Advertisement

Anonymous

My parents are considering to sell their 4-room HDB to get a 4-room SBF, with minimal cash outlay. Confused when searching HDB online, how does the sale proceedings and CPF work to fund for the SBF?

The resale price of the current flat is $390k-400k and assuming the SBF price before the grant is about $350k. The current HDB's HDB loan is fully repaid. The current flat was a resale flat.

2

Discussion (2)

Learn how to style your text

Reply

Save

Kenneth Fong

29 Oct 2020

Marketing Manager at Seedly

Hi anonymous,

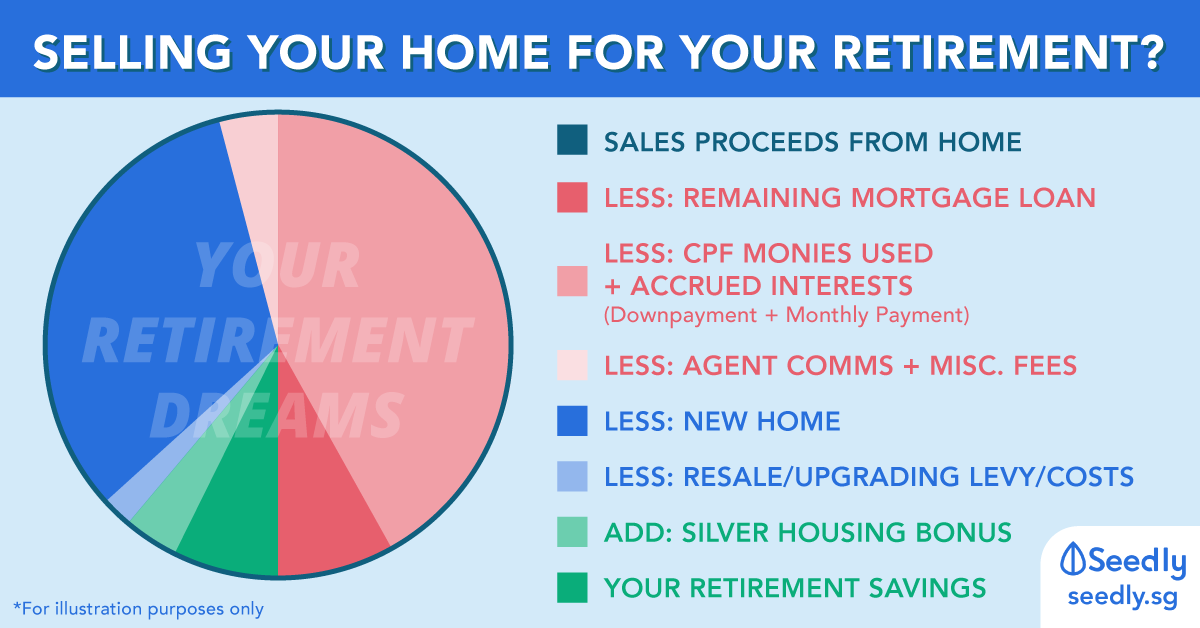

Since your parents took a HDB housing loan (aka paid for their home using CPF) when your parents sell their flat they will need to refund the principal amount + any accrued interest back (assuming they sell the house before 55).

If they're selling it after 55 years old, they will need to do the same + return any amount withdrawn from their Retirement Account.

If they haven't met their Full Retirement Sum, they will need to do a top up (using the remaining cash from the sales proceeds of their 4-room flat).

Once this is settled, let's look at the new 4-Room SBF flat that they're gonna buy.

To fund the purchase of the 4-Room SBF, they will be able to use their RA savings (above the Basic Retirement Sum) as well as any remaining OA savings to pay for it. So long as the lease covers them till at least 95 years old. If not, the CPF they can use will be pro-rated based on how much the remaining lease can cover the youngest buyer till the age of 95.

Ultimately, if they've been proactively contributing to their CPF all the while using it to pay for their initial 4-Room resale flat, they should return a substantial amount back to their CPF-OA (along with the accrued interest). This amount should definitely be enough to cover most of the cost of their next home.

However, they might want to think about retirement plans in the long run too. If you're old enough and are about to move out or live on your own soon, they might want to consider a smaller flat instead to keep as much of their CPF monies for retirement as possible. Otherwise it'll be a situation where they have too many rooms left once you (and perhaps your siblings, if you have any) leave the nest.

Arguably, they'll be able to rent out the rooms and etc. for passive income but that really depends on whether they are comfortable with that.

Hope this clarifies! I'm sorry I can't offer any exact calculations because it really depends on various factors like how much CPF monies was used, the accrued interest, and etc.

Best thing they can do is to talk to an HDB officer and get them to assist with working out the details!

Reply

Save

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

Most property agents will be willing to share more.