Advertisement

Anonymous

Looking to have start a small retirement sum for my parent with 20k. Parent is curently 50 year old. What will be good to stretch this 20k? What will you recommend?

Noting that all the necessary insurance for health, accident , CI, ECI protection have been covered and hit full retirement sum alr in CPF for my parent! And that this 20,000 is meant for her but we want to stretch this further.

2

Discussion (2)

Learn how to style your text

Colin Lim

17 Aug 2020

Financial Services Consultant at Colin Lim

Reply

Save

Aidan Neo

17 Aug 2020

Financial Services Consultant at Manulife Financial Advisers

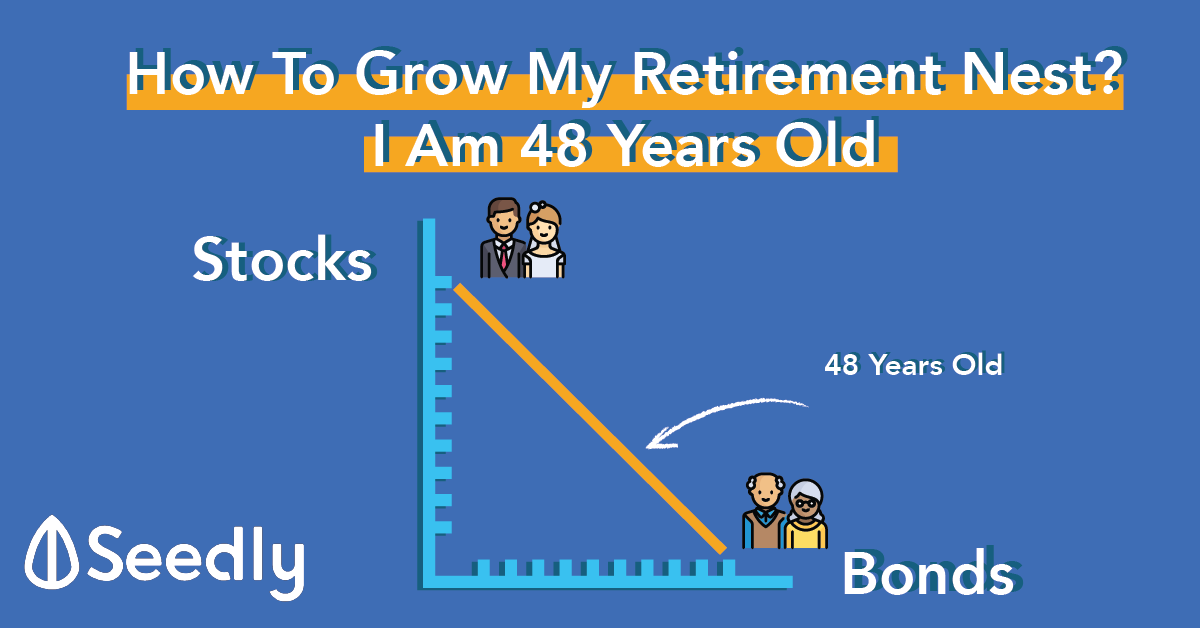

In my opinion, since your parent is currently 50 year old and with a sum of $20,000, you might want to look at low risk vehicles such as bonds, bond fund, high yield accounts like Singlife, or short term endowment like Tiq 3-Year Endowment Plan. All these helps in ensuring minimal volatility (however, of course low returns) and liquidity purposes.

Reply

Save

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

Your parent have reach the CPF Full retirement sum, your mom is she working? or retired already?

regarding the 20k, u can invest the money as a lump sum investment. you can put into stashaway as a lump sum or a good stock to get dividends.

#planwithcolin