Advertisement

Discussion (3)

Learn how to style your text

Reply

Save

Luke Ho

11 Feb 2019

Founder and Director at CFX Money Maverick Pte Ltd

Yes. Basically.

In fact, 1M65 was 1M55 not so long ago.

I have no idea how people in your position reconcile themselves to that fact when it comes to CPF...

That being said, it's not unlikely you'll live to that age.

So you can plan for your retirement at 45 using private investments for example, and the money only needs to last 20 years before 65 kicks in. Or the money from 45 can complement it by that age.

Thats certainly one way.

I'd love to help you with this if you like, since I enjoy structuring such portfolios for my ambitious clients. Who doesn't love a challenge, like retiring at 45?

Reply

Save

Jonathan Chia Guangrong

11 Feb 2019

SOC at Local FI

1m65 is a retirement strategy using CPF. It is outlined here https://dollarsandsense.sg/1-million-65...

Read 1 other comments with a Seedly account

You will also enjoy exclusive benefits and get access to members only features.

Sign up or login with an email here

Write your thoughts

Related Articles

Related Posts

Related Posts

Advertisement

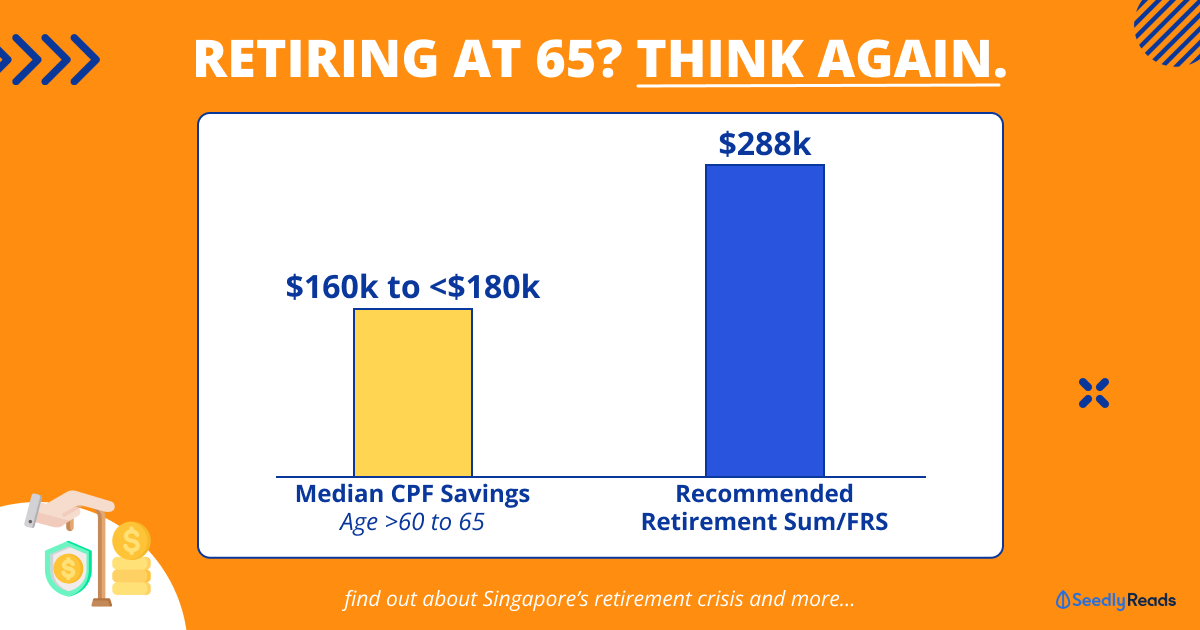

I've been working since 1990 earning $850 per month. In 2000s, my salary was about $60k per annum. From 2010 to 2020, I earn an average of $100k per annum. I'm now 52 and semi-retired with $932k in my CPF. I figured based on an annual interest rate of 2.5%, I'll have 1M55.

I didn't know about 1M65, but in 2011 (I was 40 years old), I tried to top up my CPF, and they'd already rejected my application as i'd exceeded all limits (monthly, annual and retirement sum).

So I guess technically hard to achieve 1M45, but 1M50 is possible if I'd been smart to move all my OA into SA when I was younger.

It looks possible to live off CPF interest from 55 (if you have at least 1M55). $2500 per month seems decent for a single person.