Advertisement

Anonymous

If I have enough to pay off my home loan, should I pay it off or use the money to invest elsewhere instead? Don't wanna have debts, but also read that it's dangerous to lock up cash in property...?

I do have 6 months of emergency funds set aside, but not sure if I should use my remaining savings to pay off the home loan or invest it?

2

Discussion (2)

What are your thoughts?

Learn how to style your text

Duane Cheng

03 Sep 2020

Financial Consultant at Prudential Assurance Company Singapore

Reply

Save

View 1 replies

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

Hi there,

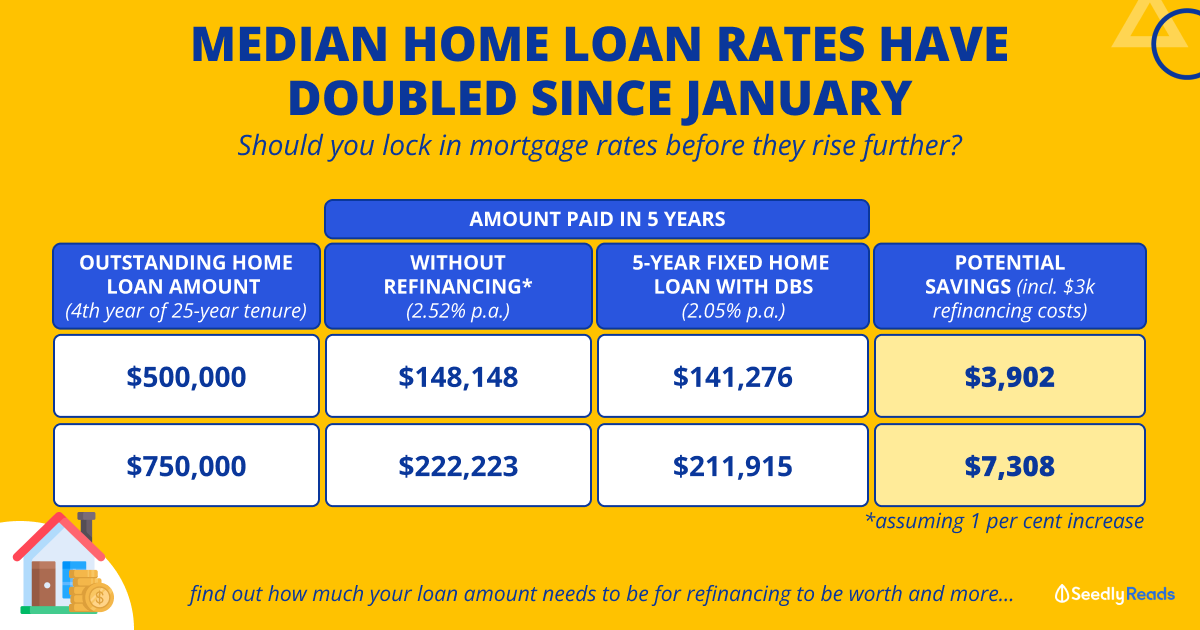

It is a very good question to ask. Paying off your housing loan is a good thing, however if you are still working, there are better options with regards to your loan. You could refinance your loan, to reduce the loan tenure and take advantage of the low-interest rates. That way you can repay your house faster, while maintaining the same payment schedule. If your situation allows it, you can also increase your payment amount, to further speed up the process.

If you do intend to stay at your current home for the long-term, you will eventually pay off your housing loan as well. You can reallocate your current cash flow, to other instruments to garner better return of your assets or to offset any interest paid from your loans.

You will need to further explore your situation as it is not very straightforward, and require more details. Hope i was able to shed some insight!