Advertisement

Anonymous

Is LendLease Global Commercial REIT IPO worth investing in?

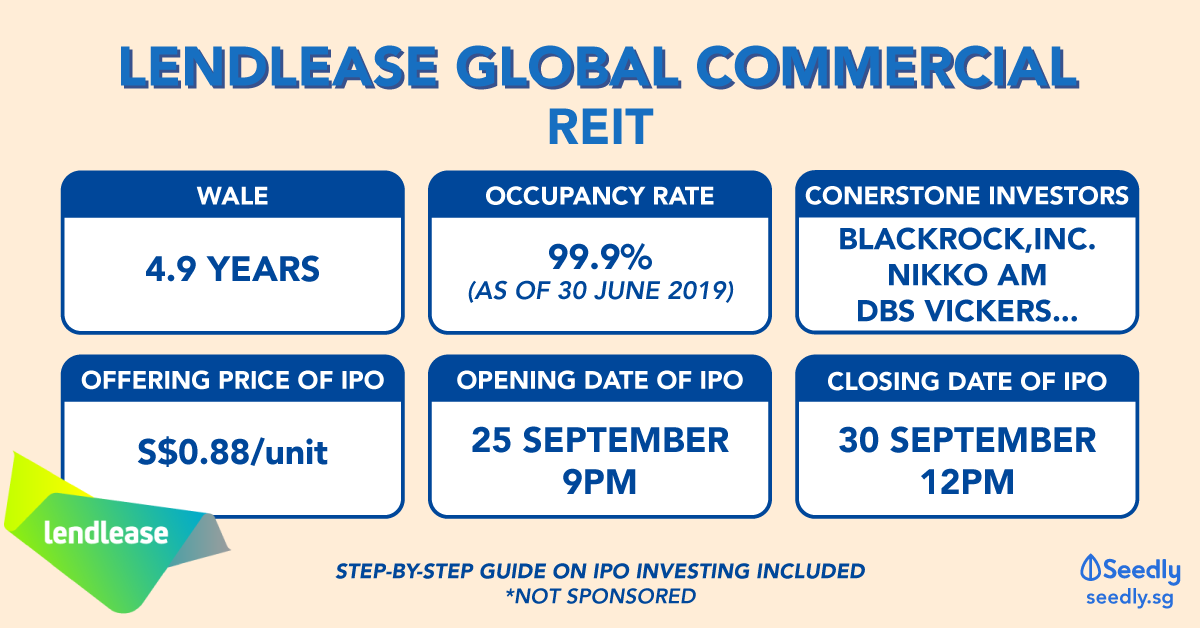

This REIT looks really good in my opinion. What are some of the things we all should be looking at? Personally, I am looking at WALE, Occupancy rate and the sponsor is strong.

8

Discussion (8)

Learn how to style your text

Just Being Ernest

02 Oct 2019

Content Creator at www.youtube.com/c/JustBeingErnest

Reply

Save

Cedric Jamie Soh

30 Sep 2019

Director at Seniorcare.com.sg

Go through the prospectus.

Currently, Lendlease has priced the IPO price UNDERVALUED. (Edit: my bad, i mean undervalued relatively to peers. On its own, $0.88 is probably a little over)

Means it's a current good buy going by current market conditions. (if the economy collapses tomorrow, don't look for me.... )

REITs are always popular with Singaporeans and stable, dividend hunters. Lend Lease properties are crowded and full of traffic... It's going to be a very popular IPO. disclaimer: I will be applying online

Reply

Save

I actually really like this REIT haha, in terms of valuations, portfolio and pipeline. Probably the ...

Read 3 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

Personally, there are two sides of the coins based on the assets under the REITs.

1) Since the properties are not so good and medium risk involved due to the lack of diversification, it would be better to wait on the side for better properties to be injected or share price to go lower to account for the risk.

or

2) Since the properties that would be injected in the future would potentially benefit shareholders with reduced risk and greater returns, it would be better to enter now and hold on with dividends received while waiting for potential upsides.

There are two approaches. Wait for better visibility and lower risk. Or take the risk and wait it out. Is your call to decide which boat you prefer.