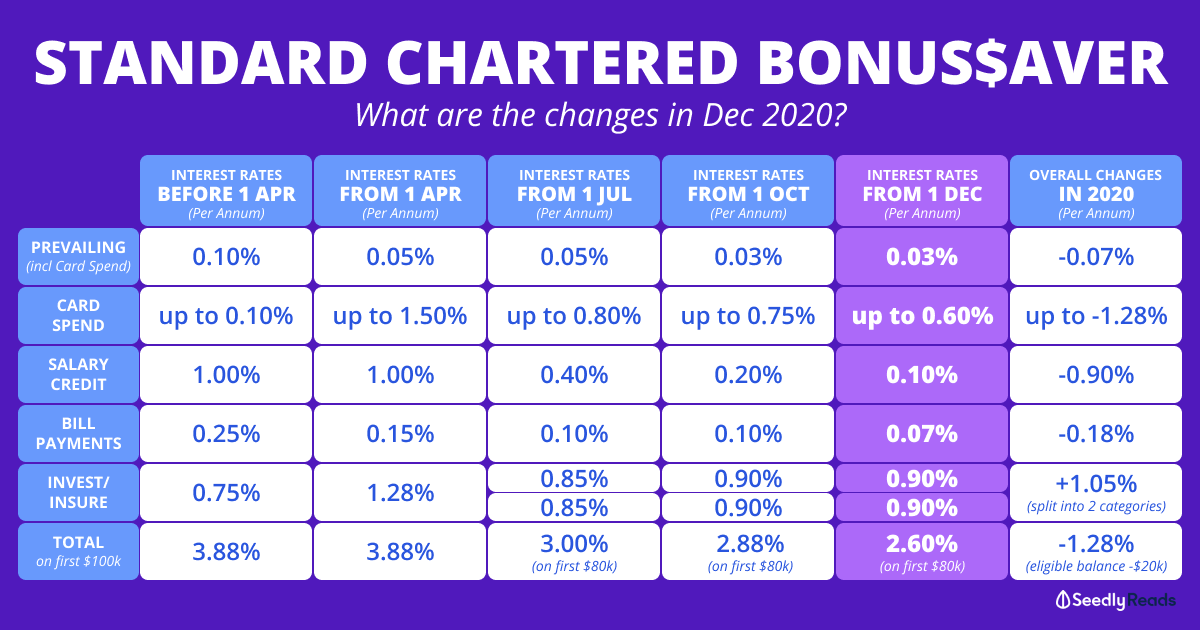

I'm looking for alternatives to my DBS Multiplier account after the recent new year update. I'm looking to move some fund after 25k in DBS. I do have the eSaver account but I'm not sure about the bonus incremental amount after depositing to this account. Can anyone here explain what is this all about and how to maximise the interest earned?

4

Discussion (4)

What are your thoughts?

Learn how to style your text

Pang Zhe Liang

02 Jan 2020

Lead of Research & Solutions at Havend Pte Ltd

Reply

Save

View 3 replies

Write your thoughts

Related Articles

Related Posts

Related Products

DBS/POSB Multiplier Account

4.3

329 Reviews

Up to 4.10% p.a.

INTEREST RATES

$0

MIN. INITIAL DEPOSIT

$0

MIN. AVG DAILY BALANCE

Standard Chartered e$aver Savings Account

5.0

1 Reviews

Standard Chartered JumpStart Account

4.8

785 Reviews

Related Posts

Advertisement

Assume that you have $1k in your Standard Chartered eSaver account now. Next, we are going to move $25k from DBS to this eSaver account.

For the $1k in your account now: earns 0.1% interest per annum

For the $25k fresh balance: earns 1.65% interest per annum

Take note that this $25k must be from another bank, i.e. not from any of your Standard Chartered account. Additionally, you cannot withdraw and re-deposit this $25k within 30 days of the promotion period.

To maximise the interest, you will need to have another high yield account for you to park your money every 2 months (assume that this promotion never ends).

Here is everything about me and what I do best.