Hi there!

Based on historical prices, Tesla stock did not rise after events like the 'Cybertruck Release Event' on 21 Nov 2019, and even 'Autonomy' day on 22 April 2019. In fact, they dropped by 3-5%.

As the saying goes, 'buy the rumour, sell the news'. This is the reason why the stock fell during those two events.

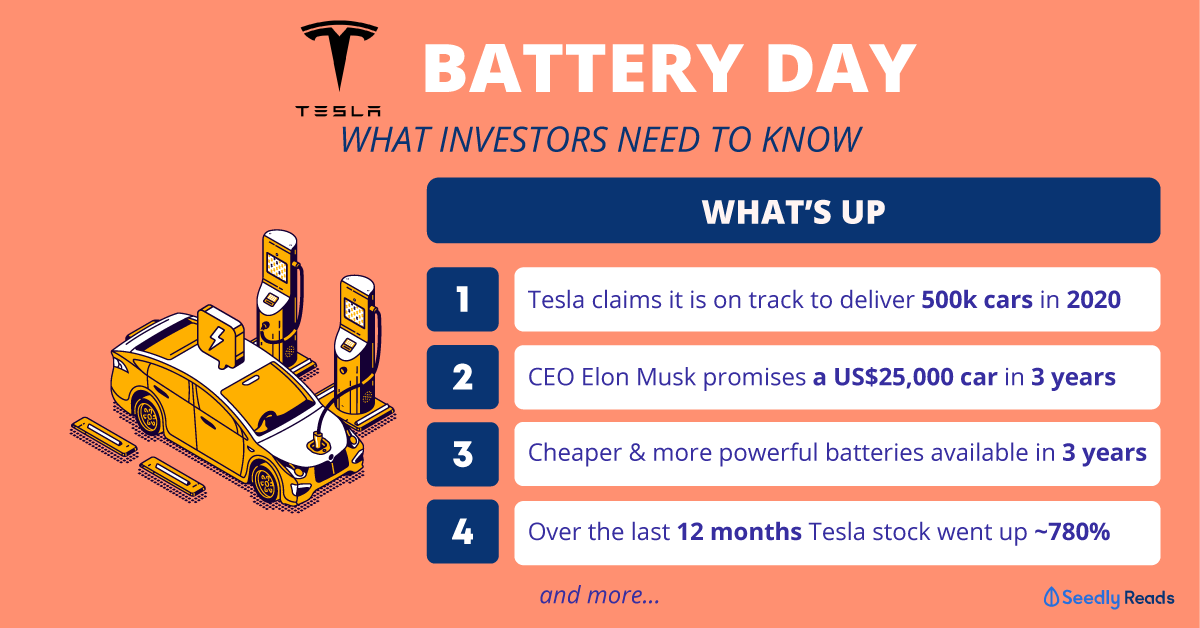

Not many retail investors can really grasp what Tesla has to offer this upcoming Battery Day. Though there are several speculations of what Tesla would probably announce. E.g. Tabless Battery Technology, the larger battery cell, Dry electrode cell, how they are going to scale their production, 1M mile battery etc.

I am not an engineer myself and I can't really tell you the chemistry about it. But what I can infer is that it will effectively improve battery production efficiency and how they pack it (essentially removing modules), and also potentially increasing their charging capacity to 300+ kW. The cost of production will fall, benefiting the company and consumers if Tesla continues to cut prices of their cars.

In the long-run, this will certainly benefit. If I were to speculate, I think it might fall a bit, based on historical data, then recover.

My strategy is just to add positions whenever it falls consecutively for three days or 10% in a single day. I wouldn't necessarily try to enter during these period of uncertainty. But if the opportunity is there I would jump in.

Hi there!

Based on historical prices, Tesla stock did not rise after events like the 'Cybertruck Release Event' on 21 Nov 2019, and even 'Autonomy' day on 22 April 2019. In fact, they dropped by 3-5%.

As the saying goes, 'buy the rumour, sell the news'. This is the reason why the stock fell during those two events.

Not many retail investors can really grasp what Tesla has to offer this upcoming Battery Day. Though there are several speculations of what Tesla would probably announce. E.g. Tabless Battery Technology, the larger battery cell, Dry electrode cell, how they are going to scale their production, 1M mile battery etc.

I am not an engineer myself and I can't really tell you the chemistry about it. But what I can infer is that it will effectively improve battery production efficiency and how they pack it (essentially removing modules), and also potentially increasing their charging capacity to 300+ kW. The cost of production will fall, benefiting the company and consumers if Tesla continues to cut prices of their cars.

In the long-run, this will certainly benefit. If I were to speculate, I think it might fall a bit, based on historical data, then recover.

My strategy is just to add positions whenever it falls consecutively for three days or 10% in a single day. I wouldn't necessarily try to enter during these period of uncertainty. But if the opportunity is there I would jump in.