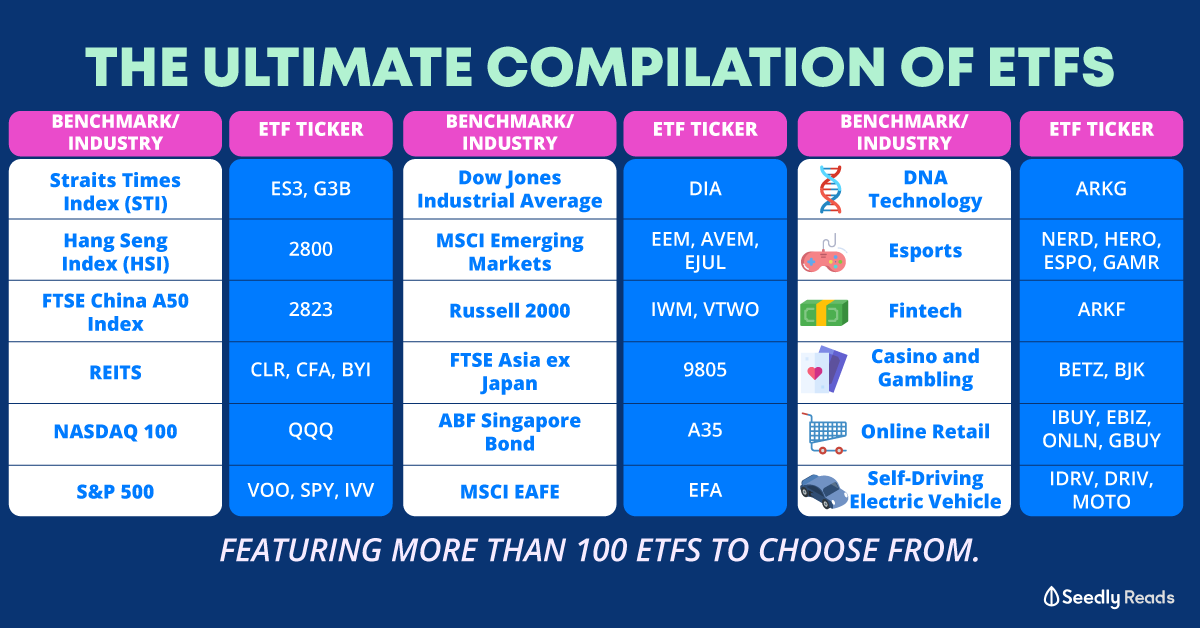

There are tons of mutual funds and also tons of etfs.

Mutual fund and unit trusts are the same. Mutual funds generally have a higher expense ratio because need to employ bigger team, do some portfolio structuring etc.

ETF or exchange traded funds also got a lot of variety. Some are not much different from mutual funds. Scientifically the difference is just ETF is listed on stock exchange, whereas mutual funds or unit trusts are bought / sold via special channels with the trust manager (eg ilp / fundsupermart / banks / wealth platforms).

A subset of etf and mutual funds are index funds, which basically just try to construct the portfolio similar to the index they follow. For index funds, the expense ratio can be really low because of volume, and you don't need all these extra jobs that try to do what fundamental analysis, follow what trend... They just need to follow and replicate the index. eg endowus has special rates and deal with Lion global for the infinity fund that tries to replicate S&p fund but the special rates only apply for cpf investing. Technically the infinity 500 fund is a mutual fund. S27 is the sgx listed version of etf. Then you have the Ireland domiciled version (eg vusd), and the US versions (eg voo) - but they all try to follow S&p 500 with some minor differences

As I started doing research on S27 (the S&p etf listed on sgx), I also realize there are some unique points. Eg s27 documents say they can pay less tax in US because they have a law in US where they can be exempted from (I think the fund level tax) if they pay out 90% of the dividends. This law is similar to the one applied to SGX listed reits. So this can also be an area where they can save on costs and have lower expense ratio vs mutual funds.

Don't be swayed by the advertising message

Actual studies show over long periods of time, there are few funds that will outperform the index itself, and so the universal truth to ensuring good returns is having low cost / expense ratios, while trying to keep up with index.

