Advertisement

Anonymous

Is Dividend Growth Investing ideal in Singapore? Also, what are your thoughts on Index Investing? Is it advisable to do both?

I've been reading a lot about investing for beginners, and index investing into the STI ETF is one of the most recommended methods. But at the same time, I've read a lot about dividend growth investing and want to try my hand at it. Was wondering if its advisable for me to do an RSP into STI ETF and try my hand at Dividend Growth Investing as well

1

Discussion (1)

What are your thoughts?

Learn how to style your text

Colin Lim

14 Apr 2020

Financial Services Consultant at Colin Lim

Reply

Save

Write your thoughts

Related Articles

Related Posts

Related Products

Moomoo Singapore

4.7

487 Reviews

From $0

MINIMUM FEE

0.03%

TRADING FEES

Custodian

STOCK HOLDING TYPE

Saxo Markets

4.5

961 Reviews

Plus500

4.7

145 Reviews

Related Posts

Advertisement

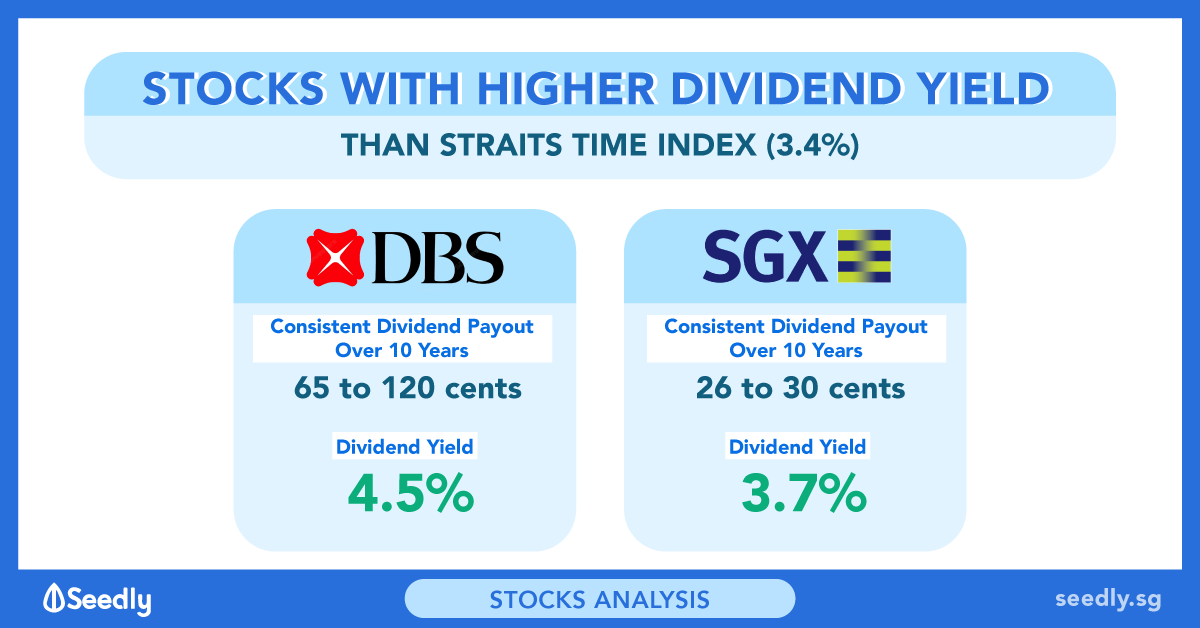

Singapore is a small market compare to US, HK and global markets. In terms of growth,not much potential.

singapore is a developed country and thus dividend have potential and we don't have tax regulation: https://www.iras.gov.sg/IRASHome/Individuals/Lo...

if u are looking at decent dividends, you can look at companies that are monopoly an duopoly.

Reits is the IN thing now for dividend.

index investing is safe bet and u don't waste time to do a lot of research. Low cost.

I looking at US indexes & stocks for growth. Investing in reits and cash cow stocks to have decent dividends. So yes, you can do both.