Advertisement

Anonymous

I am currently in my 20s and i've been thinking a lot on increasing my finances so i've been juggling part time jobs. recently i am into earning passive income but need some suggestions to start?

I am not entirely savvy on savings and investments, and is not a high risk taker. but recently i just believe if i can earn a passive income it would help with my finances situation a lot better as I find it tiresome to do part time even when i get a full time job later. so i am looking into ways i might be able to earn some passive income, can someone suggest what to do and how much capital should i have to start?

3

Discussion (3)

Learn how to style your text

Pang Zhe Liang

16 Apr 2020

Lead of Research & Solutions at Havend Pte Ltd

Reply

Save

From your question, it seems you are not yet full time employed, perhaps still studying or in National Sevice? The two most important and fastest ways to build wealth is high income and high savings rate. If you are still a student, I strongly urge for you to re-evaluate your spending habits to become much savvier and strive to get a high paying job.

Passive income refers to doing a work once or minimal effort and continously receiving an income. Examples can include investing in bonds for periodic coupon payments, investing in high dividend yield stocks, writing a book and receiving royalties, selling a patent, etc. This should not be your first priority before/just starting your job.

Depending on the skillset you posses, some may be easier to complete than others.

If you do not have such expertise, then you can fall back to stocks, REITS and bonds. The downside of choosing this method is that it requires significant capital for it to be significant. Consider a stock bearing 4% dividend yield. A $10,000 investment will only give $400, not enough to be considered an income but a small allowance (~$33 per month). There is Syfe, a REITs focused roboadvisor, that can help manage the hassle of choosing and managing your REITs.

This should be a goal for older working adults who have accumulated certain amount of savings, especially for investments with high weightage in REITS/bonds/high dividend stocks. I believe when you are just starting out, capital appreciation will be more important as you will have a lot of expenses to take care of later on and there is high opportunity cost forgone when you persue consistent small streams of cashflow over long term capital gains.

Reply

Save

Write your thoughts

Related Articles

Related Posts

Related Products

Standard Chartered JumpStart Account

4.8

785 Reviews

Maximum Interest: 2.50% p.a. for balances up to S$50,000

INTEREST RATES

$0

MIN. INITIAL DEPOSIT

$0

MIN. AVG DAILY BALANCE

DBS/POSB Multiplier Account

4.3

329 Reviews

OCBC FRANK Account

4.7

213 Reviews

Related Posts

Advertisement

You don't necessarily need capital in order to build a healthy stream of passive income. Here are some ideas to help you:

Royalty, e.g. book, stock photo

Ad revenue, e.g. GoogleAdsense

Dividend, e.g. stocks

Annuity, e.g. endowment

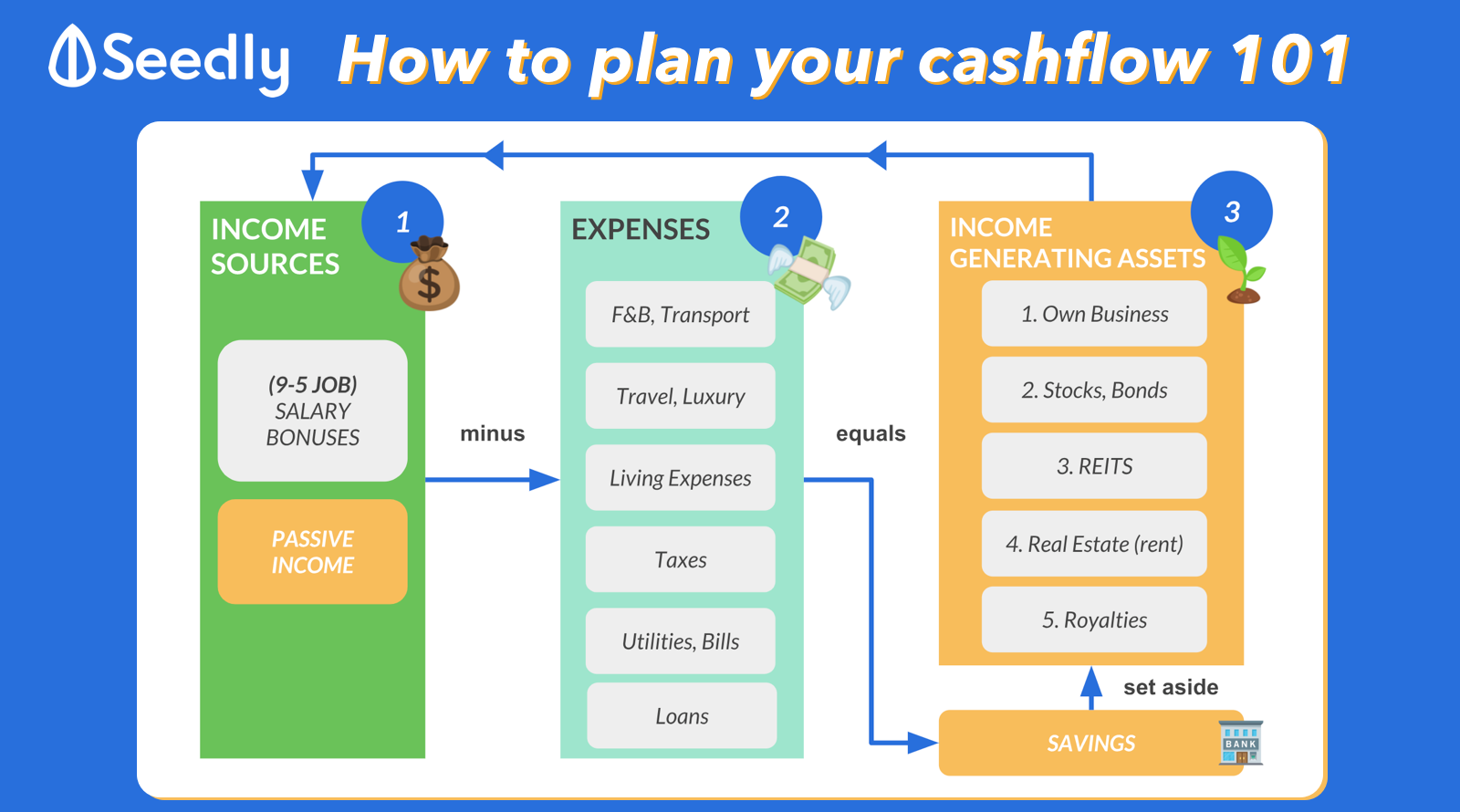

While brainstorming for ideas, don't forget the basics by understanding your cashflow! As always, create a tangible goal to keep fixed expenditure low and control your variable expenses. This way, you are also increasing your net cash flow over time!

More Details:

Understanding Your Personal Cash Flow

I share quality content on estate planning and financial planning here.