Side note of why Ilp are inferior products - if you study the structure of ilp, the fees include

A) the expense ratio and fees for the underlying funds or trusts (same as what the mutual fund will charge you individually)

B) The commissions paid to the agent who sold you the ILP (typically 50% of your annual premiums in year 1, 30% in year 2, and 20% in year 3). You will not need to pay this if you do the investing yourself instead of buying the ilp. To be fair to the insurance Co, I think they try to price the ilp as a 20 year plan, so 1 year of premiums paid to insurance agent just means if you stick to 20 year plan, it's 5% transaction fees over 20 years. But the front loading definitely makes the IRR super horrible, below par, and always making the breakeven point seem so far and hard to achieve in less than 10 years.

C) the insurance cost of the 101% coverage and admin fees. I get a feel this is about 6% of the premiums you pay annually.

If you choose to do investing yourself, you save on costs B and C, which can be tremendous in making sure the portfolio returns are not horrible.

In reinvesting dividends, would they possibly be able to do better (than you) when reinvesting dividends and taking on economies of scale in diversification and volume? Of course but that's why you pay for the higher expense ratio. But this is not a key reason why they would be better.

but based on how market goes, it can also be a disadvantage if they are re-investing it when market is peaking.

And different people have different needs. Some retirees will use dividends as the source of their income (rather than to draw down and sell investments to take cash out). So it's not always true that people want to re-invest dividends. So I can't really say that is a point to sell too.

There are tons of mutual funds and also tons of etfs.

Mutual fund and unit trusts are the same. Mutual funds generally have a higher expense ratio because need to employ bigger team, do some portfolio structuring etc.

ETF or exchange traded funds also got a lot of variety. Some are not much different from mutual funds. Scientifically the difference is just ETF is listed on stock exchange, whereas mutual funds or unit trusts are bought / sold via special channels with the trust manager (eg ilp / fundsupermart / banks / wealth platforms).

A subset of etf and mutual funds are index funds, which basically just try to construct the portfolio similar to the index they follow. For index funds, the expense ratio can be really low because of volume, and you don't need all these extra jobs that try to do what fundamental analysis, follow what trend... They just need to follow and replicate the index. eg endowus has special rates and deal with Lion global for the infinity fund that tries to replicate S&p fund but the special rates only apply for cpf investing. Technically the infinity 500 fund is a mutual fund. S27 is the sgx listed version of etf. Then you have the Ireland domiciled version (eg vusd), and the US versions (eg voo) - but they all try to follow S&p 500 with some minor differences

As I started doing research on S27 (the S&p etf listed on sgx), I also realize there are some unique points. Eg s27 documents say they can pay less tax in US because they have a law in US where they can be exempted from (I think the fund level tax) if they pay out 90% of the dividends. This law is similar to the one applied to SGX listed reits. So this can also be an area where they can save on costs and have lower expense ratio vs mutual funds.

Don't be swayed by the advertising message

Actual studies show over long periods of time, there are few funds that will outperform the index itself, and so the universal truth to ensuring good returns is having low cost / expense ratios, while trying to keep up with index.

Side note of why Ilp are inferior products - if you study the structure of ilp, the fees include

A) the expense ratio and fees for the underlying funds or trusts (same as what the mutual fund will charge you individually)

B) The commissions paid to the agent who sold you the ILP (typically 50% of your annual premiums in year 1, 30% in year 2, and 20% in year 3). You will not need to pay this if you do the investing yourself instead of buying the ilp. To be fair to the insurance Co, I think they try to price the ilp as a 20 year plan, so 1 year of premiums paid to insurance agent just means if you stick to 20 year plan, it's 5% transaction fees over 20 years. But the front loading definitely makes the IRR super horrible, below par, and always making the breakeven point seem so far and hard to achieve in less than 10 years.

C) the insurance cost of the 101% coverage and admin fees. I get a feel this is about 6% of the premiums you pay annually.

If you choose to do investing yourself, you save on costs B and C, which can be tremendous in making sure the portfolio returns are not horrible.

In reinvesting dividends, would they possibly be able to do better (than you) when reinvesting dividends and taking on economies of scale in diversification and volume? Of course but that's why you pay for the higher expense ratio. But this is not a key reason why they would be better.

but based on how market goes, it can also be a disadvantage if they are re-investing it when market is peaking.

And different people have different needs. Some retirees will use dividends as the source of their income (rather than to draw down and sell investments to take cash out). So it's not always true that people want to re-invest dividends. So I can't really say that is a point to sell too.